Price going against me while long ? No me jodas, pendejo

The ideas that I trade by:

Moderator: moderators

Re: The ideas that I trade by:

Price is going up ? Long.

Price going against me while long ? No me jodas, pendejo

Price going against me while long ? No me jodas, pendejo

There's no business like [strike]show[/strike] covid19 business.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

-

Sacrophage

- rank: 150+ posts

- Posts: 152

- Joined: Tue May 17, 2016 8:16 pm

- Reputation: 16

- Gender:

Re: The ideas that I trade by:

Adding some general parameters:

Risk: 0.25 ATR in order to trade full position size - adjust size linearly based on entry/SL - size becomes 1 unit

Add size: every 0.25*ATR add 1 unit, in order to easily adjust for different timeframes

Question: Even though I am keeping my entry subjective, am I skewing risk against myself by setting these parameters in stone?

Risk: 0.25 ATR in order to trade full position size - adjust size linearly based on entry/SL - size becomes 1 unit

Add size: every 0.25*ATR add 1 unit, in order to easily adjust for different timeframes

Question: Even though I am keeping my entry subjective, am I skewing risk against myself by setting these parameters in stone?

Re: The ideas that I trade by:

Marking closes didn't work very well so I thought why not include them?

After using the high/low method you look at the close to see if any points can be made; each 'x' is an area, if price closes in the area then that is a point.

Towards the end there I started marking the closing points differently to see what it would look like.

HIGH/LOW+CLOSE P&F:

After using the high/low method you look at the close to see if any points can be made; each 'x' is an area, if price closes in the area then that is a point.

Towards the end there I started marking the closing points differently to see what it would look like.

HIGH/LOW+CLOSE P&F:

-

Sacrophage

- rank: 150+ posts

- Posts: 152

- Joined: Tue May 17, 2016 8:16 pm

- Reputation: 16

- Gender:

Re: The ideas that I trade by:

Updating given the nice moves this Asia session, +3.2% since open yesterday between GJ, AJ, AU, EA. All directly correlated trades, which obviously will not bode well when I take losses. Also didn't trade nearly heavy enough given the number of points I pocketed.

Going to learn P&F and follow along with you, Mighty, especially since you said we may be able to be more objective with this method. Objectivity and data give me confidence!

Going to learn P&F and follow along with you, Mighty, especially since you said we may be able to be more objective with this method. Objectivity and data give me confidence!

Re: The ideas that I trade by:

Another HIGH/LOW+CLOSE PNF chart:

All the stars are points made with the closing price:

All the stars are points made with the closing price:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

-

Sacrophage

- rank: 150+ posts

- Posts: 152

- Joined: Tue May 17, 2016 8:16 pm

- Reputation: 16

- Gender:

Re: The ideas that I trade by:

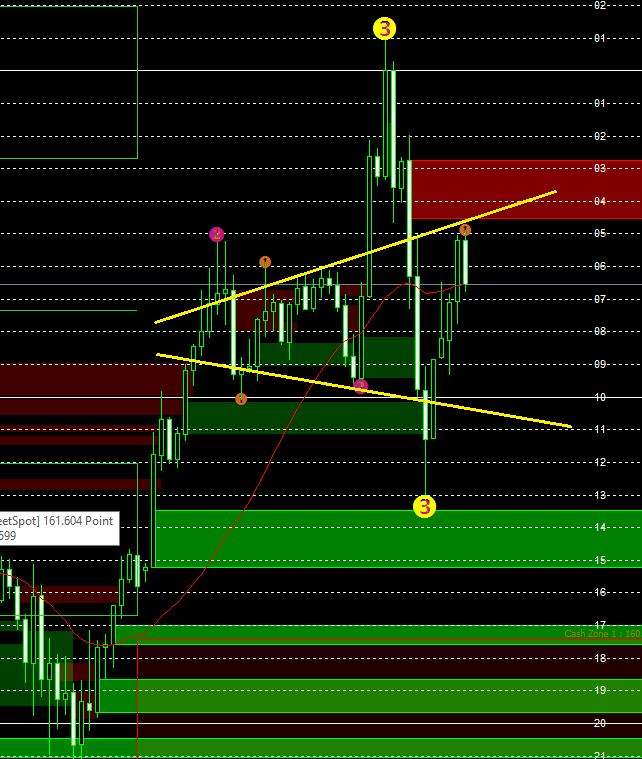

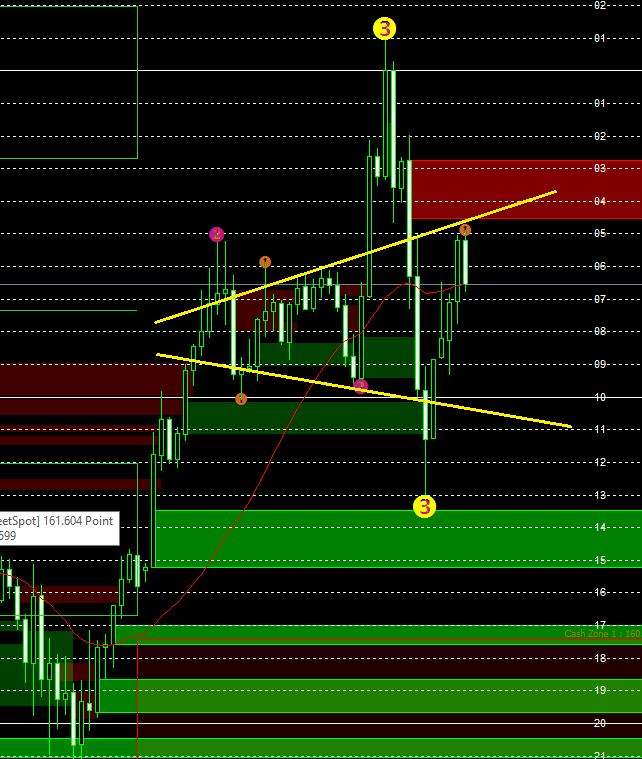

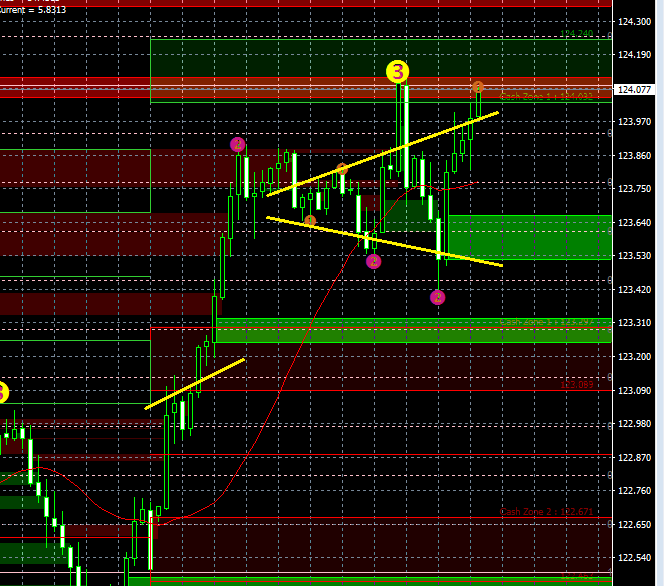

Goonslinger nice reaction off of the 2+ Mo high in GJ. I'm flat but waiting to play it back up... I didn't have the nutz to play it short - my fundamental biases and ivy league education cloud my eyes

- Attachments

-

- GBPJPYH1.png (33.81 KiB) Viewed 3038 times

Re: The ideas that I trade by:

LEFT: HIGH/LOW method and then price closing in an area to mark a point.

RIGHT: HIGH/LOW method and then the standard close method where price has to close over a line to mark a point (brown).

Are the close markings worth all the trouble? Is the picture more clear or less clear?

I think that I will file away the left chart in the "interesting ideas" folder and mark a few more of the right chart.

RIGHT: HIGH/LOW method and then the standard close method where price has to close over a line to mark a point (brown).

Are the close markings worth all the trouble? Is the picture more clear or less clear?

I think that I will file away the left chart in the "interesting ideas" folder and mark a few more of the right chart.

Re: The ideas that I trade by:

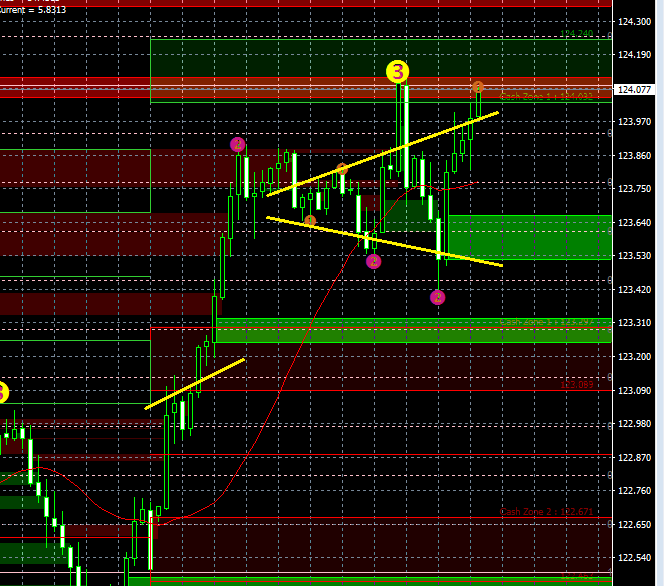

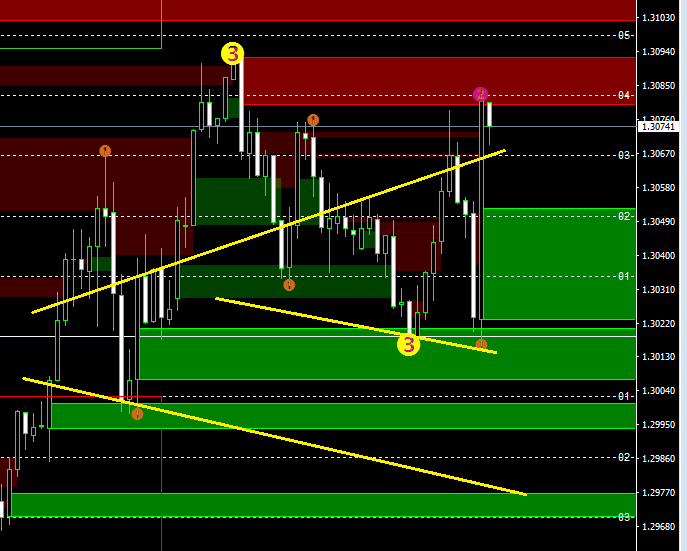

can you guys see if im doing this right? im learning to scalp MACROS

what is the general idea behind trading cones. buying and selling at the lows and highs of the cones...buying the breakout if it closes high and vice versa.

edit* if cones are continually expanding from a center point, then it makes sense to trade from the midpoint of the cone outwards?

would you buy this breakout right now?

what is the general idea behind trading cones. buying and selling at the lows and highs of the cones...buying the breakout if it closes high and vice versa.

edit* if cones are continually expanding from a center point, then it makes sense to trade from the midpoint of the cone outwards?

would you buy this breakout right now?

-

Sacrophage

- rank: 150+ posts

- Posts: 152

- Joined: Tue May 17, 2016 8:16 pm

- Reputation: 16

- Gender:

Re: The ideas that I trade by:

^I am just learning as well, but this is my take. It hasn't broken through resistance and risk looks like the 3 semafor on the downside, so, no, I would not go long there. Long from cone bottom or below if possible, and vice-versa, with a tight stop. Cone is just a resting place until the next breakout, so be ready to cut if you're wrong.

- Braathen

- rank: 500+ posts

- Posts: 615

- Joined: Mon Jul 20, 2009 6:21 pm

- Reputation: 15

- Location: Infront of the PC O_o

- Gender:

Re: The ideas that I trade by:

Saturday is where most of the work is done (sacrilege I know): looking through the long-term charts, placing alerts, determining the position sizing for each chart, etc.

I must move towards this, instead of just trading the same pairs week in and out i should be looking/planning ahead witch pairs i will trade but ofc always keep an eye on my fav scalp pair

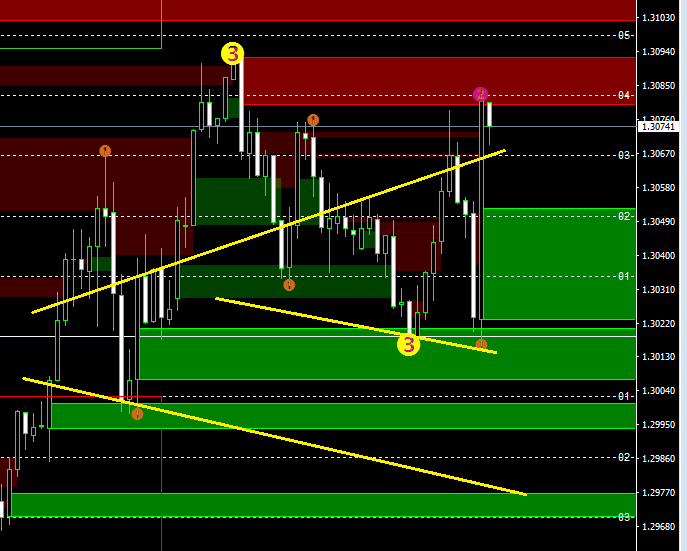

LEFT:

What i love about this chart is, it keeps you engaged in whats happening on a medium TF.

I think incorperating the close gives you hints towards things like speed, profit taking and closing above below something.

I recall you saying some of the best advice you could give was to paper trade for a few years, maybe hand marking charts

like this could have a similar outcome.

RIGHT:

Now this chart has a little less info so i think for purposes of "paper trading" it might not be as good? I dont know ofc

On the other hand... entries and trailing is just ridiculously easy to see on this chart.

I could see some serious OPM stacking trades here going for those weekly/monthly ranges.

So yeah.. thats my opinion on it. I will defently be drawing both styles as i might aswell get as much "grinding" as possible for now.

Heres a continuation of the GJ cone and a GU cone

"Trading is the ability to see & to plan & to act; it is not crystal balls, precision entries, and ego stroking."

MO-

MO-

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.