TygerKrane wrote:[highlight=tan]::NOTE::

The EURUSD trades happened b/c I wanted to participate in NFP to try and erase some of my losses...it worked, I got a few dollars off of it, but the overall intention is to have enough success to not even need to do that.[/highlight]

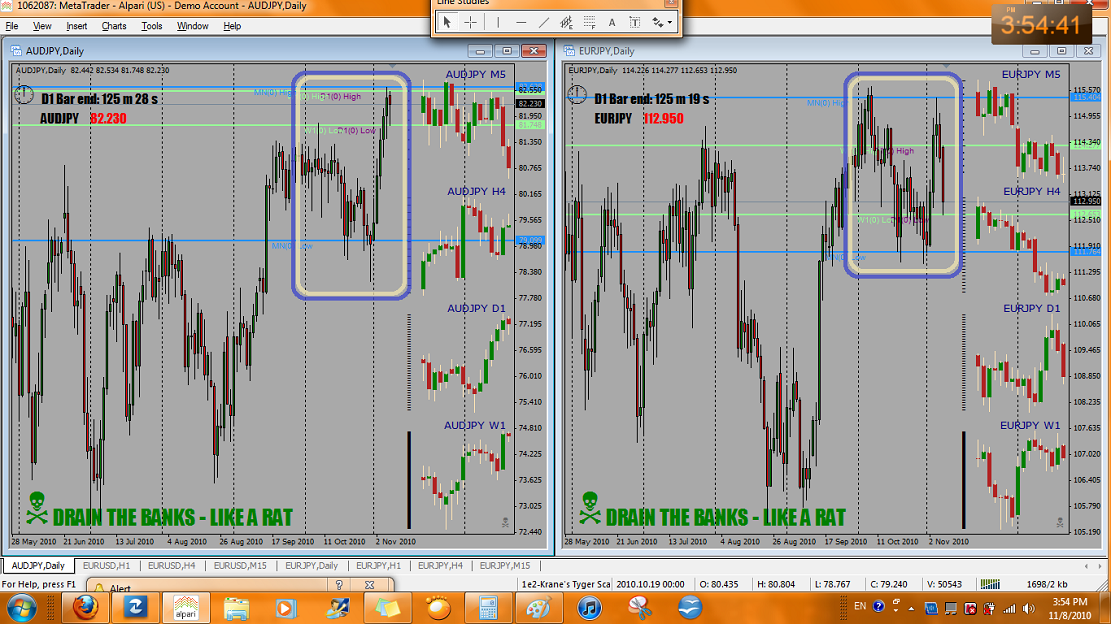

ummm...yeah...about that whole not wanting to trade EURUSD, and strictly sticking to trading AJ & EJ...yeah, I'm gonna have to take back that statement.

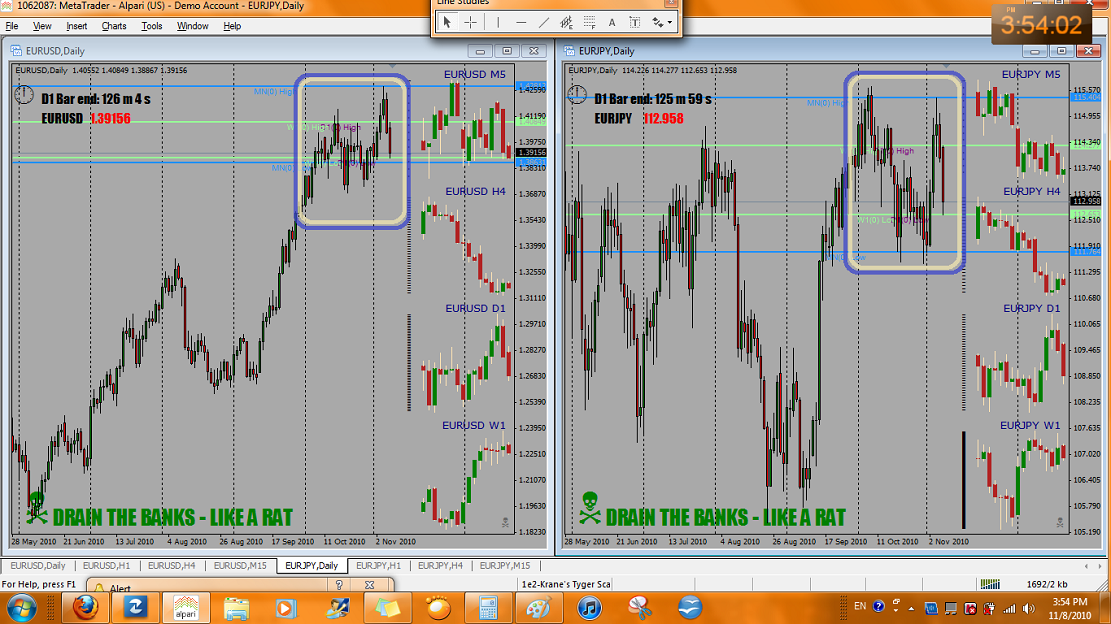

With correlation like this, you'd do the same thing too! (and No, the correlation wasn't this good when I first put this plan together, believe me, I checked!)

M15 & H1 EU / EJ

H1 & H4 EU / EJ

And for the last month and a few days, the daily charts have also been a really good correlation:

D1 EU / EJ

Much better than the AJ / EJ ~

I wonder if this makes it any easier to see?

In any case in, keeping with [highlight=BLACK]Krane cat[/highlight][highlight=orange]ches Tyger[/highlight], it is still only EU Long and EJ short; so now it is a switch to a play on the strength of the Euro

[highlight=darkgreen]{whereas before it was a play on the strength of the Yen}[/highlight]