Never thought of it like that, I feel like a rich man already!

TygerKrane's Pip-Pickpocketing

Moderator: moderators

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

Krane catches Tyger, additions for Rev. 01

Got this great idea for possible filters to increase the number of trades available while reading  tmanbone's latest post.

tmanbone's latest post.

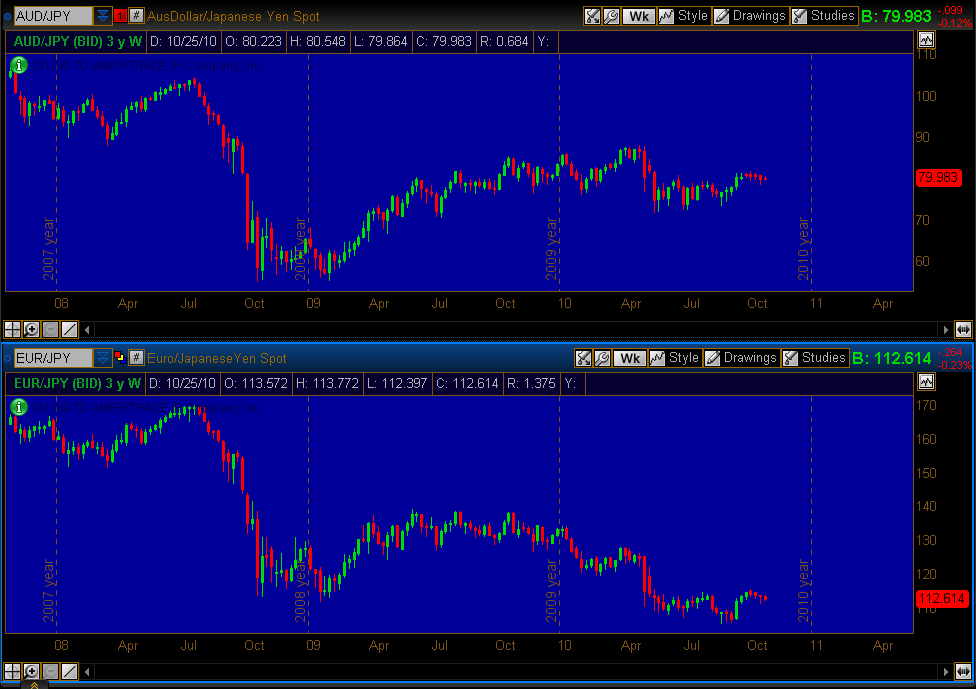

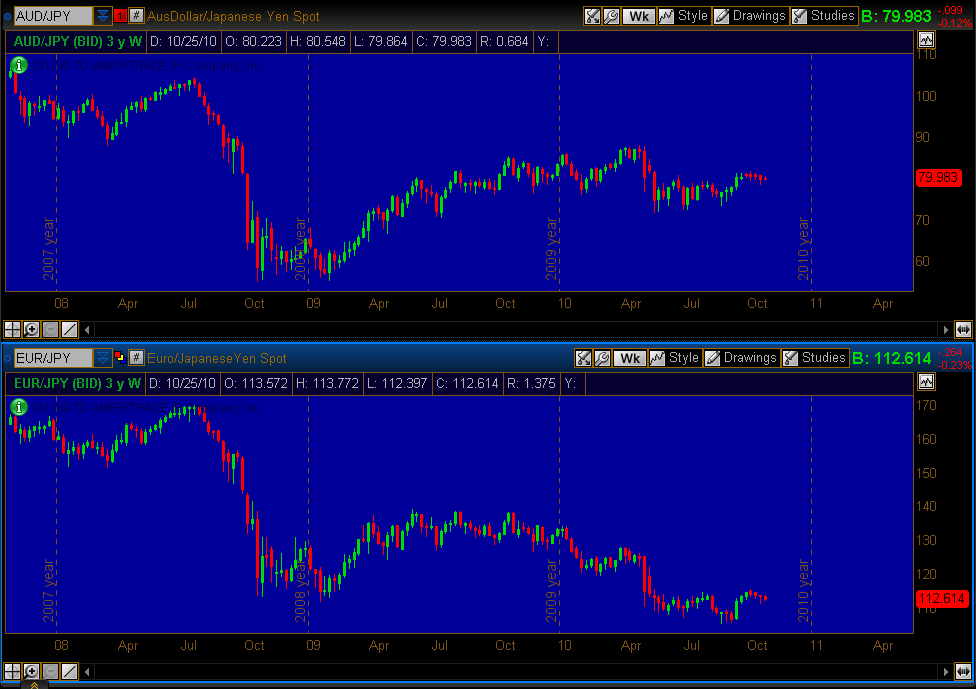

Weekly A/J and E/J comparison charts

Now I KNOW I've been looking at ONLY AJ and EJ charts for over a month now, but something about the layout of his picture gave me a great idea for additional filters and considerations for [highlight=BLACK]Krane cat[/highlight][highlight=orange]ches Tyger[/highlight]

<YES, some of this is REALLY VERY obvious, I couldn't believe I overlooked certain things.>

No, I am not looking to start using them now. I want to keep it simple by only going Long AJ, and only going Short EJ.

When I have the consistent results {I still have to prove that the method works for me! ) and I am sitting on a mountain of profit, then I will add in these ideas, to have more trades available for me. (I assume I won't be as scared of increased exposure to risk if I have other people's money that I am working off of.)

) and I am sitting on a mountain of profit, then I will add in these ideas, to have more trades available for me. (I assume I won't be as scared of increased exposure to risk if I have other people's money that I am working off of.)

1. If the week bias matches my trade, more emphasis on holding the trade to the next 3Sema, not closing out quicker at a 2Sema.

2. Actually taking AJ SHORT: [font=Comic Sans MS]If[/font] the current weekly bias is Short, matching the EJ weekly bias Short; AND if the previous AJ week was short.

-----To exploit that the Yen just might be strong overall, enhanced/filtered by exploiting Consecutive Candle Pattern.

3. Actually taking EJ LONG: [font=Comic Sans MS]If[/font] the current weekly bias is Long, matching the AJ weekly bias Long; AND if the previous EJ week was Long.

-----To exploit that the Yen just might be weak overall, enhanced/filtered by exploiting Consecutive Candle Pattern.

Weekly A/J and E/J comparison charts

Now I KNOW I've been looking at ONLY AJ and EJ charts for over a month now, but something about the layout of his picture gave me a great idea for additional filters and considerations for [highlight=BLACK]Krane cat[/highlight][highlight=orange]ches Tyger[/highlight]

<YES, some of this is REALLY VERY obvious, I couldn't believe I overlooked certain things.>

No, I am not looking to start using them now. I want to keep it simple by only going Long AJ, and only going Short EJ.

When I have the consistent results {I still have to prove that the method works for me!

1. If the week bias matches my trade, more emphasis on holding the trade to the next 3Sema, not closing out quicker at a 2Sema.

2. Actually taking AJ SHORT: [font=Comic Sans MS]If[/font] the current weekly bias is Short, matching the EJ weekly bias Short; AND if the previous AJ week was short.

-----To exploit that the Yen just might be strong overall, enhanced/filtered by exploiting Consecutive Candle Pattern.

3. Actually taking EJ LONG: [font=Comic Sans MS]If[/font] the current weekly bias is Long, matching the AJ weekly bias Long; AND if the previous EJ week was Long.

-----To exploit that the Yen just might be weak overall, enhanced/filtered by exploiting Consecutive Candle Pattern.

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

Have you read thru here?

http://kreslik.com/forums/viewtopic.php ... c&start=20

If not do and pay particular attention to Dragon33's ideas about using the Semas. Looks like a part of his evolutionary process. These ideas will help you. HTH

http://kreslik.com/forums/viewtopic.php ... c&start=20

If not do and pay particular attention to Dragon33's ideas about using the Semas. Looks like a part of his evolutionary process. These ideas will help you. HTH

"The simplicity of the markets is it's greatest disguise"

T

T

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

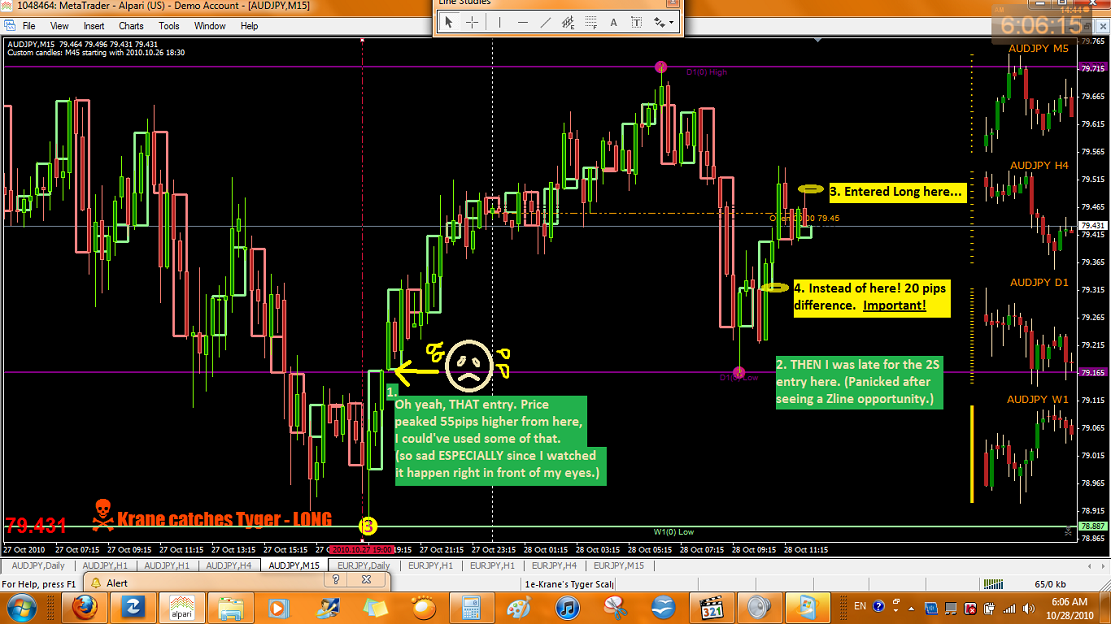

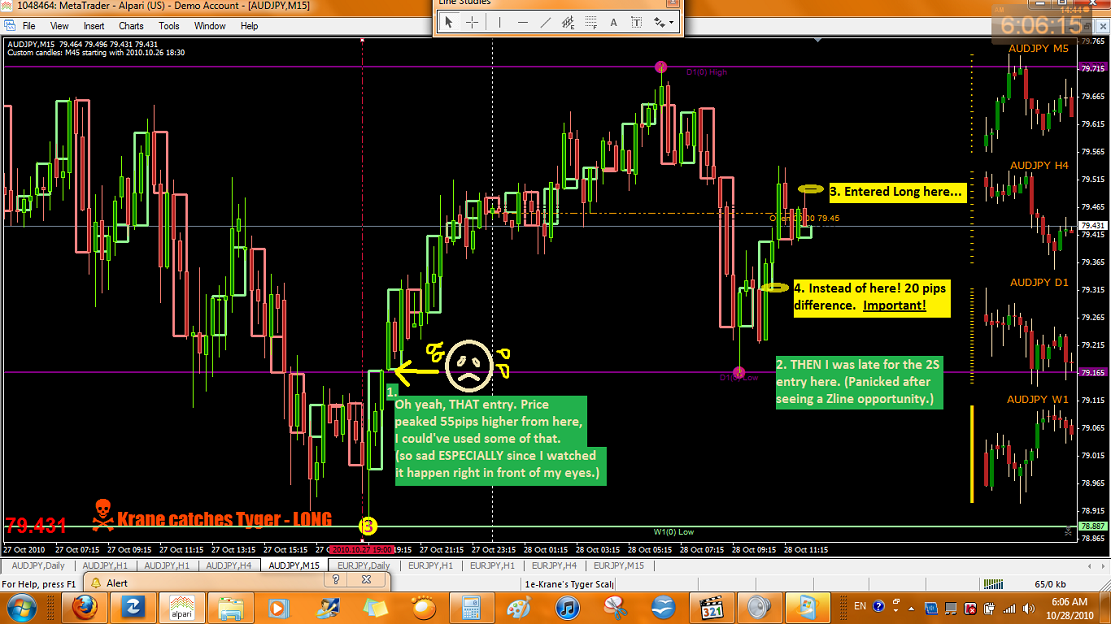

KcT, recap of the last two weeks

Just some highlights of the mistakes and more memorable parts of the last two weeks.

Was surprised to see that I still felt the need to take a ton of screenshots, but it'll be all good for when I finish going through those and remembering the lessons in them.

[highlight=green]

From Tuesday, October 26 (start of forex day 10/27), first day of Trading KcT[/highlight]

Was surprised to see that I still felt the need to take a ton of screenshots, but it'll be all good for when I finish going through those and remembering the lessons in them.

[highlight=green]

From Tuesday, October 26 (start of forex day 10/27), first day of Trading KcT[/highlight]

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

KcT, recap of the last two weeks; Part 2

[highlight=green]From Wednesday, October 27 (going into start of forex day 10/28 ):[/highlight]

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

KcT, recap of the last two weeks; Part 3

One last memorable moment of mine from the last two weeks, (not really important, but something *I'll* certainly remember)

[highlight=green]From Thursday evening, October 28 (going into start of forex day 10/29 ):[/highlight]

[highlight=green]From Thursday evening, October 28 (going into start of forex day 10/29 ):[/highlight]

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

KcT, recap of the last two weeks; Part 4

There was definitely one outside factor that had been affecting my trades over the last 10 days. I had discovered a contrarian indicator that basically, told you whether more people where long or short a currency pair and then you should form your bias to do the opposite, since most retail traders are wrong.

Interesting information to have available, as it parallels the Put/Call Ratio used by people trading Stock Options, and the other number ( I don't recall what it is called) that lets you know the number or percentage of stocks that are being sold short.

Anyhow, I interpreted it to mean that I should expect the JPY to get stronger...so over these days, I was only mainly interested in finding my short opportunities on EJ.

And I'm not saying there is anything wrong with that contrarian indicator, I'm certain that I wasn't using it correctly in the first place.

So that was definitely a cause of me missing alot of the AJ long moves.

But still, I looked back on the charts two days ago and REALLY got to see what was happening during this time:

I was really shocked to discover such a HUGE hole in my trading plan, but I feel very lucky to have discovered it so early in the process.

I need to take into consideration a larger set of factors for getting into continuing, strong trending moves, b/c trust me, there definitely WERE NOT a lot of pullbacks to lower 2Sema on the H1 for me to use to get long entries off of.

I already have several considerations, and think I might have it solved now though.

Interesting information to have available, as it parallels the Put/Call Ratio used by people trading Stock Options, and the other number ( I don't recall what it is called) that lets you know the number or percentage of stocks that are being sold short.

Anyhow, I interpreted it to mean that I should expect the JPY to get stronger...so over these days, I was only mainly interested in finding my short opportunities on EJ.

And I'm not saying there is anything wrong with that contrarian indicator, I'm certain that I wasn't using it correctly in the first place.

So that was definitely a cause of me missing alot of the AJ long moves.

But still, I looked back on the charts two days ago and REALLY got to see what was happening during this time:

I was really shocked to discover such a HUGE hole in my trading plan, but I feel very lucky to have discovered it so early in the process.

I need to take into consideration a larger set of factors for getting into continuing, strong trending moves, b/c trust me, there definitely WERE NOT a lot of pullbacks to lower 2Sema on the H1 for me to use to get long entries off of.

I already have several considerations, and think I might have it solved now though.

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

- TygerKrane

- rank: 1000+ posts

- Posts: 1733

- Joined: Mon Jan 25, 2010 3:36 pm

- Reputation: 297

- Location: Long Island, NY

- Gender:

KcT, recap of the last two weeks; Part 5

So, I'm having trouble with FXSTAT and am waiting for them to resolve it.

Basically, they are not calculating my Growth Chart and Balance Chart correctly, and it is also messing up on displaying my correct Balance and Equity.

The stats that they are keeping on my trades is correct though, so here is my recap of the overall process since October 26, when I actually started placing trades:

[highlight=tan]::NOTE::

The EURUSD trades happened b/c I wanted to participate in NFP to try and erase some of my losses...it worked, I got a few dollars off of it, but the overall intention is to have enough success to not even need to do that.[/highlight]

And overall here are the numbers:

Account started at $265, but I received another $25 donation, so,

Overall outside money deposited into the account $290

Current Balance $204.13

So, losses Totaling $85.87

This week, I am receiving another $25 donation, so in about two days, the overall money input will be $315.

Basically, they are not calculating my Growth Chart and Balance Chart correctly, and it is also messing up on displaying my correct Balance and Equity.

The stats that they are keeping on my trades is correct though, so here is my recap of the overall process since October 26, when I actually started placing trades:

[highlight=tan]::NOTE::

The EURUSD trades happened b/c I wanted to participate in NFP to try and erase some of my losses...it worked, I got a few dollars off of it, but the overall intention is to have enough success to not even need to do that.[/highlight]

And overall here are the numbers:

Account started at $265, but I received another $25 donation, so,

Overall outside money deposited into the account $290

Current Balance $204.13

So, losses Totaling $85.87

This week, I am receiving another $25 donation, so in about two days, the overall money input will be $315.

**Krane catches Tyger** !>I'm here to chew bubble gum and make major pips...and I'm all out of bubble gum.<!

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.