laksh wrote: Hi Sacrophage,

MightyOne's Space money management idea has the power to take away all the troubles with big size.

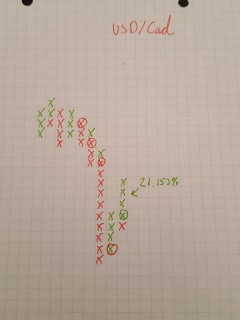

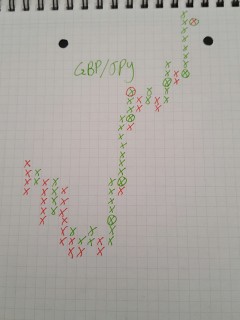

My experience: 6 Months ago I used to sweat to trade a size of $10 per pip. I started using space MM (1.5% initial risk and 21.6% way points) since January and at the current stage of my project, my $MAX_SIZE of $79 per pip feels like a pleasant walk in the park.

Even in the worst case if I take a full loss of 39 pips @ $79 per pip, all I lose is 1.5% of last way point balance.

Space MM has been such a boost to my trading psychology, when I reach a way point target it gives me mental ejaculations

Thanks for the encouragement Space Traveler - I will check out your thread to see what you've been up to - I just need to make the same trades I'm already making, albeit with 10X the leverage!