If MightyOne want to comment he is more then welcome but I am pretty sure he explained this hundreds and times in the past and is tired of repeating himself.

The reason I want to revisit this topic is because many new traders here keep taking every single trade that looks like a "MO ZONE" and they end up losing money. This concept is very easy to understand and can make your trading very profitable if used correctly.

------------------------------------------------------

Most traders think that the market moves to stop them out. This is true however there is very little profit in stopping out someone who trades with small lots and only risks 1-2% of his account.

The big money is in taking out the mid/long term traders that are hundreds of pips in profit.

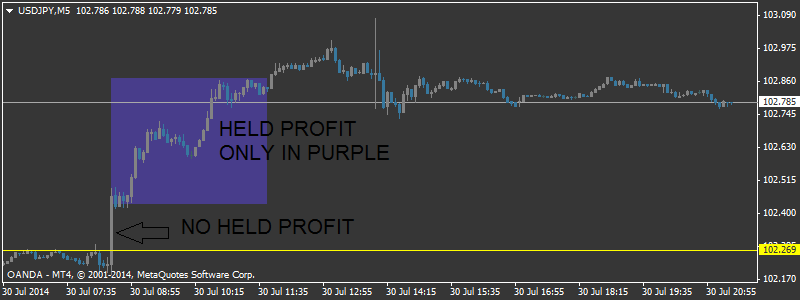

In my opinion there is little or no held profit in any M1-M15 charts. Only on the larger timeframe charts.

Can you imagine placing a trade to profit in a direction where there is almost no money left?

Consider that a professional will risk 1-2% of his account.

This means that when price moves a number of pips that equals ~2% of his account that he is out of the market and NO MORE of his money can be gained by any other trader.

So where do your massive profits come from?

The answer is the medium and long term traders who are IN PROFIT with medium to HUGE stop losses!

As day traders we each take turns filling the gap on these traders while at the same time filling the gap on other day traders using smaller charts!

Support and resistance just means that the money ran out in the direction being traded and for the size of the traders being targeted at that moment.

Think about a glass of water that is 2% full...

Do you want to take that traders drink? Is it worth it?

What about a glass that is over flowing into other cups...

Oh, you want that water now don't you!

Not support and resistance, but a vacuum in which nothing exists to trade to lower/higher prices (traders are zero lined and devoid of profit).

In a place where every one is risking 1-5% the thunderous moves for fat profits are made through evaporating profits not accounts blowing up.

This can be best demonstrated for one of the most successful and largest company on the entire stock market. Apple.

Imagine how much money you could of made if you anticipated this move. You could of been very rich if you just bought a few calls options. Very low risk and huge reward.