So I have a list of 15 Sam Seiden videos that I am considering watching. I'm hoping that hearing about the same mechanics of MightyOne's concepts in a slightly different form might make all the difference in improving what I SEE and my interpretation of these charts Price Action.

Sooner rather than Later.

I realize that at some point, my notes will get

REALLY redundant in restating the same info in different ways. Let's hope I get some confidence and clarity before that gets too crazy...besides I really don't feel like watching or taking notes on

ALL 15 videos.

Here goes:

Understanding The Exact Process Behind The Movement In Price (32:49)

http://www.fxstreet.com/live/sessions/s ... d3a6771192

The Basics of How & Why Prices Move

The People that know getting paid by those that don't know

Price only moves out of a consolidation area when

demand exceeds supply (breakout long) or

supply exceeds demand (breakout short).

Dealers will still have orders at that breakout point --leading to the first retracement/pullback to the base--

[highlight=violet]___________________________________________________________________[/highlight]

The 2 novice mistakes we look to profit on: [after the pullback of a breakout LONG; as price returns to the origin of the breakout]

- Selling after a Decline in Price

- Selling at a Price level where we already know there is more demand than supply

Take the other side of the trade from the novice (Must be able to determine areas of support & resistance, where demand exceeds supply

[highlight=violet]___________________________________________________________________[/highlight]

<<If you're trying to sell 5k[highlight=black]

where [/highlight] there are orders to buy 10,000k, there is no way you can profit.

<<Learn to be a professional at spotting dumb money; if you can't spot dumb money, then it is probably you.

Candles represent the order flow; don't need doji's and head & shoulders etc.

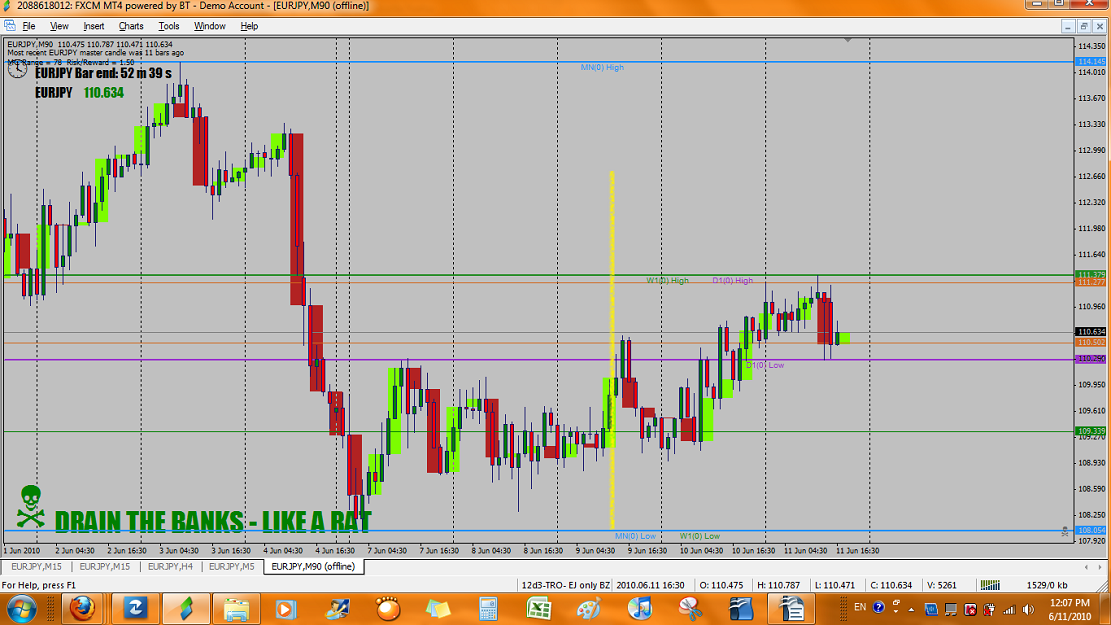

Find price levels where price could not stay there, where price moved away in a hurry. Understand that they move away in a hurry b/c of an imbalance between buyers and sellers...Look to buy/{sell} the pullbacks to these areas.

Why do prices retrace? B/c professionals get prices back to where their orders are stacked at.

When price rallies really strong from a level, it tells you that there is a strong imbalance of supply and demand at that level. [You want to buy/{sell} the pullback to that level b/c you have just identified a level where big banks have their orders at. Don't worry about missing that big initial move out of the area.]

Sharp point pivots are also good points to note b/c supply & demand is so out of balance at that level that price can only stay there for a short period of time; so you want to enter a pullback to that area.

There are buyers and sellers at each price level, what you want to find out is how many buyers vs sellers are at each price level. This is what the chart is there to tell you.