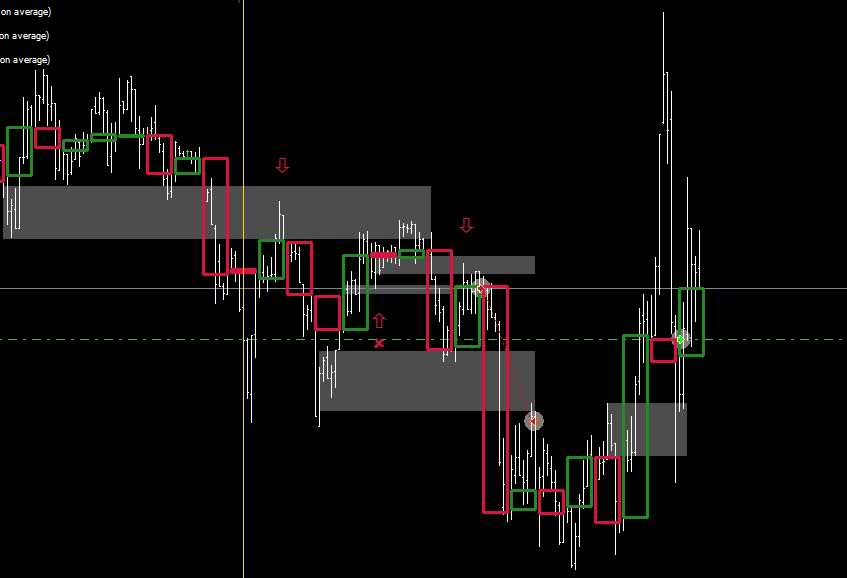

MightyOne wrote:Not Forex, but I thought you might find it interesting to see that zero lines occur in every market and in every time frame.

This is the MONTHLY SPOT GOLD chart with a bounce off the zero line worth more than $100/oz!

Really?

What about S&P 500 index and e-mini S&P?

It's mostly driven by daily only speculators and pitt.

But guys from pitt has a habit close all trades by 5pm

daily the latest.

So nowdays (still fresh memory about recent bearish run)

there are no much heroes to hold S&P positions for longer

than one day.

Question: Is zero-line method is still applicable here?

P.S. This is from NLA thread, but seems noone

(myself including) is able to see this 777-page monster

anymore, I'm posting to this thread, as its inheritage.