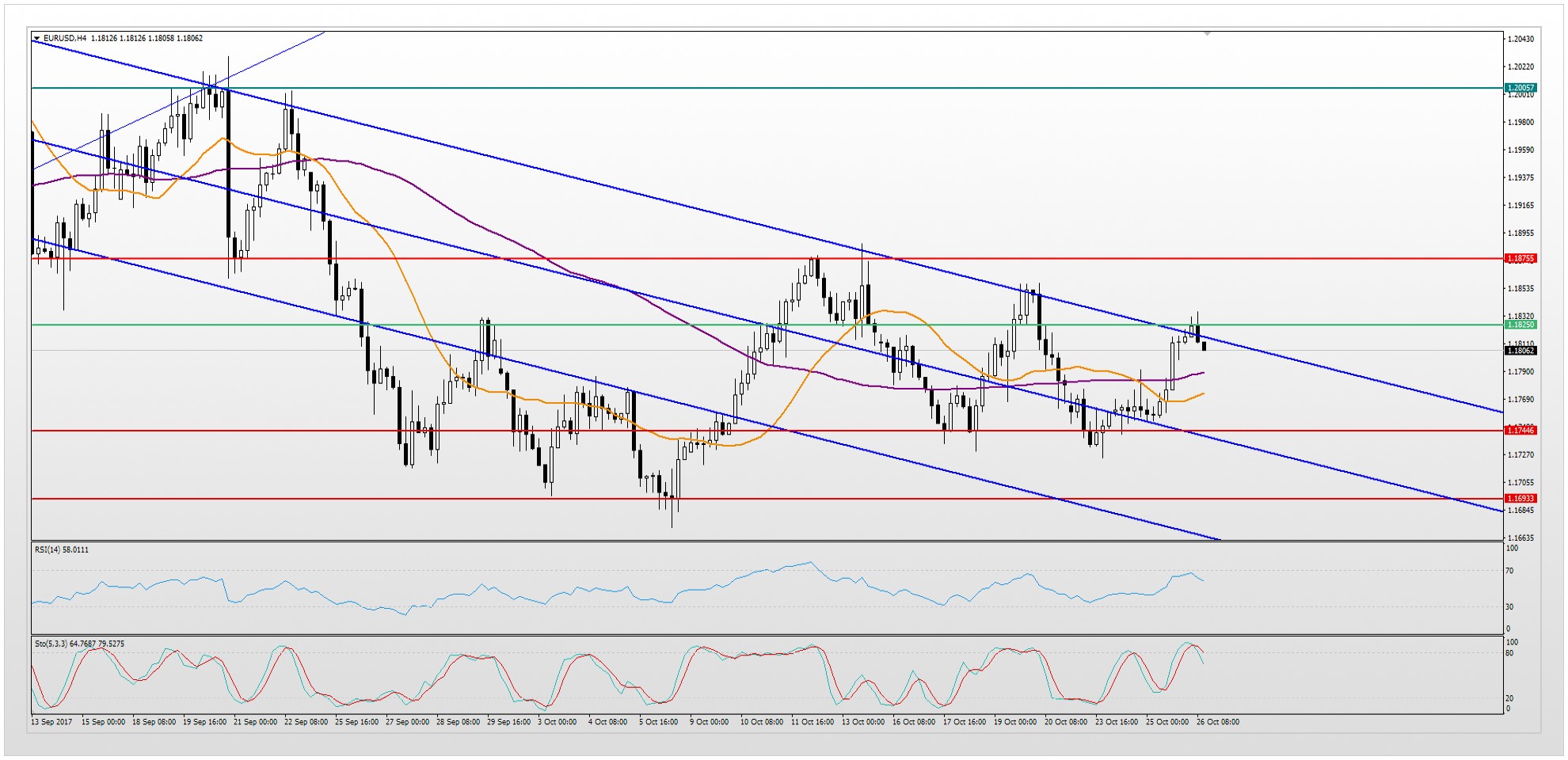

At the moment, we see that the pair is trading in a downward channel.

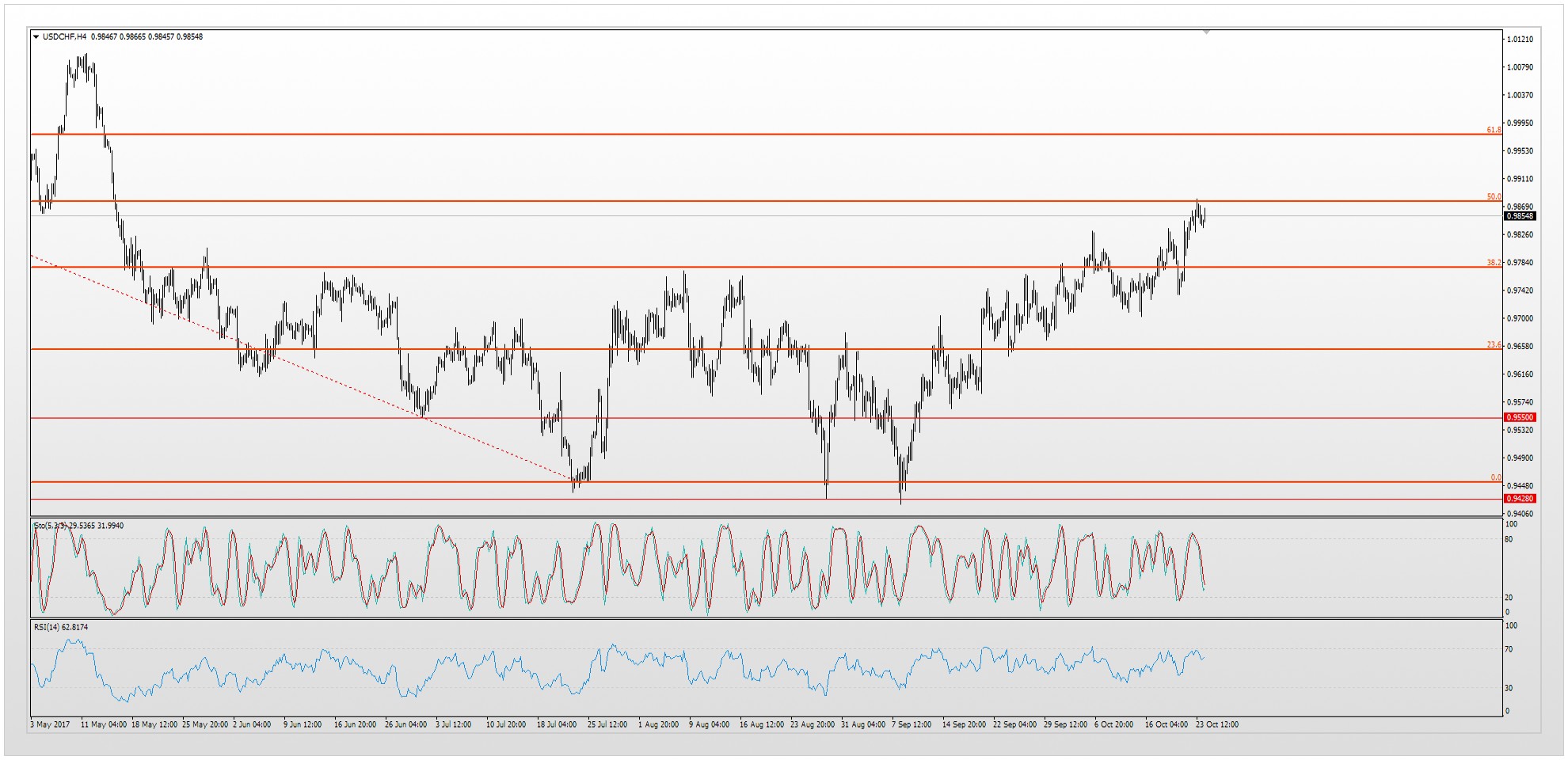

At the moment we see that the pair is trading in a downward channel.

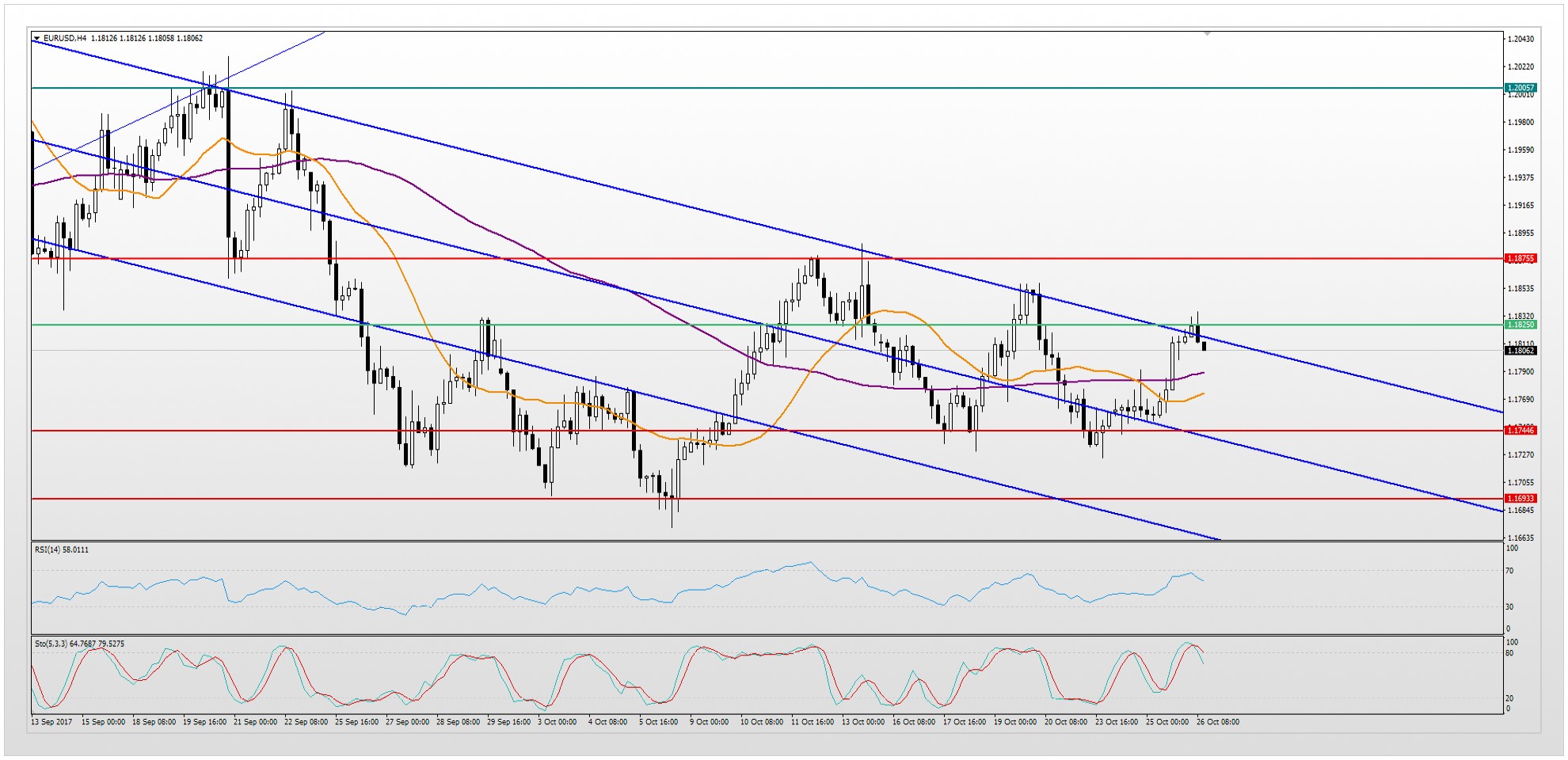

Today we expect the ECB press conference at which Mario Draghi will announce the amount of reduction of asset redemption, which will undoubtedly impact the single currency. At this point the market has already played the expectations of strengthening and if the volumes amount to 30 billion, as we do not expect, it is assumed that significant fluctuations will occur.

The growth rate of the reserve currency continues to be affected by a number of factors that are encouraging to investors. It's possible that there will be an adoption of Trump's tax reform and the expectations of higher interest rates are steady as well.

Now, our pair found resistance level around the 1.1825 mark and is trying to get back in the downstream channel.

The Stochastic indicator came out of the overbought zone and gave us a sell signal.

The RSI strayed from level 70 and also shows a downward movement.

This is why we need to look at the short positions near the entry point marks 1.1825 and the upper border of the channel 1.1815. The targets will be 1.1790 and 1.1745.

In the case of a smaller decline in bonds repurchase, at the level of 40 billion euro, we should expect a positive trend for the Euro and then these levels will serve as support. Then our objectives in long positions will be 1.1850 and 1.1875.

At the time of the press conference entrance into the market is risky.