I had no trades this week because i wanted to focus on confirmations and stop&reverse ideas.

Last week i made +35% (demo) in three days with a starting risk of 1%, then i had a loss and i stopped trading for a while.

The problem is that i was wasting my space

I was placing a limit at 50% of Momo letting ALL my space at risk.

Fortunately i remembered the WD idea and now i have a better plan for my bad exits!

In NLA MO talked a lot about LIS (line in the sand), and finally i got it!

My position (max risk) is still based on major momentum but a CLOSE over a minor (smaller tf) momentum is my signal to get out.

The result is that i'm risking very little of my space and 1/2 of times i can end up at B/E if i wait for a pullback.

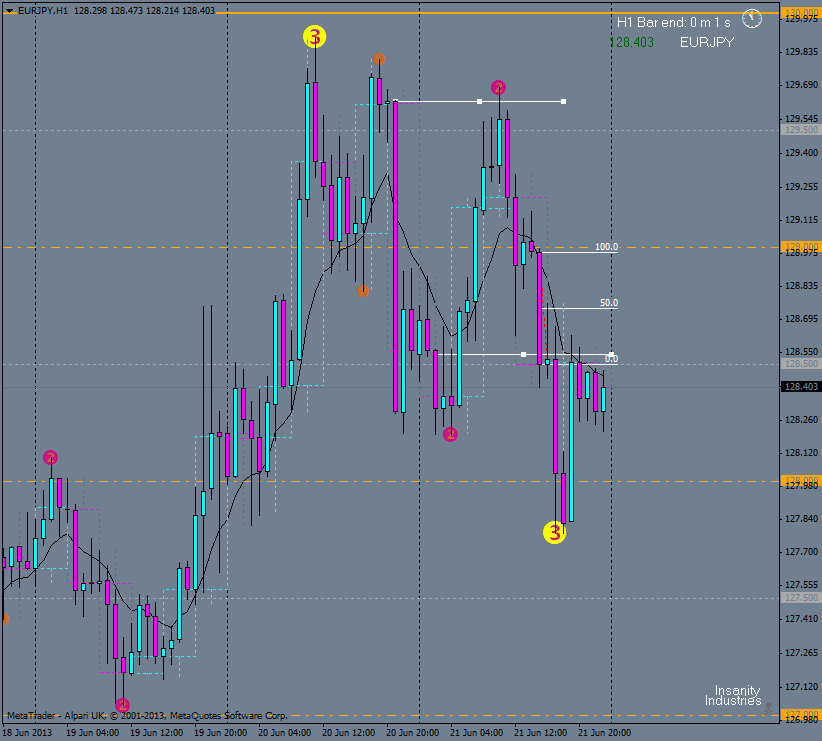

I'm in this trade right now:

- 00 is my position

- i went long when price reached the 50% line and left with a H1 momo

- BETTER RISK 1.png (14.01 KiB) Viewed 3030 times

Now the trade is not working so good, but i'm not letting price touching my sl, because if it closes below LIS i'm out with a risk smaller than 1 lines over 3 (H4)

- BETTER RISK 2.png (14.84 KiB) Viewed 3030 times

Still working hard, thanks MO and everybody on the board!

IS A LIE__________

IS A LIE__________