I don't understand what you are asking.

If you add lots you must normalize risk or you are screwed if the trade goes against you.

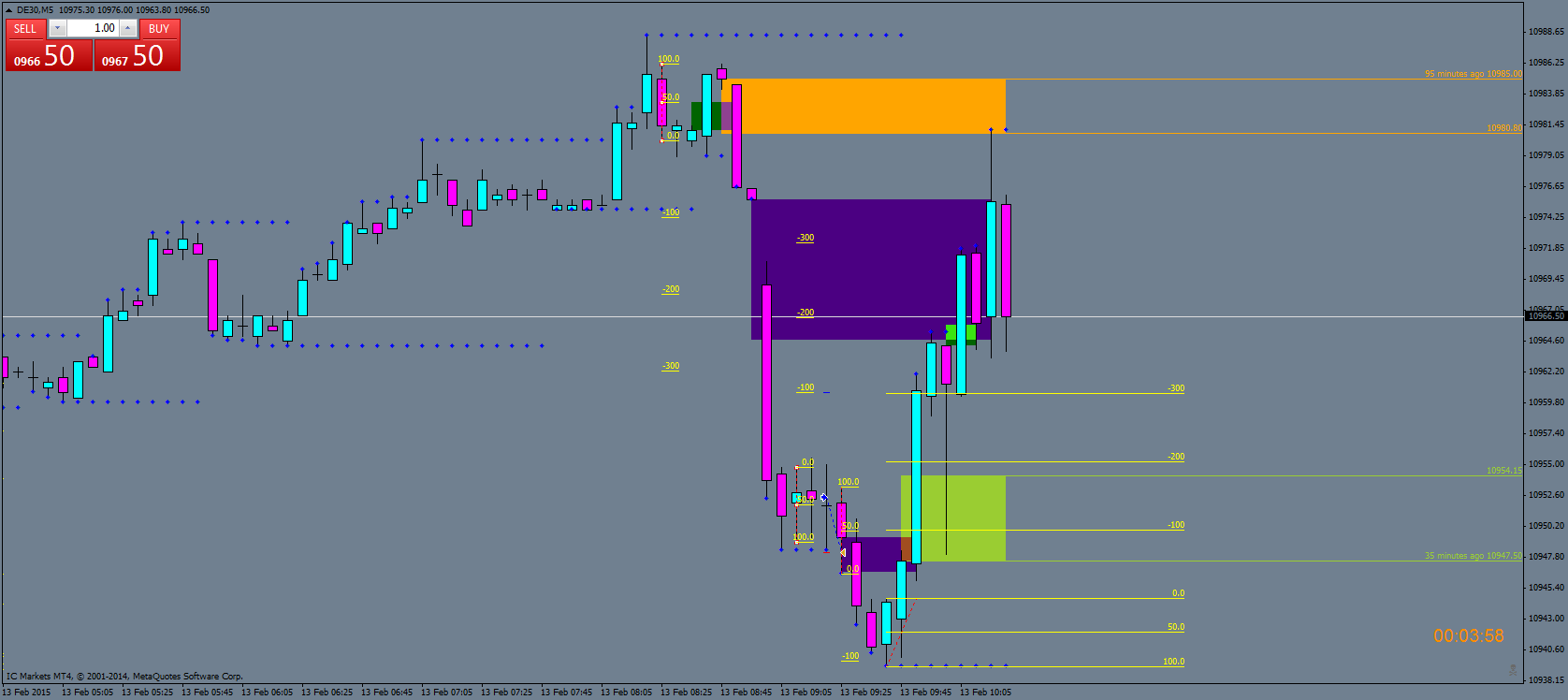

Building a position is all it is.

Depending if you are doing a short term stack like doji or something more long term like mo talks of is where you need to find the levels of the If/Then lines.

Again, if you stack you

normalize risk. So set your order and then move your sl in accordance with your risk %.

Simplified, with market orders to be clear. Enter trade, risk 1.0%, goes in favour 3%, move sl to b/e, reason to enter 2nd trade 1% risk (first trade b/e so risk should still only be 1.0% of account), 3rd stack reason to enter, 1.0% sl of new account size as the first trade moved to +ve (say 1.5%), 2nd trade @ b/e, so can now risk a little more (i.e 1.5% that you just gained) etc etc. Vague template but work with it and it is just simple arithmetic.

Though if stacking do consider the swissy debacle and such things, ya don't wanna be walking the plank do ya?

Peace