im lost...back to reading....

The ideas that I trade by:

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

Sandra wrote::(

im lost...back to reading....

Forget the technical analysis that these guys are bringing up

Trading has two parts:

1) placing a STOP LOSS on a LARGE CHART (2+ day) from an EXTREME or better.

2) trailing the STOP LOSS behind the EXTREMES of said large chart.

Large charts for profit potential, small charts for reduced risk:

Do you know how to trail a stop?

We NEVER physically move a stop unless we are normalizing risk or have liquidated and are repositioning to strengthen the position

("position" = "position at an extreme")

IF YOU CAN TRAIL A STOP LOSS THEN YOU CAN TRADE!

As a novice, we would focus on 3 position types to trade from:

1) Bad Wickdoll (failed BO)

trading against the bodies on small charts taking a chance that the large chart will give you a body in the direction of profit in the near future.

2) BOx (position at a BO)

we might use this if there is a strong trend and the 2-day extreme is too far back.

3) Good Wickdoll (like the BOx only there is a retest)

trading with the bodies.

- Captain Pugwash

- rank: 500+ posts

- Posts: 529

- Joined: Wed Sep 14, 2011 7:59 am

- Reputation: 166

- Location: Insanitary Industries

- Gender:

MightyOne wrote:

That is true, [highlight=yellow]context is everything in trading[/highlight].

I have only recently REALLY understood that word.

Withnail has been saying to me the last year or so -

"Context"

"Context"

"Context" .. nearly every time I made any error!

I know what "context" meant - but I did not really KNOW in relation to trading (the Spanish lingo has a great way of differentiating - "Conosco" and "Sé" - shame English doesn't have the same distinction)

Finally........ I read somewhere -

"What you want to see, Where you want to see it" ......Bingo!

that's the wine talking - as usual

"MOJO 1)Self-confidence, Self-assuredness. As in basis for belief in ones self in a situation. Esp/In context of contest or display of skill such as going into battle. 2)Ability to bounce back from a debilitating trauma and negative attitude YEH BABY

-

roctao

- rank: 50+ posts

- Posts: 55

- Joined: Sun Jan 08, 2012 3:50 pm

- Reputation: 13

- Location: backwoods tennessee

- Gender:

- Contact:

Alan88,

I hope you don't mind me trying my attempt at explaining.

When in a position where you are risking say 2% off of a 2+ daily extreme.

As the trades are going in your favor you are taking smaller trades on smaller charts and gaining profit that you are adding to your position so that

you are still only risking 2% but your trades are for larger lot sizes. At some point you are at lot sizes that your account can't handle so your position moves to a closer extreme and you are back to the same risk of 2%

but with good profit in your pocket.

the only way I think you reduce your initial risk is to lose it.

Being that if your first entry (say .5% like MO states) goes against you and you close the trade. You then readjust your lot size down to compensate for your loss but never give up the position till it is invalidated. But do take a breather after a loss and let it prove your speculation before reentering.

Well, deciding to not risk as much then readjust to a comfortable %.

I hope you don't mind me trying my attempt at explaining.

When in a position where you are risking say 2% off of a 2+ daily extreme.

As the trades are going in your favor you are taking smaller trades on smaller charts and gaining profit that you are adding to your position so that

you are still only risking 2% but your trades are for larger lot sizes. At some point you are at lot sizes that your account can't handle so your position moves to a closer extreme and you are back to the same risk of 2%

but with good profit in your pocket.

the only way I think you reduce your initial risk is to lose it.

Being that if your first entry (say .5% like MO states) goes against you and you close the trade. You then readjust your lot size down to compensate for your loss but never give up the position till it is invalidated. But do take a breather after a loss and let it prove your speculation before reentering.

Well, deciding to not risk as much then readjust to a comfortable %.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

Alan88 wrote:I don't get it MO, you say 'trailing the STOP LOSS behind the EXTREMES of said large chart', then you say 'We NEVER physically move a stop unless we are normalizing risk', then 'small charts for reduced risk:', and here comes the chart, where you move a SL from D2 + EX to H4 EX (or smaller). To me it doesn't make sense. Or maybe 'normalizing risk' and 'reducing risk' does not mean the same?

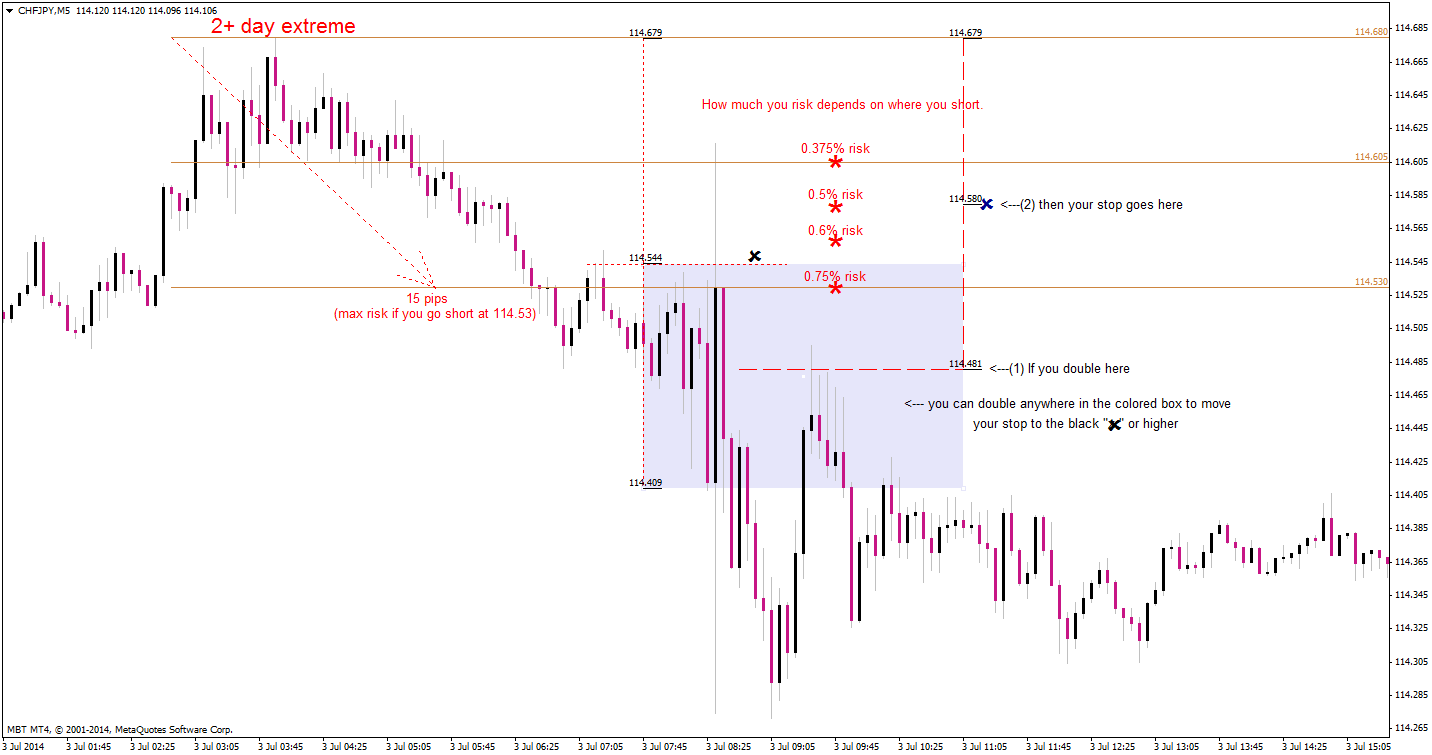

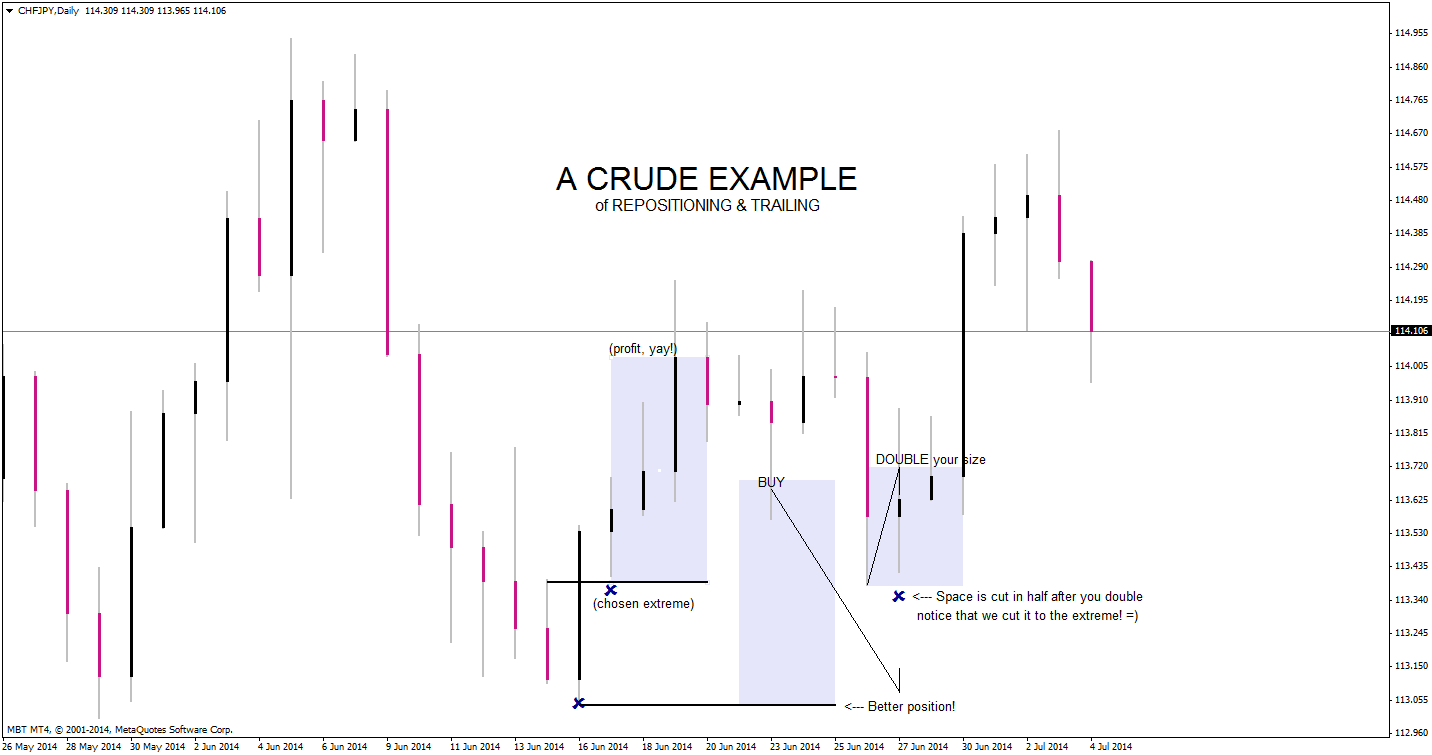

Your stop trails closer to the current price because you are increasing your position size & normalizing risk.

Example: if you place your stop at an extreme and then double your lot size then you must cut your space in half (trailing your stop) to bring your risk back to your initial risk level.

We DO NOT MOVE STOPS without first ADDING to our POSITION SIZE.

LONG TERM you want your stop to trail the LONG TERM extremes.

SHORT TERM you want to increase your size ahead of the long term chart resuming its trend.

In other words, at the end of the day(s) you want your position to trail the LONG TERM EXTREMES.

You can get away with a slightly weaker position over the short term.

Trading is a balancing act between position size and position safety.

If you follow my template then your risk will automatically be reduced:

1) If you are willing to risk 0.75% & end up initiating a trade at a better price then your initial risk drops.

2) When you double your size at a better price than say the lowest price at which you can double but you place your stop as if you had 2x at the lowest price then your risk is reduced.

3) Halving your space after increasing your position size by 50% reduces your risk.

Please help me understand extremes. We trade away from extremes on a daily, or weekly chart?

When you say 2 day extremes is it the highs or lows for the 2 days?

or

Is it only the highs or lows of 2 days that fall with a color change?

thank you,

S

When you say 2 day extremes is it the highs or lows for the 2 days?

or

Is it only the highs or lows of 2 days that fall with a color change?

thank you,

S

- Attachments

-

- 2014-07-07_0050.png (21.36 KiB) Viewed 5046 times

Sandra,

A 2 day range is the highest & lowest price in the last 48 hours.

I'd say trade the 2 day chart most of the time and a larger chart when there is a rare opportunity.

Alan88,

Reducing risk means reducing your risk to a lower number.

Normalizing risk means reducing your risk to ~ the same number as before.

A 2 day range is the highest & lowest price in the last 48 hours.

I'd say trade the 2 day chart most of the time and a larger chart when there is a rare opportunity.

Alan88,

Reducing risk means reducing your risk to a lower number.

Normalizing risk means reducing your risk to ~ the same number as before.

- TheRumpledOne

- rank: 10000+ posts

- Posts: 15740

- Joined: Sun May 14, 2006 9:31 pm

- Reputation: 3046

- Location: Oregon

- Real name: Avery T. Horton, Jr.

- Gender:

- Contact:

MightyOne wrote:Alan88 wrote:I don't get it MO, you say 'trailing the STOP LOSS behind the EXTREMES of said large chart', then you say 'We NEVER physically move a stop unless we are normalizing risk', then 'small charts for reduced risk:', and here comes the chart, where you move a SL from D2 + EX to H4 EX (or smaller). To me it doesn't make sense. Or maybe 'normalizing risk' and 'reducing risk' does not mean the same?

Your stop trails closer to the current price because you are increasing your position size & normalizing risk.

Example: if you place your stop at an extreme and then double your lot size then you must cut your space in half (trailing your stop) to bring your risk back to your initial risk level.

We DO NOT MOVE STOPS without first ADDING to our POSITION SIZE.

LONG TERM you want your stop to trail the LONG TERM extremes.

SHORT TERM you want to increase your size ahead of the long term chart resuming its trend.

In other words, at the end of the day(s) you want your position to trail the LONG TERM EXTREMES.

You can get away with a slightly weaker position over the short term.

Trading is a balancing act between position size and position safety.

If you follow my template then your risk will automatically be reduced:

1) If you are willing to risk 0.75% & end up initiating a trade at a better price then your initial risk drops.

2) When you double your size at a better price than say the lowest price at which you can double but you place your stop as if you had 2x at the lowest price then your risk is reduced.

3) Halving your space after increasing your position size by 50% reduces your risk.

"If you follow my template then your risk will automatically be reduced: "

What template, MO? Did/can you upload it?

IT'S NOT WHAT YOU TRADE, IT'S HOW YOU TRADE IT!

Please do NOT PM me with trading or coding questions, post them in a thread.

Please do NOT PM me with trading or coding questions, post them in a thread.

TheRumpledOne wrote:MightyOne wrote:Alan88 wrote:I don't get it MO, you say 'trailing the STOP LOSS behind the EXTREMES of said large chart', then you say 'We NEVER physically move a stop unless we are normalizing risk', then 'small charts for reduced risk:', and here comes the chart, where you move a SL from D2 + EX to H4 EX (or smaller). To me it doesn't make sense. Or maybe 'normalizing risk' and 'reducing risk' does not mean the same?

Your stop trails closer to the current price because you are increasing your position size & normalizing risk.

Example: if you place your stop at an extreme and then double your lot size then you must cut your space in half (trailing your stop) to bring your risk back to your initial risk level.

We DO NOT MOVE STOPS without first ADDING to our POSITION SIZE.

LONG TERM you want your stop to trail the LONG TERM extremes.

SHORT TERM you want to increase your size ahead of the long term chart resuming its trend.

In other words, at the end of the day(s) you want your position to trail the LONG TERM EXTREMES.

You can get away with a slightly weaker position over the short term.

Trading is a balancing act between position size and position safety.

If you follow my template then your risk will automatically be reduced:

1) If you are willing to risk 0.75% & end up initiating a trade at a better price then your initial risk drops.

2) When you double your size at a better price than say the lowest price at which you can double but you place your stop as if you had 2x at the lowest price then your risk is reduced.

3) Halving your space after increasing your position size by 50% reduces your risk.

"If you follow my template then your risk will automatically be reduced: "

What template, MO? Did/can you upload it?

Strategy template

Risk is 0.5% per 10 pips.

Space is 15, 25, or 35 points.

We start by placing our stop at a 2+ day extreme.

Just as in your "20 pip from the D1 extreme" method (20 pips is your "space") you can enter at any price within your space.

Using the fibo tool, we place the 100% ret at our extreme and drag the 0% ret down until the 50% ret is at the location we wish to trail our stop loss to; the 0% ret is now our maximum [short].

Every time we increase our size we halve our space.

Next we double our lot size (at any price above maximum) & cut our stop to our planned location.

Lastly we increase our size by 50% & capture a few pips before liquidating everything.

One cycle has now been completed

For the next trade we reposition our stop back at the 2+ day extreme and enter for our last lot size when price moves within range.

We then follow the rest of the steps (double, + half, liquidate) to complete the 2nd cycle.

We are mindful of the 2-day chart...

(or whatever long term chart we are trading)

...when repositioning our stop.

Our ultimate goal is to max out our lot size & then ride the long term chart until we have doubled our account; unless of course there are attractive premiums to be made.

Greed be with you -MO

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.