MO says: Always oversize your space.

How much space would you use?

Would that be...

The ideas that I trade by:

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

xXx wrote:MO says: Always oversize your space.

How much space would you use?

Would that be...

My space would be 15, 25, or 35 pips.

Where before I might have entered for varying lot sizes I now initiate a trade at minimum size.

I have also cut my risk significantly to 0.5% per 10 pips while doubling the number of charts I trade at one time.

Start by using the smallest box size from the 2+ day extremes & then increase as needed.

Once in a trade immediately plan your double.

After you double you add 50% as if you were scalping in the direction of profit only instead of closing a small trade you liquidate everything.

- Libertarian

- rank: 150+ posts

- Posts: 267

- Joined: Tue Nov 30, 2010 6:32 am

- Reputation: 178

- Location: MN

- Gender:

- Libertarian

- rank: 150+ posts

- Posts: 267

- Joined: Tue Nov 30, 2010 6:32 am

- Reputation: 178

- Location: MN

- Gender:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- Jalarupa

- rank: 1000+ posts

- Posts: 1300

- Joined: Tue Feb 23, 2010 5:50 pm

- Reputation: 324

- Location: South Africa

- Gender:

Libertarian wrote:I'd like to tell you Jalarupa, I really appreciate the effort you put in all over this board (and others). You have really helped me understand these concepts even though I haven't been vocal until recently. Caps off to you sir.

Thank you for the kind words, i wish to remain of service and use to this community (which has given so much to me).

I am merely repeating what I have been shown by the great great traders here on this forum. All credit goes to them... and I appreciate their continued participation and endeavor in further enlightening and instructing me.

If ever I can be of any help further, please ask

- xXx

- rank: 50+ posts

- Posts: 112

- Joined: Sat Feb 12, 2011 10:30 am

- Reputation: 1

- Location: London

- Gender:

MightyOne wrote: My space would be 15, 25, or 35 pips.

Where before I might have entered for varying lot sizes I now initiate a trade at minimum size.

I have also cut my risk significantly to 0.5% per 10 pips while doubling the number of charts I trade at one time.

Start by using the smallest box size from the 2+ day extremes & then increase as needed.

Once in a trade immediately plan your double.

After you double you add 50% as if you were scalping in the direction of profit only instead of closing a small trade you liquidate everything.

By double do you mean the lot size?

Could you show an example on a chart please?

What about catching the weekly+?

- Jalarupa

- rank: 1000+ posts

- Posts: 1300

- Joined: Tue Feb 23, 2010 5:50 pm

- Reputation: 324

- Location: South Africa

- Gender:

xXx wrote:Jalarupa wrote:

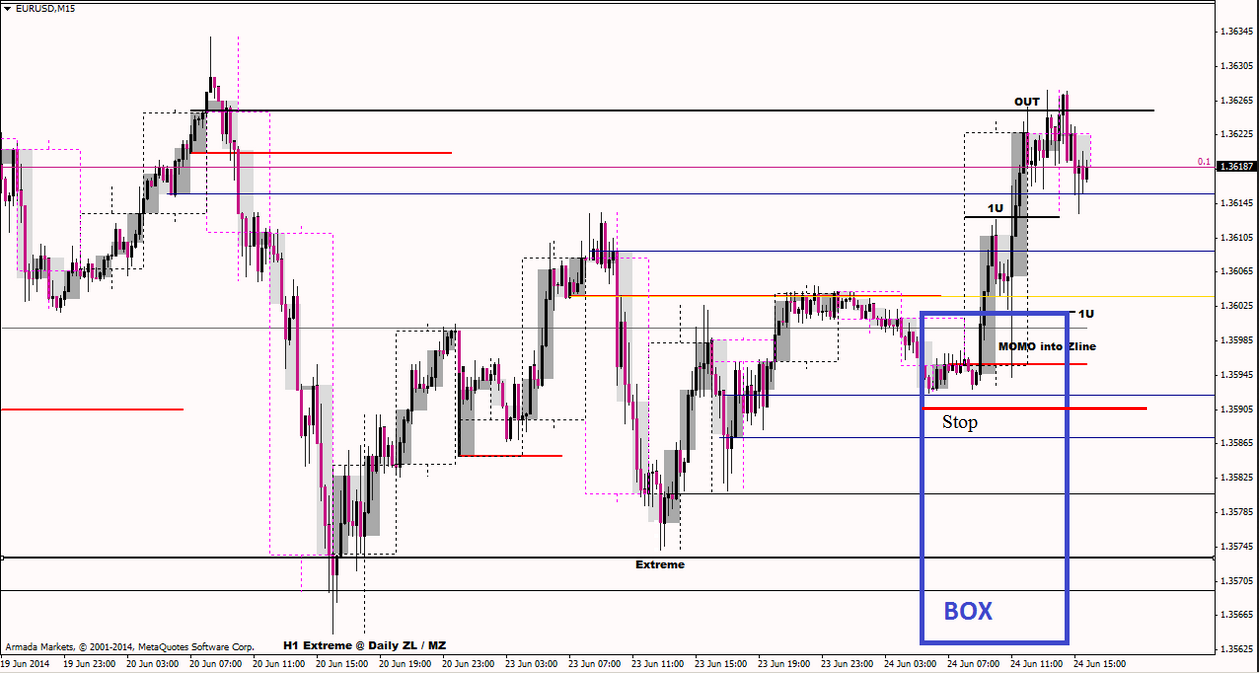

Using a stop below the swing low, which is covered by both by the MOMO H1 Zline, Dragon Lines and the H4 Zline... So I figured I could afford to tighten things up...

Thank you.

Do you think that a beginner should have bigger box?

Well i have experimented with box size... at first I was risking 1% over 100 pips...

That go me NOWHERE!!!

Then I started risking 3.5% at 60 pips... that got me scared out of trades off extremes only to watch the trade go in my favour... So i lost money and lost my awesome position...

I now risk 0.5% per trade on my first entry of a stack... and its cool cause if I think about it 0.5% means very little to me so I can lose it (heck I was losing way more when I was risking 3.5% /60 so in a way I'm glad that happened) so the psychological asoect has been tempered and I can explore adding our doubling my position at a pull back or breakout and then scalping half of a position size to my profit target .... Its an easy +2% off the first setup and then you can make that +2% work for you in your next setups...

Time to get MIGHTY!!!!

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.