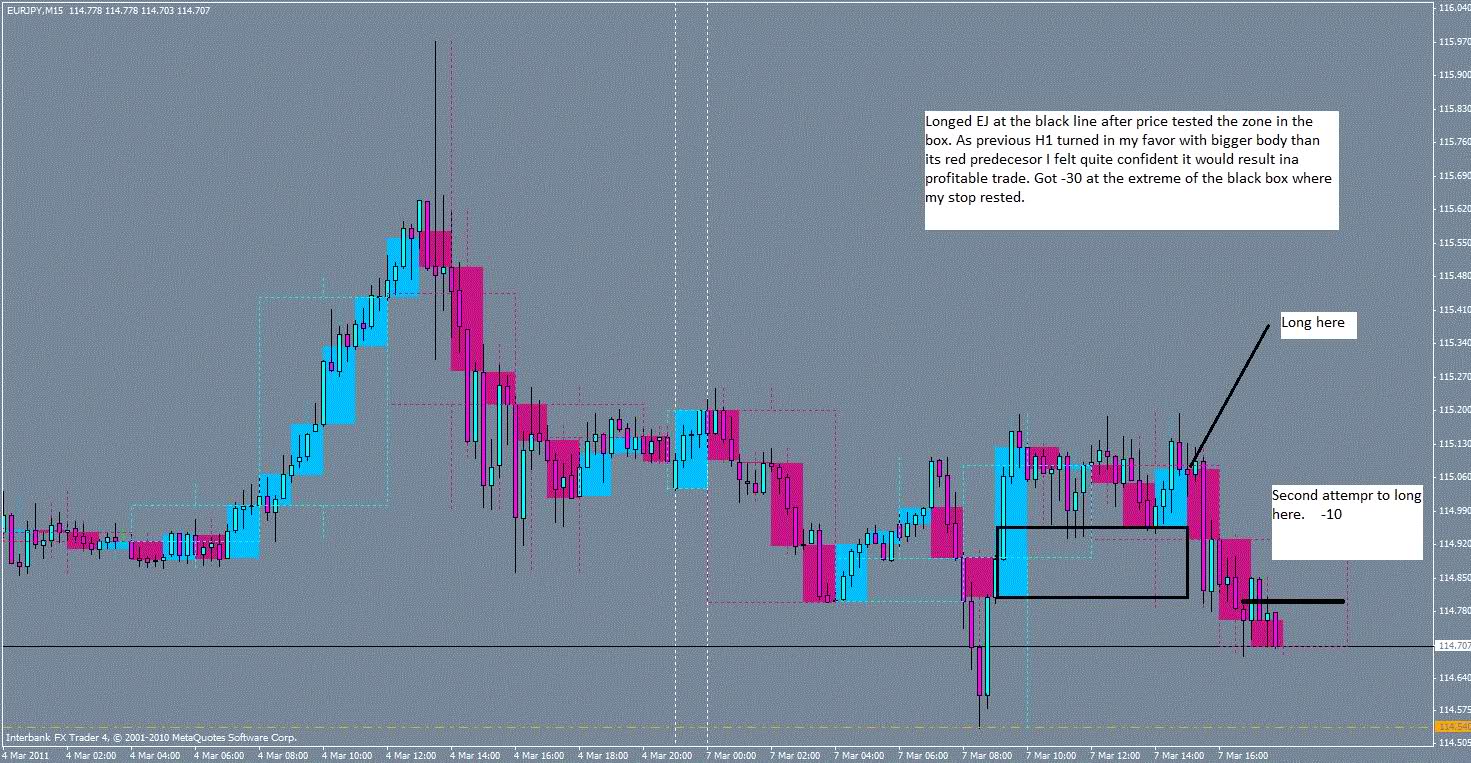

Any comments are more than apreciated.

Cheers

Moderator: moderators

dojirock wrote:I used to find this problem all the time. Take notice of the 8 hr momo bar. You never closed above that bar line. Break time zones down, the houlry m bars gave you some pips then zeroed out, the 15 min mbars gave you pips then zeroed. I try to take pip ranges based on what i see for each time period. hourly may give 15 to 40, 15 min 5 to 15 pips. i try to stay 4 to 5 candles out for mzones....so on the 8 hour if it enters the mz zone with in 3 8 hour candles I would take a long in this instance. When I place a trade I dont mix time frames.

dojirock

FXfreak wrote:cfabian, i'm far away from an expert but i did the same trades on another pair and ended like you in a loss.

i can tell you the only thing that worked (for me): trading the extremes from h1 or h4.

if i look at your trades than i have to say that you are always late. today there would have been one entry near 114.50 for a long and a short near 115.25. look for these areas at h1 or h4 or d1 and than use entries near these extreme levels.

MightyOne wrote:Small charts L' kill you

FXfreak wrote:trading is bad!

the idea behind my long was a 50% fib-retracement and a support-line. it was the same idea which ended in a loss on gu. the only way to get out of these "random-trades" is to cut your losses and let your profits run. my results from last week were spectacular (for me) because i only tried to get the big reversals on 4h- or at least 1h-extremes which had a potential profit margin of at least 50-100 pips.

this 50%-fib trade is everything else than a trade with a wonderful rr-ratio.

...target 40, sl be