So we have accumulated a cushion (using spreads, limiting risk/profit) and are long the underlying.

We sell OTM calls to collect the premium and avoid being assigned so as to keep our long underlying position going.

Accumulate more contracts and sell more calls.

If the write gets assigned, we sell a portion of the position and buy back lower

At some point we can collar a portion of our position by buying a put (limit risk)

No lack of OPTIONS

Moderator: moderators

- PebbleTrader

- rank: 1000+ posts

- Posts: 1633

- Joined: Fri Nov 12, 2010 2:15 am

- Reputation: 15

- Gender:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

If the write gets assigned then you are short from the strike price:

Since you are already long the underlying, & cannot be both long and short in the same month, your position is liquidated automatically at the strike price.

Getting assigned is not a big deal:

00 to the strike is your space & you simply reposition 00, increasing your Space if needed, and write more calls.

While writing OTM calls is the standard play for covered calls, writing in the money calls has advantages that should not be overlooked...

don't you love hints

Since you are already long the underlying, & cannot be both long and short in the same month, your position is liquidated automatically at the strike price.

Getting assigned is not a big deal:

00 to the strike is your space & you simply reposition 00, increasing your Space if needed, and write more calls.

While writing OTM calls is the standard play for covered calls, writing in the money calls has advantages that should not be overlooked...

don't you love hints

- PebbleTrader

- rank: 1000+ posts

- Posts: 1633

- Joined: Fri Nov 12, 2010 2:15 am

- Reputation: 15

- Gender:

Thanks MO

"While writing OTM calls is the standard play for covered calls, writing in the money calls has advantages that should not be overlooked... "

OTM Covered Calls: The advantage is that you realize an increased gain in the underlying while collecting the premium. I see this being used for profit targets. The disadvantage is that it requires price to move up to the strike which might not be a big deal if you didn't mind keeping your long position. OTM Covered Calls is like an exit strategy?

ITM Covered Calls: Unlike OTM, there is no benefit to additional upward movement. The advantage is that the premium is larger which can be used to protect against a downward move against you. It's also like getting a better price by lowering the cost basis of the entry price. ITM Covered Calls is more of an entry strategy?

"While writing OTM calls is the standard play for covered calls, writing in the money calls has advantages that should not be overlooked... "

OTM Covered Calls: The advantage is that you realize an increased gain in the underlying while collecting the premium. I see this being used for profit targets. The disadvantage is that it requires price to move up to the strike which might not be a big deal if you didn't mind keeping your long position. OTM Covered Calls is like an exit strategy?

ITM Covered Calls: Unlike OTM, there is no benefit to additional upward movement. The advantage is that the premium is larger which can be used to protect against a downward move against you. It's also like getting a better price by lowering the cost basis of the entry price. ITM Covered Calls is more of an entry strategy?

Life is just a journey

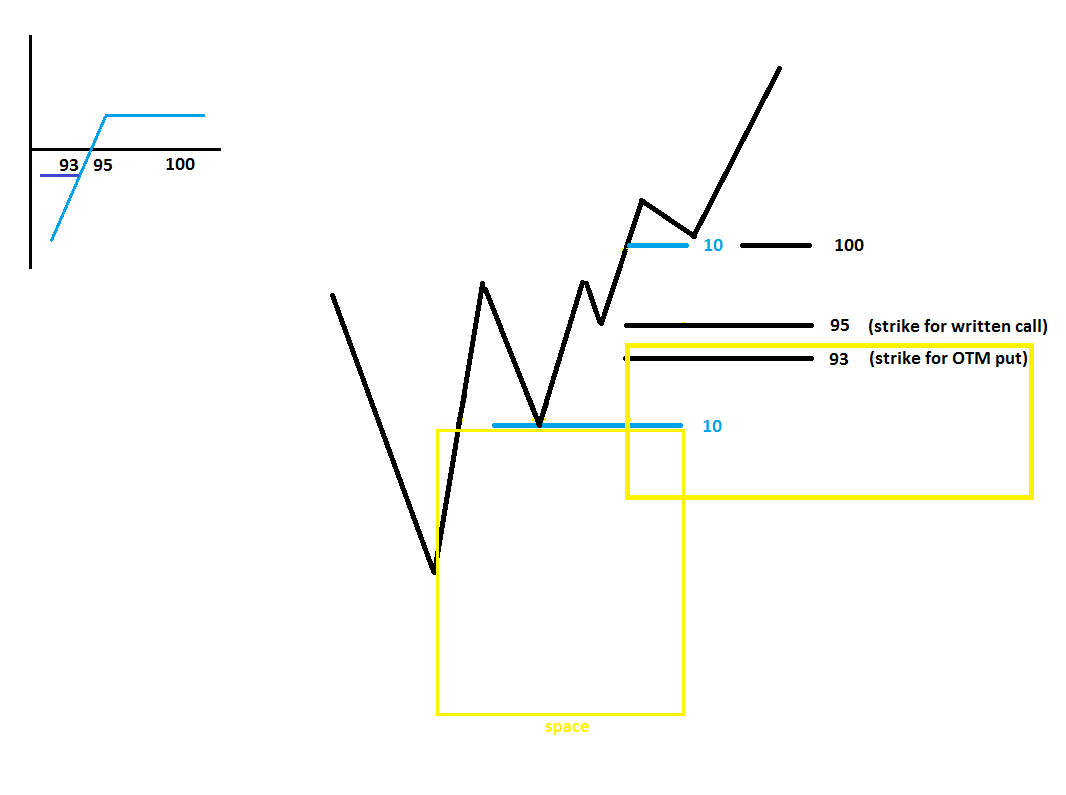

Here is an extreme example:

You are long 10 contracts, price makes a breakout type move, & you double your position to 20 contracts. Should you write OTM or ITM calls?

ITM:

-If price is at 100 and you write a 95 call then you receive 5 (cents?) in intrinsic value; you do not lose Space until price falls below 95.

-Options closer to the money have higher THETA...

-You can better fund OTM puts to collar part of your position (driving 00 backwards).

-You can more easily leg into different shapes, at a credit, after an adverse move...

This would free up the underlying so that you can reduce your size (driving 00 backwards) which might now be overprotected by puts (driving 00 backwards).

I probably shouldn't be telling you my strategies as I have a way of perverting common practice

The key thoughts to take away from what I am saying is:

1) if you are the type of guy who buys 2 Futures contracts and sets a SL/TP then by all means write OTM calls.

2) if you accumulate large positions then write in the money options;

it sounds crazy until you consider future changes to your position size.

3) strategies are not as black & white as you think them to be.

Lets say that the ITM option is $2300:

In the first example, we increased our size in the underlying from 10 to 20 contracts (halving space) & can now collect $46,000 in premium.

With this money we can now restore some Space by collaring part of the position.

-If we spend $6000 on puts then we are left with $40,000 of OPM

that is not an insignificant sum considering that we only generated space with 10 contracts or less (when flat, size can increase on a move towards 00).

You really need price to move sideways &/or up.

If price moves down then you are going to have to use half of your premium to protect your contracts or take profit on the calls and deal with the declining price.

-One strategy would be to use some of your space to convert a portion of your contracts into calls and write OTM options; that is what I did when Coffee prices were low & volatility was skyrocketing.

You are long 10 contracts, price makes a breakout type move, & you double your position to 20 contracts. Should you write OTM or ITM calls?

ITM:

-If price is at 100 and you write a 95 call then you receive 5 (cents?) in intrinsic value; you do not lose Space until price falls below 95.

-Options closer to the money have higher THETA...

-You can better fund OTM puts to collar part of your position (driving 00 backwards).

-You can more easily leg into different shapes, at a credit, after an adverse move...

This would free up the underlying so that you can reduce your size (driving 00 backwards) which might now be overprotected by puts (driving 00 backwards).

I probably shouldn't be telling you my strategies as I have a way of perverting common practice

The key thoughts to take away from what I am saying is:

1) if you are the type of guy who buys 2 Futures contracts and sets a SL/TP then by all means write OTM calls.

2) if you accumulate large positions then write in the money options;

it sounds crazy until you consider future changes to your position size.

3) strategies are not as black & white as you think them to be.

Lets say that the ITM option is $2300:

In the first example, we increased our size in the underlying from 10 to 20 contracts (halving space) & can now collect $46,000 in premium.

With this money we can now restore some Space by collaring part of the position.

-If we spend $6000 on puts then we are left with $40,000 of OPM

that is not an insignificant sum considering that we only generated space with 10 contracts or less (when flat, size can increase on a move towards 00).

OTM Covered Calls: The advantage is that you realize an increased gain in the underlying while collecting the premium...

You really need price to move sideways &/or up.

If price moves down then you are going to have to use half of your premium to protect your contracts or take profit on the calls and deal with the declining price.

-One strategy would be to use some of your space to convert a portion of your contracts into calls and write OTM options; that is what I did when Coffee prices were low & volatility was skyrocketing.

"...ITM Covered Calls is more of an entry strategy?"

- PebbleTrader

- rank: 1000+ posts

- Posts: 1633

- Joined: Fri Nov 12, 2010 2:15 am

- Reputation: 15

- Gender:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- PebbleTrader

- rank: 1000+ posts

- Posts: 1633

- Joined: Fri Nov 12, 2010 2:15 am

- Reputation: 15

- Gender:

-

lazygeorge

- rank: 150+ posts

- Posts: 157

- Joined: Sun Aug 23, 2009 7:01 pm

- Reputation: 0

- Gender:

- PebbleTrader

- rank: 1000+ posts

- Posts: 1633

- Joined: Fri Nov 12, 2010 2:15 am

- Reputation: 15

- Gender:

-You can better fund OTM puts to collar part of your position (driving 00 backwards).

I understand how closing some of the underlying would drive 00 backwards,

but I was trying to understand how the OTM puts (creation of the collar) would

drive 00 backwards. I think I understand...Since the risk is limited, it's almost

as if the portion of the underlying that is protected by the put doesn't exist

(other than the small risk) it's sort of like if you had closed out the underlying

to gain space.

Life is just a journey

Buying a put is similar to selling part of your position at the strike price.

It is not exactly the same because long options must to sold in order to receive the premium necessary to offset your losses; you can still get a margin call even with protective puts.

That said, your margin is significantly lower when you have protective puts...but you are not going to have puts cover your entire position.

If you are long 5 contracts & you buy 2 puts then that is similar to (5/3) * remaining space or (00 to the strike).

If you exercise the options then that is exactly what happens; you are given a short position from the strike which offsets an equal amount from your long position (in this case, short 2 at the strike for (5/3) * Space).

It is not exactly the same because long options must to sold in order to receive the premium necessary to offset your losses; you can still get a margin call even with protective puts.

That said, your margin is significantly lower when you have protective puts...but you are not going to have puts cover your entire position.

If you are long 5 contracts & you buy 2 puts then that is similar to (5/3) * remaining space or (00 to the strike).

If you exercise the options then that is exactly what happens; you are given a short position from the strike which offsets an equal amount from your long position (in this case, short 2 at the strike for (5/3) * Space).

In your example, where you bought 10 contracts at a price of 90 and bought additional 10 contracts at a price of 100, how many calls do you write with strike price of 95?

20 (the full position)?

What are you doing, if price is further rising? Your profits won't increase because you've written calls. So you have to buy new contracts and sell calls again, at what prices?

20 (the full position)?

What are you doing, if price is further rising? Your profits won't increase because you've written calls. So you have to buy new contracts and sell calls again, at what prices?

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.