Can you tell me what is meant by

"I trade the 6 hour with D1 color, 8 hour with W1 color, etc."

Is it:

1. the current Daily or weekly candle color (not closed) ?

or

2. the last closed daily or weekly candle color (closed) ?

Moderator: moderators

JESGPY wrote:MO.

So according to the entry triggers you posted we need to find an option that bets that price will move in that direction.. and to make the bet interesting we have to find one that if far from 100 and near to 0 (if betting in favor of the options outcome), or a bet that says price will move toward our entry and bet against it, in this case trying to buy near 100 aiming for it to go to 0.

If i am mistaken please correct me.

Thanks for showing us this interesting idea.

JUAN

MightyOne wrote:JESGPY wrote:MO.

So according to the entry triggers you posted we need to find an option that bets that price will move in that direction.. and to make the bet interesting we have to find one that if far from 100 and near to 0 (if betting in favor of the options outcome), or a bet that says price will move toward our entry and bet against it, in this case trying to buy near 100 aiming for it to go to 0.

If i am mistaken please correct me.

Thanks for showing us this interesting idea.

JUAN

You simply need to plan everything out so that you know which strike to be interested in when the chart signals for you to enter.

If the strikes are spaced by 20 pips and price is within 10 pips of the 111.10 strike then what is your max risk if you purchase that strike?

What is the risk of purchasing a strike that is 1, 2, or 3 out?

How far does price have to move before I start making money?

How far does price have to move before I am over the strike?

Plan all this out and then trigger the strike that matches your risk/reward and size of expected move.

JESGPY wrote:MightyOne wrote:JESGPY wrote:MO.

So according to the entry triggers you posted we need to find an option that bets that price will move in that direction.. and to make the bet interesting we have to find one that if far from 100 and near to 0 (if betting in favor of the options outcome), or a bet that says price will move toward our entry and bet against it, in this case trying to buy near 100 aiming for it to go to 0.

If i am mistaken please correct me.

Thanks for showing us this interesting idea.

JUAN

You simply need to plan everything out so that you know which strike to be interested in when the chart signals for you to enter.

If the strikes are spaced by 20 pips and price is within 10 pips of the 111.10 strike then what is your max risk if you purchase that strike?

What is the risk of purchasing a strike that is 1, 2, or 3 out?

How far does price have to move before I start making money?

How far does price have to move before I am over the strike?

Plan all this out and then trigger the strike that matches your risk/reward and size of expected move.

Thanks for the reply MO

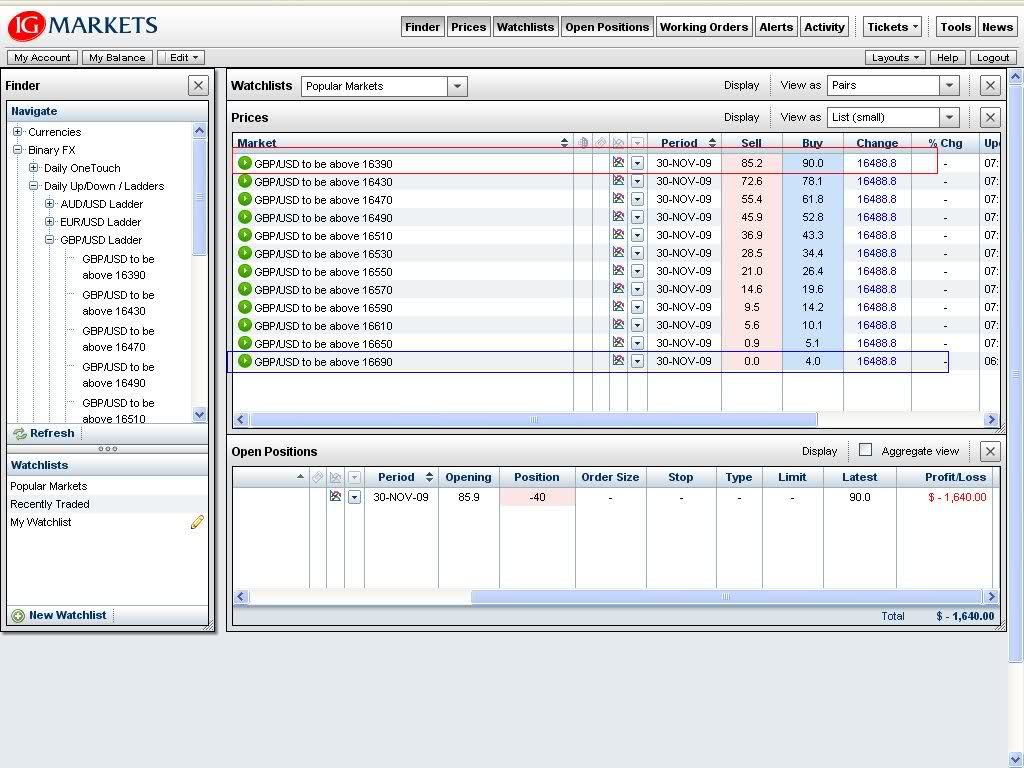

I attach my charts that will show me my entry and the strikes I have available to chose from.

I will chose the strike that is inside the red rectangle. Because of all the available is the one that is most into the money.. so I will bet against it. This is the cheapeast strike available in the demo today, so it should give be the best Risk/Reward.

I should sell that option when price crosses the red line in my chart and exit at the white one hopefully.

Please any coments, they will be much appreciated.

thanks

JUAN

MightyOne wrote:JESGPY wrote:MightyOne wrote:JESGPY wrote:MO.

So according to the entry triggers you posted we need to find an option that bets that price will move in that direction.. and to make the bet interesting we have to find one that if far from 100 and near to 0 (if betting in favor of the options outcome), or a bet that says price will move toward our entry and bet against it, in this case trying to buy near 100 aiming for it to go to 0.

If i am mistaken please correct me.

Thanks for showing us this interesting idea.

JUAN

You simply need to plan everything out so that you know which strike to be interested in when the chart signals for you to enter.

If the strikes are spaced by 20 pips and price is within 10 pips of the 111.10 strike then what is your max risk if you purchase that strike?

What is the risk of purchasing a strike that is 1, 2, or 3 out?

How far does price have to move before I start making money?

How far does price have to move before I am over the strike?

Plan all this out and then trigger the strike that matches your risk/reward and size of expected move.

Thanks for the reply MO

I attach my charts that will show me my entry and the strikes I have available to chose from.

I will chose the strike that is inside the red rectangle. Because of all the available is the one that is most into the money.. so I will bet against it. This is the cheapeast strike available in the demo today, so it should give be the best Risk/Reward.

I should sell that option when price crosses the red line in my chart and exit at the white one hopefully.

Please any coments, they will be much appreciated.

thanks

JUAN

It looks like you're are triggering a trade when price touches a strike instead of the 2 bar avrg and that wouldn't be correct.

Which strike is 10 pips away from your trigger?

How many strikes out are you trading based on range and risk?

That is all that you are doing.

Braathen wrote:I am starting to believe that the only things that matter are:

1. Range

2. Correction Size

&

3. Color

So im wondering where correction size comes in the picture.. i have a notion this might help me