Is price closing higher or lower than something?

Simple yet powerful question.

2009.09.10 DRAIN THE BANKS - LIKE A RAT

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

Thank You MO  i see it now.

i see it now.

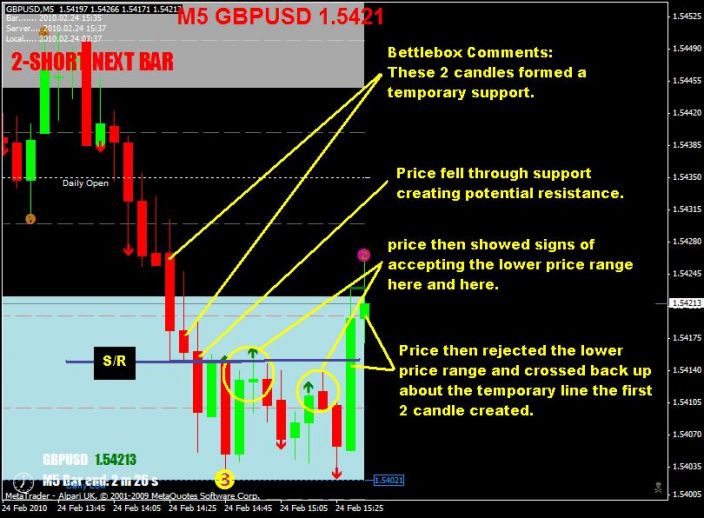

MightyOne wrote:I think that he wants you to see the false support in the downtrend and then note that the first bull candle stopped at the last false support level. If you took the second Rat signal then you would be trading right on top of the same level, but if you take the third you would have enough space to take partial profits around that same level.

There are two forces acting upon us: Suffering pushes us forward from behind and pleasures entice us and pull us forward.

- TheRumpledOne

- rank: 10000+ posts

- Posts: 15740

- Joined: Sun May 14, 2006 9:31 pm

- Reputation: 3046

- Location: Oregon

- Real name: Avery T. Horton, Jr.

- Gender:

- Contact:

- TheRumpledOne

- rank: 10000+ posts

- Posts: 15740

- Joined: Sun May 14, 2006 9:31 pm

- Reputation: 3046

- Location: Oregon

- Real name: Avery T. Horton, Jr.

- Gender:

- Contact:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

Hi K

I remember reading a post from the TheMightyOne he is/was trading from higher timeframe and gave a calculation for the ratio. You could come up with your own calculation?

Plus this what i would do and TRO said it many a time if you open position and your in profit after a period time (you must define how long that time period is) tighten up your stop loss.

Think about, if you entered a position, to go long, with a huge stoploss say 50 pips and after hour your up 25 pips. Were would price have to go to make you fearful of trade turning against you?

answer: The lower bottom extreme of that hourly candle. So why not tighten your stop loss up to couple pips below the candle.

I personally enter daily trades with 20 pip stoploss and soon as the hour candle closes im reducing my risk on average to 8 pips.

The way i see it is, if i picked my trade thats with flow of market then all i have to worry about is the wick of the next candle. That leads to next question.

Whats the average length of a wick in an hourly candle? between 10-19pips on eurusd as example. So if i use 20 pip stoploss i know im relatively safe. Its all about managing your trade and reducing your risk.

I know some guys here hedge positions but doesnt suit me but might something else to look into.

These are concepts you need to think about.

best wishes

BB

I remember reading a post from the TheMightyOne he is/was trading from higher timeframe and gave a calculation for the ratio. You could come up with your own calculation?

Plus this what i would do and TRO said it many a time if you open position and your in profit after a period time (you must define how long that time period is) tighten up your stop loss.

Think about, if you entered a position, to go long, with a huge stoploss say 50 pips and after hour your up 25 pips. Were would price have to go to make you fearful of trade turning against you?

answer: The lower bottom extreme of that hourly candle. So why not tighten your stop loss up to couple pips below the candle.

I personally enter daily trades with 20 pip stoploss and soon as the hour candle closes im reducing my risk on average to 8 pips.

The way i see it is, if i picked my trade thats with flow of market then all i have to worry about is the wick of the next candle. That leads to next question.

Whats the average length of a wick in an hourly candle? between 10-19pips on eurusd as example. So if i use 20 pip stoploss i know im relatively safe. Its all about managing your trade and reducing your risk.

I know some guys here hedge positions but doesnt suit me but might something else to look into.

These are concepts you need to think about.

best wishes

BB

wkestler wrote:Hi TRO i have trading like a rat on the D1 frame but my question is which is a good SL to use. 10 pips or more? so far i`ve been using much more than 10 and profit is very good my i still have that concern.

Thanks for your advice

There are two forces acting upon us: Suffering pushes us forward from behind and pleasures entice us and pull us forward.

- TheRumpledOne

- rank: 10000+ posts

- Posts: 15740

- Joined: Sun May 14, 2006 9:31 pm

- Reputation: 3046

- Location: Oregon

- Real name: Avery T. Horton, Jr.

- Gender:

- Contact:

"Look, for example, at this elegant little experiment. A rat was put in a T-shaped maze with a few morsels of food placed on either the far right or left side of the enclosure. The placement of the food is randomly determined, but the dice is rigged: over the long run, the food was placed on the left side sixty per cent of the time. How did the rat respond? It quickly realized that the left side was more rewarding. As a result, it always went to the left, which resulted in a sixty percent success rate. The rat didn't strive for perfection. It didn't search for a Unified Theory of the T-shaped maze, or try to decipher the disorder. Instead, it accepted the inherent uncertainty of the reward and learned to settle for the best possible alternative.

The experiment was then repeated with Yale undergraduates. Unlike the rat, their swollen brains stubbornly searched for the elusive pattern that determined the placement of the reward. They made predictions and then tried to learn from their prediction errors. The problem was that there was nothing to predict: the randomness was real. Because the students refused to settle for a 60 percent success rate, they ended up with a 52 percent success rate. Although most of the students were convinced they were making progress towards identifying the underlying algorithm, they were actually being outsmarted by a rat."

P64 HOW WE DECIDE (italics added)

========================= ====================

"Now, 2 patterns of market behavior happen on a regular basis:

1) the price breaks to new high's (or low's)

2) the price reverses from new high's (or low's)

They happen regardless of time frame (with the obvious limitations explained above)

They are phenomena that can be exploited without the fear if found out by others, that they might cease to exist." - H. Rearden

=============================================

1) Price within 20 pips of the daily low (ClLo < 20): This is OPPORTUNITY

============================================

WHY ISN'T EVERYBODY DOING IT?

Most of you know I catch a lot of flak on my forums because SOME PEOPLE don't like the way I post.

One worn out argument that is used repeatedly is, "If this is so (simple, great, profitable, ), then why isn't everybody doing it?"

Simple answer is because SOYLENT GREEN is people!

We all know exercise is great, but how many actually exercise?

We all know smoking is bad, but how many do it anyway?

We all know which foods are bad for our health, but how many eat those foods?

We all know that we should save for our future and spend less than we earn but who does that?

The list is almost endless.

As long as there are people, there will always be some STUPID people and some smart people making STUPID decisions, where STUPID is defined as knowing better but acting otherwise.

Meanwhile, the RATS are still beating the Yale students.

=============================================

PLEASE DO NOT PM ME WITH QUESTIONS ABOUT TRADING, INDICATORS, CODING, ETC... Post your questions in the forum. Thank you.

IT'S NOT WHAT YOU TRADE, IT'S HOW YOU TRADE IT!

Please do NOT PM me with trading or coding questions, post them in a thread.

Please do NOT PM me with trading or coding questions, post them in a thread.

- TheRumpledOne

- rank: 10000+ posts

- Posts: 15740

- Joined: Sun May 14, 2006 9:31 pm

- Reputation: 3046

- Location: Oregon

- Real name: Avery T. Horton, Jr.

- Gender:

- Contact:

- TheRumpledOne

- rank: 10000+ posts

- Posts: 15740

- Joined: Sun May 14, 2006 9:31 pm

- Reputation: 3046

- Location: Oregon

- Real name: Avery T. Horton, Jr.

- Gender:

- Contact:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.