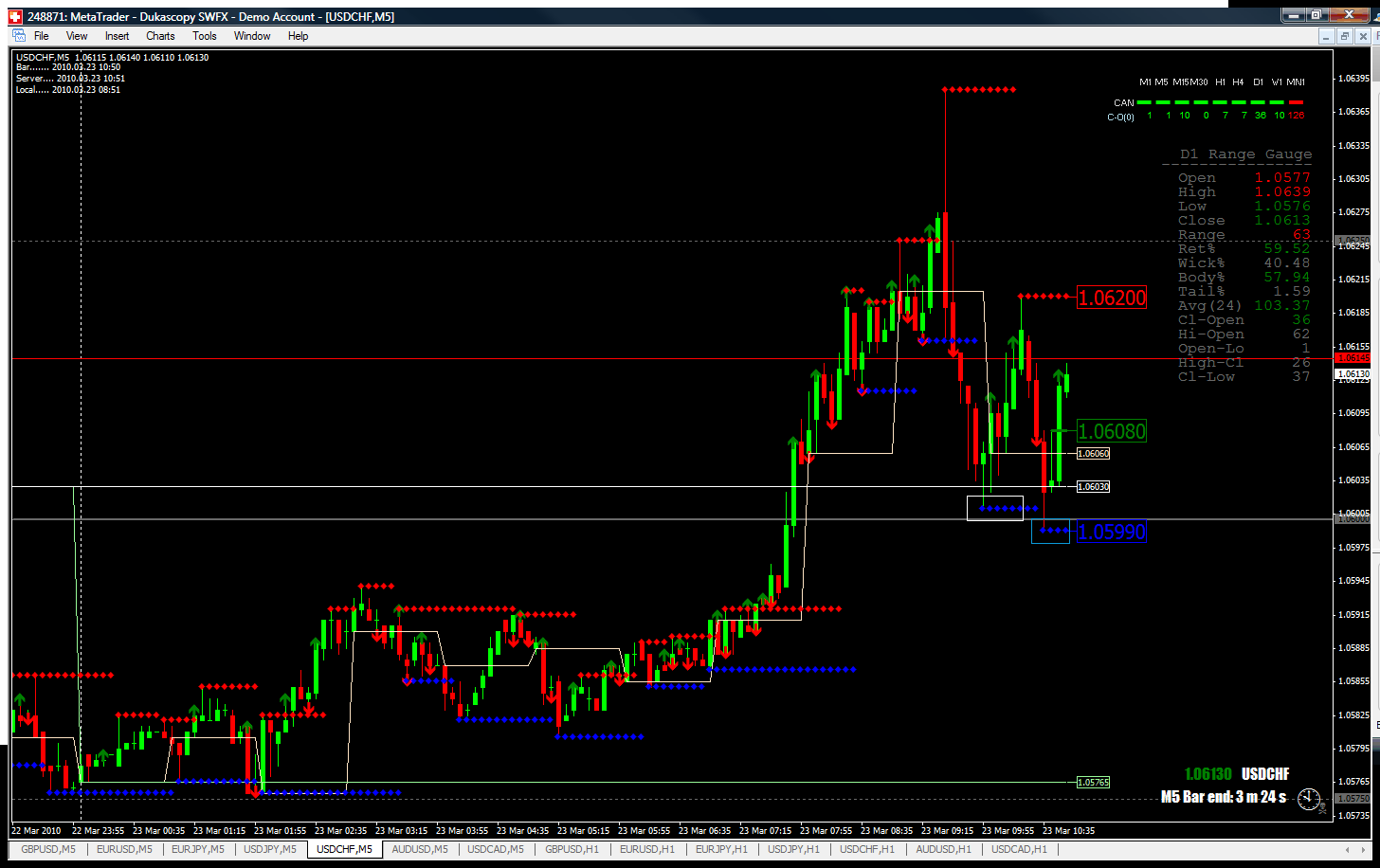

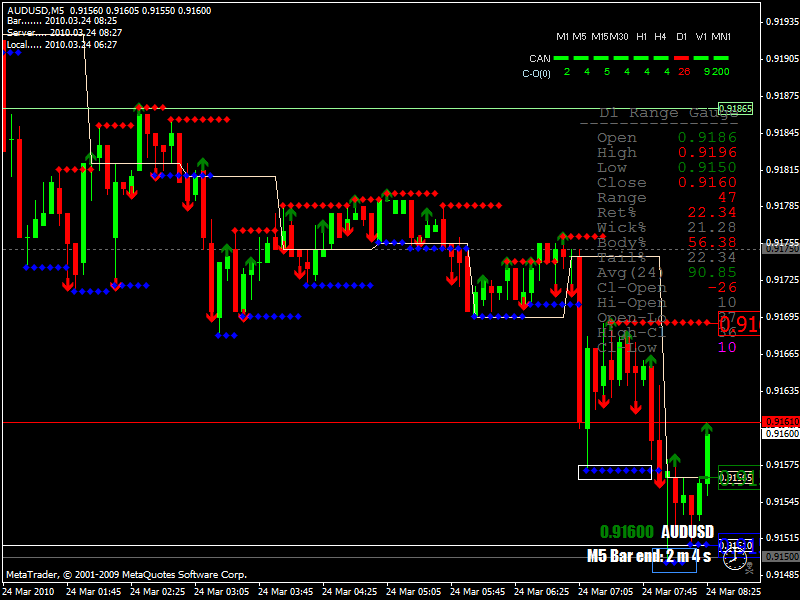

1) price within 20 pips of the daily low - that is OPPORTUNITY

2) red candle closes

3) green candle closes - note the high price of the green candle.

4) enter long at the green candle's high price

5) STOP LOSS IS 10 PIPS

6) Take whatever profit you can.

"The technique is so simple that just several lessons (or a few pages of explanations) cover it all. Now what? Now the student has to practice, practice and practice again to understand what he had been taught. The teacher DOES know much more than the student, but his understanding can't be "passed", "transferred" or taught in any way -- not even by reading books."

GREEN RAT REVERSAL - LONG ENTRY CRITERIA: 1) RED CANDLE CLOSES 2) GREEN CANDLE CLOSES 3) PRICE TOUCHES HIGH OF PREVIOUS GREEN CANDLE - ENTER LONG. STOP LOSS IS ALWAYS 10 PIPS.

RED RAT REVERSAL - SHORT ENTRY CRITERIA: 1) GREEN CANDLE CLOSES 2) RED CANDLE CLOSES 3) PRICE TOUCHES LOW OF PREVIOUS RED CANDLE - ENTER SHORT. STOP LOSS IS ALWAYS 10 PIPS.