trueblueTEX wrote:dojirock wrote:Fx, your definition is different than mine. You need a close of a red candle higher than a open of a red candle. You cant verify that until you have a close of a green candle.

I think I may have missed the proper definition of a zline. I thought it was just red candle closes and green candle closes Above red candle's open.

Are you saying that it takes at least 3 candles to form?

Someone may have already answered this as I haven't read through all the posts yet, its great to see the forum so busy again

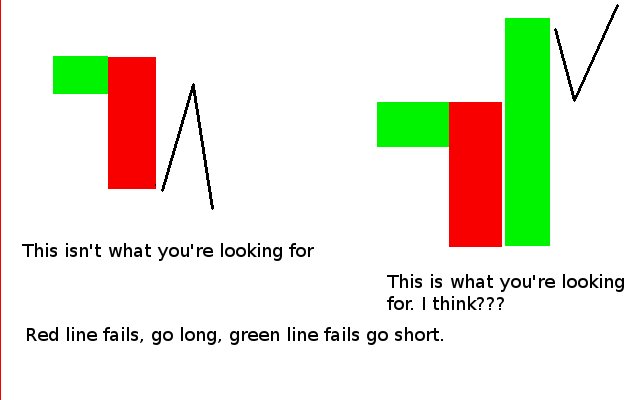

Please look to the picture I posted up that says 'this is not a z-line'. I spelled it out, plain as day, no subterfuge or written in code - absolutely there in black and white (at last lol).

On the lower timeframe, yes, a z-line will take at least 3 candles to form.

It's the first time it has been explicitly put in those terms. I've been confused by it all along but it's this:

If you are looking at H1 and see a big H1 momo candle breakout of a small candle...it might look like a z-line but it isn't - you don't know where the zline is is for one thing.

In this instance H1 is your 'power chart' but your bias chart as Doji has termed it is on a lesser timeframe, say M30.

Now refer to the other picture I posted up

See this below?

What is the phenomenon I'm illustrating there re profit and loss and stops etc?

Who wins and who loses and when?

Think about seeing held profit but that's not the whole picture, think about those same people moving from massive profit into loss and then shitting themselves trying to get back out for break even. When will they buy/sell, when will you buy/sell?

Forget the moving stop losses to breakeven idea, that's not it.

The problem with visualising it is that on the higher timeframe it actually looks like the momo bar breakout, stops to breakeven scenario but that's not it at all - look at the z-lines that form on the shorter timeframe.

Of the three timeframes you look for z-lines on the middles one, body showing the way on the higher one then try to get in on a wick on the lower one.

So when you see a bias line form from a big, confirmed down move on M30 and then fail with H1 momo closing up over it, that's when you think 'long'