EDIT:

dropped like 15 ticks

i took it

didnt take any screenshots

so i can go fk myself

sold once more tho

.11 now

EDIT:

stopped -3

Moderator: moderators

paweldobkowski wrote:and since i think the buyers are in a bad shape now

just shorted .00

lets get the new low and i can go start packing for the fkn wedding

EDIT:

ok

im moving my stop to BE right now

because i need to be doing everything else but trading

so its either 0 or +30 at the new low

oh and there is also this scenario where the market skips my stop and i come back here sitting on -300 ticks

still better then the wedding

LeMercenaire wrote:paweldobkowski wrote:and since i think the buyers are in a bad shape now

just shorted .00

lets get the new low and i can go start packing for the fkn wedding

EDIT:

ok

im moving my stop to BE right now

because i need to be doing everything else but trading

so its either 0 or +30 at the new low

oh and there is also this scenario where the market skips my stop and i come back here sitting on -300 ticks

still better then the wedding

You never know, Pawel, something interesting might happen...

couldbefun.jpg

IS A LIE__________

IS A LIE__________paweldobkowski wrote:dojirock wrote:dchappy wrote:Excellent trading ..I would like to learn more about order flow trading ..specifically how are you spotting your entries ..are candles involved or strictly volume ..Thanks ...

Same here, looking for a additional way to spot target areas.

doji

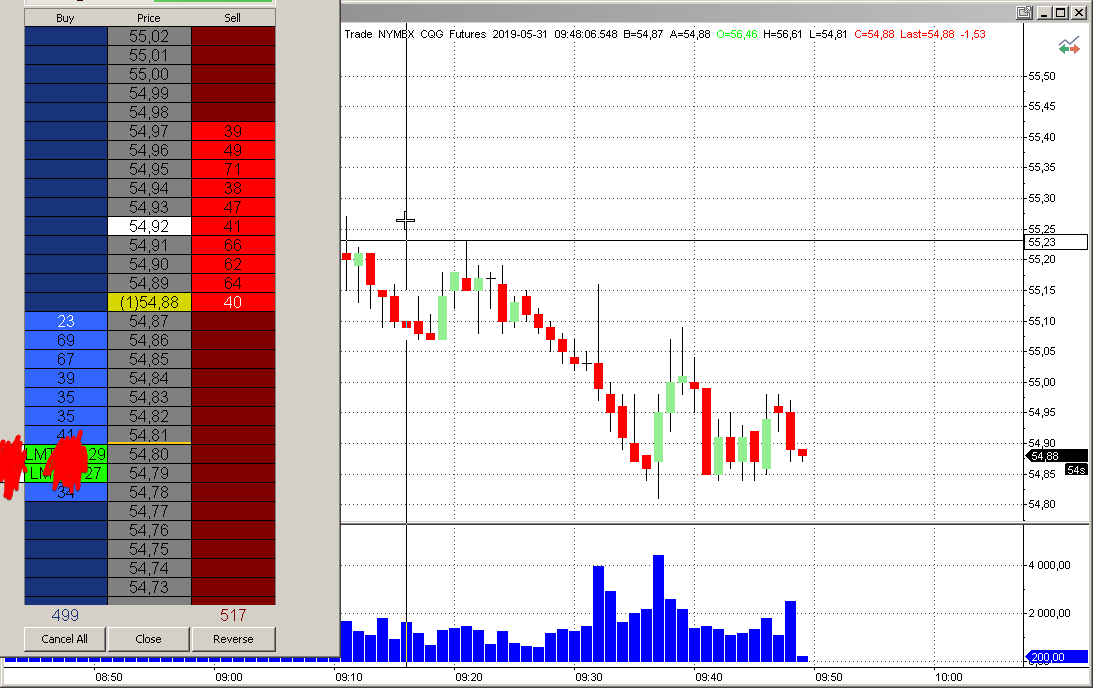

order flow trading is basically looking at the depth of market for patterns to profit from

its basically mainly scalping for 1 - 5 ticks

you look for people to do people stuff

be greedy or fearful

what they got, what they want to trade, what they dont want to trade, how they trade it etc.

sometimes you can spot an algo doing some shady sht ---- but still its there to trick people so you might aswell just watch people

now way of doing this allows me to scalp but also trade some bigger moves (although i know people who would argue if its still order flow trading)

to make a long story short i dont care about the candles (for the most part)

at least not in a traditional sense ---- im not opening and closing based on candles

of course im aware of my chart placement but thats not because of the chart

i know where are the daily highs and lows

i know where are the previous swings

as TRO famously said: "price is the same on every time frame"

its like scalping the daily candle looking at that daily candle

as i said somewhere here ---- i had to trade for around 3 years without charts

i look at the transactions going in and people moving orders around and form an idea about whats going on

i trade (almost) every day and i watch levels being traded

so over time i get the whole map in my head

of course just because someone bought yesterday @ .10 doesnt mean he will buy again next time we visit .10

and just like with technical analysis there are unfortunately no black and white rules

its all context ---- as always ---- up momentum candle off the low is a different thing then the up momentum candle pushing to new highs

i can elaborate on this for hours

also its my first time talking about it so im surprised at what comes to my mind

but i dont want to bore everyone to death

also you guys are well seasoned traders so im aware there are not a lot of things i can tell you that you dont know about

the questions you asked are very open ended

so please let me know if there are any specific things i can help with or elaborate on