PhilipLangford wrote: You have to physically watch the markets almost all the time.

What holds you back?

Hi Philip

It depends by the chart period you want to trade.

A daily+ chart doesn’t need all the attentions that a H4- chart needs.

Moderator: moderators

PhilipLangford wrote: You have to physically watch the markets almost all the time.

What holds you back?

IS A LIE__________

IS A LIE__________

Mira wrote:A daily+ chart doesn’t need all the attentions that a H4- chart needs.

MightyOne wrote:I found this site a few days ago and I really like it.

If you have a participating local library then you can learn languages here for free (or else it is $20/month).

You are not going to master a language at this site but you'll put a dent in a goodly number of languages by reason of curiosity.

If you don't see your language then you can request for it to be added.

TheRumpledOne wrote:MightyOne wrote:I found this site a few days ago and I really like it.

If you have a participating local library then you can learn languages here for free (or else it is $20/month).

You are not going to master a language at this site but you'll put a dent in a goodly number of languages by reason of curiosity.

If you don't see your language then you can request for it to be added.

Do they have MightyOne to English?

MightyOne wrote:TheRumpledOne wrote:MightyOne wrote:I found this site a few days ago and I really like it.

If you have a participating local library then you can learn languages here for free (or else it is $20/month).

You are not going to master a language at this site but you'll put a dent in a goodly number of languages by reason of curiosity.

If you don't see your language then you can request for it to be added.

Do they have MightyOne to English?

Grab a bottle of rum and in 20 minutes you'll speak fluent MO

Pjort wrote:Hello MO

So here is a question about a statement you have made that is coming back to my mind again and again;

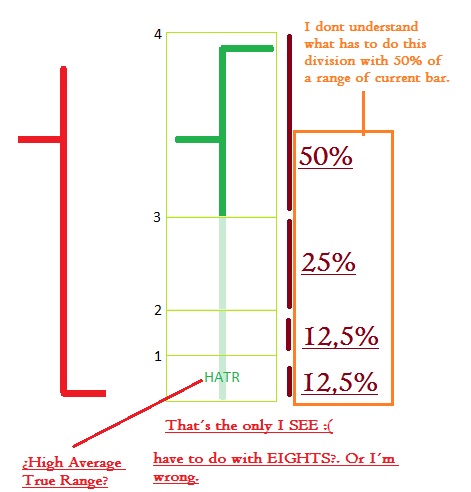

"The range of a bar can only expand upwards if price is above its midpoint, simple."

Please explain that rule if possible,,,

Thanks in advance,,,

Pjort