A fresh start! Doji's Trading Journal

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- newscalper

- rank: 1000+ posts

- Posts: 1068

- Joined: Tue Oct 19, 2010 5:58 pm

- Reputation: 7

- Gender:

dojirock wrote:I can count the number of times on one hand that I look at a weekly or daily chart. Im not a long term trader. I will look rarely at a 4hour. I trade hourly for bias and ANY time frame less for bias and or entry.

Learn to crawl before you run. You seem to really like TRO. Listen to what he says, "Don't Be A Yalie" Trade one direction until your making money. This is key. It is alot less overwhelming and you will build confidence, learn to take small losses and work on letting the winners run more than the losses.

The H4 example you speak of that I took, I closed. Why, because it drives me nuts to hold trades all week. Im not that kind of trader. If I was I would still be short on that E/J, there has been no stop out.

Pick one way to find a bias, dont change it till your making money.

There are many ways to do it...Taught here at KR

Lines, indicators, flip a coin. It doesnt matter. Im serious about that.

Then determine what your entry method is going to be. Keep it simple.

It can be a ema pullback, a ma cross, a zline wick, a rat trade, a breakout, a Dragon line, ect. BUT ONLY in ONE DIRECTION, MATCHING YOUR BIAS.

Then learn to take the pips when they are given, there will be more trades.

Dont let a winner, based on your own criteria turn to a loss.

Many times when I post these 100 pip gains, it because I dont follow the trade. Im up 10-20 pips, I set to B/E and go to bed. I wake up with price in my favor, then I close it. Do I care if it ends up being a B/E. NO...ITs not a LOSS. Im probably most defined as as swing, scalper trader. This Zebra hasnt learned how to change his stripes! So now I concetrate on larger lot sizes, hit my goals. Over acheiving my daily goals, bankrolls my next days goal which reduces pressure.

doji

Forget bias. I am still trying to define method.

Both trades I just showed were both long. So say my bias is long

So: you move your stop. That kind of methodology, is completely contra to MOs teachings and the whole principle of zline. OK, no problem if it works but I certainly haven't been moving my stop.

So I suggest w.r.t to what you just wrote that the whole principle of what you are doing has very little to do with entry criteria. It's all trade management. Which I why I keep asking again and again: where is the exit?

This whole stacking thing: is it really just a case of defining a bias in some way then trading engulfing bar breakouts and moving the stop to b/e after a certain period? In which case again, where is the exit? When a stop gets hit then close all? When a target gets hit? I don't know.

I do know the logic does not work if you look at even one TF larger. If a larger TF shows a bias by your exact criterion for short, why would you take a long on a shorter TF? Going by that logic, shorter TFs MUST overrule higher TFs, ergo anything to do with higher TF supply/demand area must be baloney? It could well be for all I know. Every move has to begin on the tick chart, not because there is a bar formation that took place 3 weeks ago.

So, you're moving your stop given certain criteria.

I can show you a very inneficient method that makes money doing just that, in theory, and it only works when the market trends. For the last 3 years it's debatable if it would have worked on the TFs I tested on back in the day.

On smaller TFs I don't know because it's all down to WHEN you move your stop and then how you trail it, if you're doing it on H4 it works because the stop sizes are well outside of near term volatility for a lot of the time but you can go weeks going b/e, small loss, b/e, b/e, b/e full loss, b/e b/e, huge win hurragh and that's as soul destroying as what I've been experiencing on smaller TFs as you know damn well that the only reason you may be profitable, for now, is luck, pure and simple. Random entry can be used with it btw, it makes little difference.

I see I've got a lot more to think about anyway and once again I feel that I thought I understood something but am, in fact, totally clueless.

- newscalper

- rank: 1000+ posts

- Posts: 1068

- Joined: Tue Oct 19, 2010 5:58 pm

- Reputation: 7

- Gender:

- newscalper

- rank: 1000+ posts

- Posts: 1068

- Joined: Tue Oct 19, 2010 5:58 pm

- Reputation: 7

- Gender:

- newscalper

- rank: 1000+ posts

- Posts: 1068

- Joined: Tue Oct 19, 2010 5:58 pm

- Reputation: 7

- Gender:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

Your still running...but ok...

Forget bias...ok

Moving stops...against Mo's teachings...

yes it is...im a swing, scalper...he is not.

I need 30-40 pips a day to reach my goal...

He has account size, im sure that dwarfs mine.

It is about entry....one direction until you master it.

Then entries are based on a market pattern that when it happens its high

probability for me to get my pips. I have very few breakevens also. When I dont care if its a breakeven, I have already made my quota for the day and am hoping for a big fat bonus check when I wake up.

Stop Losses... example

I enter a trade, Im up 17 pips....my daily goal is 30 pips. Am I going to let that go back against me....ah...no...very seldem do I let it go back 50 percent. Mo has said many times, exit after a big momo, target reached or dont give back more than 25 percent.

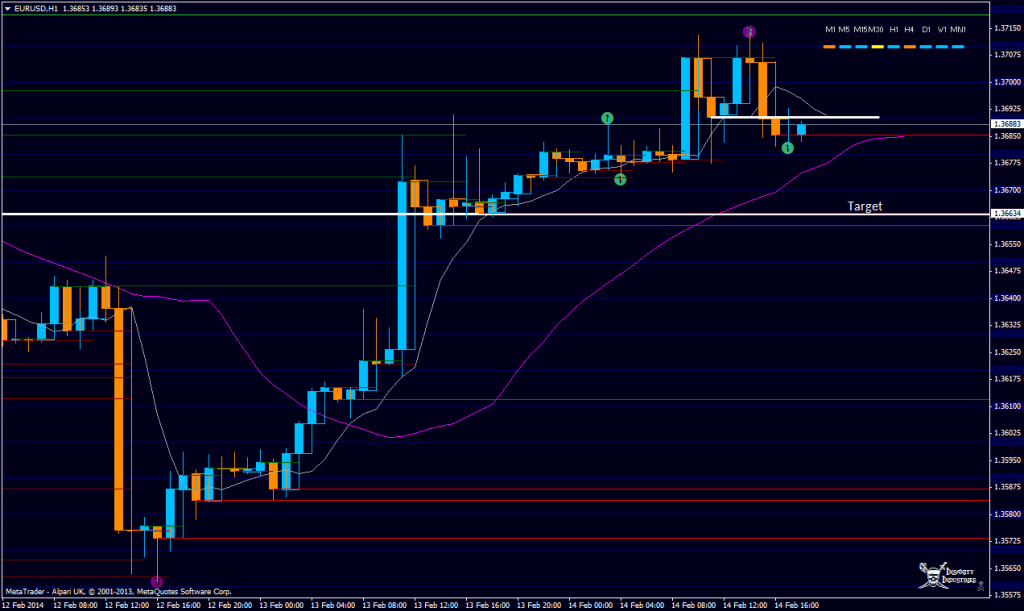

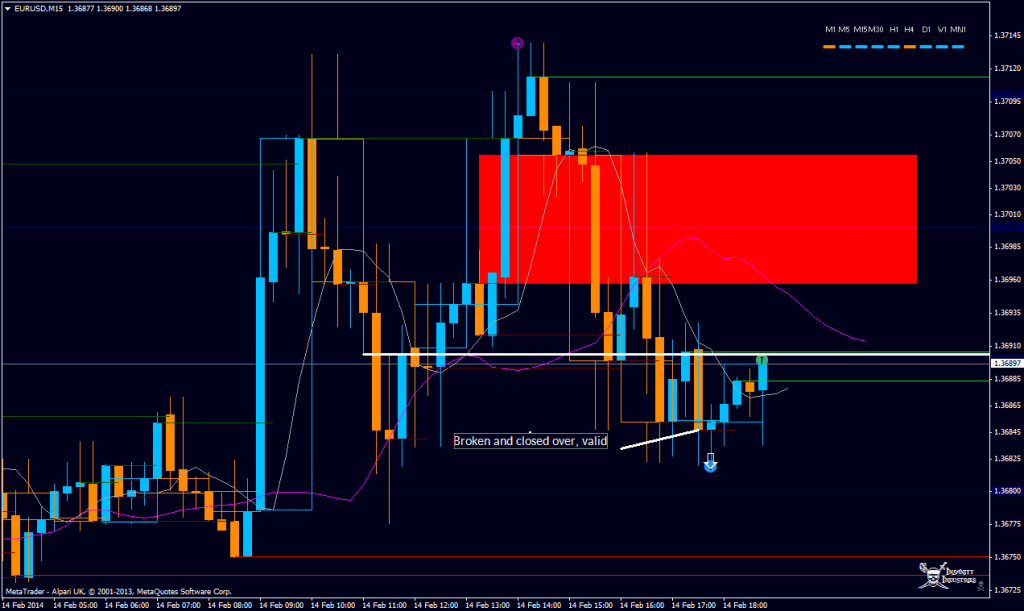

If you look at my bias lines...then drop to the lower time frame you will see im entering on the zeroing out of a zline...so its already in my favor to take off and not zero me out again.

Target lines...blue ones...those are 15 min zlines that didnt get zero'ed out yet....do I have to hold till it gets there...no but I know its highly probabe it will get to 1 or 2 of those lines.

I rarerly take full stops....If I were it would be closing against me...thats a rule breaker...

You dont have to trade like me...find you method...and test it...I have shown ema, BB bands, macd crosses, renko macd (dc), dragon lines.

im still looking for that pic from mo...i will post it when i find it...

doji

doji

Forget bias...ok

Moving stops...against Mo's teachings...

yes it is...im a swing, scalper...he is not.

I need 30-40 pips a day to reach my goal...

He has account size, im sure that dwarfs mine.

It is about entry....one direction until you master it.

Then entries are based on a market pattern that when it happens its high

probability for me to get my pips. I have very few breakevens also. When I dont care if its a breakeven, I have already made my quota for the day and am hoping for a big fat bonus check when I wake up.

Stop Losses... example

I enter a trade, Im up 17 pips....my daily goal is 30 pips. Am I going to let that go back against me....ah...no...very seldem do I let it go back 50 percent. Mo has said many times, exit after a big momo, target reached or dont give back more than 25 percent.

If you look at my bias lines...then drop to the lower time frame you will see im entering on the zeroing out of a zline...so its already in my favor to take off and not zero me out again.

Target lines...blue ones...those are 15 min zlines that didnt get zero'ed out yet....do I have to hold till it gets there...no but I know its highly probabe it will get to 1 or 2 of those lines.

I rarerly take full stops....If I were it would be closing against me...thats a rule breaker...

You dont have to trade like me...find you method...and test it...I have shown ema, BB bands, macd crosses, renko macd (dc), dragon lines.

im still looking for that pic from mo...i will post it when i find it...

doji

doji

newscalper wrote:dojirock wrote:I can count the number of times on one hand that I look at a weekly or daily chart. Im not a long term trader. I will look rarely at a 4hour. I trade hourly for bias and ANY time frame less for bias and or entry.

Learn to crawl before you run. You seem to really like TRO. Listen to what he says, "Don't Be A Yalie" Trade one direction until your making money. This is key. It is alot less overwhelming and you will build confidence, learn to take small losses and work on letting the winners run more than the losses.

The H4 example you speak of that I took, I closed. Why, because it drives me nuts to hold trades all week. Im not that kind of trader. If I was I would still be short on that E/J, there has been no stop out.

Pick one way to find a bias, dont change it till your making money.

There are many ways to do it...Taught here at KR

Lines, indicators, flip a coin. It doesnt matter. Im serious about that.

Then determine what your entry method is going to be. Keep it simple.

It can be a ema pullback, a ma cross, a zline wick, a rat trade, a breakout, a Dragon line, ect. BUT ONLY in ONE DIRECTION, MATCHING YOUR BIAS.

Then learn to take the pips when they are given, there will be more trades.

Dont let a winner, based on your own criteria turn to a loss.

Many times when I post these 100 pip gains, it because I dont follow the trade. Im up 10-20 pips, I set to B/E and go to bed. I wake up with price in my favor, then I close it. Do I care if it ends up being a B/E. NO...ITs not a LOSS. Im probably most defined as as swing, scalper trader. This Zebra hasnt learned how to change his stripes! So now I concetrate on larger lot sizes, hit my goals. Over acheiving my daily goals, bankrolls my next days goal which reduces pressure.

doji

Forget bias. I am still trying to define method.

Both trades I just showed were both long. So say my bias is long

So: you move your stop. That kind of methodology, is completely contra to MOs teachings and the whole principle of zline. OK, no problem if it works but I certainly haven't been moving my stop.

So I suggest w.r.t to what you just wrote that the whole principle of what you are doing has very little to do with entry criteria. It's all trade management. Which I why I keep asking again and again: where is the exit?

This whole stacking thing: is it really just a case of defining a bias in some way then trading engulfing bar breakouts and moving the stop to b/e after a certain period? In which case again, where is the exit? When a stop gets hit then close all? When a target gets hit? I don't know.

I do know the logic does not work if you look at even one TF larger. If a larger TF shows a bias by your exact criterion for short, why would you take a long on a shorter TF? Going by that logic, shorter TFs MUST overrule higher TFs, ergo anything to do with higher TF supply/demand area must be baloney? It could well be for all I know. Every move has to begin on the tick chart, not because there is a bar formation that took place 3 weeks ago.

So, you're moving your stop given certain criteria.

I can show you a very inneficient method that makes money doing just that, in theory, and it only works when the market trends. For the last 3 years it's debatable if it would have worked on the TFs I tested on back in the day.

On smaller TFs I don't know because it's all down to WHEN you move your stop and then how you trail it, if you're doing it on H4 it works because the stop sizes are well outside of near term volatility for a lot of the time but you can go weeks going b/e, small loss, b/e, b/e, b/e full loss, b/e b/e, huge win hurragh and that's as soul destroying as what I've been experiencing on smaller TFs as you know damn well that the only reason you may be profitable, for now, is luck, pure and simple. Random entry can be used with it btw, it makes little difference.

I see I've got a lot more to think about anyway and once again I feel that I thought I understood something but am, in fact, totally clueless.

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

- newscalper

- rank: 1000+ posts

- Posts: 1068

- Joined: Tue Oct 19, 2010 5:58 pm

- Reputation: 7

- Gender:

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

ah ha!

I found it!

http://kreslik.com/forums/search.php?se ... &start=210

posted below also....

Look at this pic...

If your a red rat( meaning shorts only) you only care about one color of lines.

If you a green rat(meaning longs only) you only care about the other color of lines.

Never lose again...thread....a classic!!!!

Thanks mo!!!!

Doji

I found it!

http://kreslik.com/forums/search.php?se ... &start=210

posted below also....

Look at this pic...

If your a red rat( meaning shorts only) you only care about one color of lines.

If you a green rat(meaning longs only) you only care about the other color of lines.

Never lose again...thread....a classic!!!!

Thanks mo!!!!

Doji

- Attachments

-

- 2w6t1qq.gif (20.59 KiB) Viewed 3463 times

-

- ae9nao.gif (17.06 KiB) Viewed 3463 times

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

- newscalper

- rank: 1000+ posts

- Posts: 1068

- Joined: Tue Oct 19, 2010 5:58 pm

- Reputation: 7

- Gender:

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.