Light trading this week.

2nd of two.

A fresh start! Doji's Trading Journal

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

3 setups today

- Attachments

-

- eurusdm5.png (49.58 KiB) Viewed 2953 times

-

- usdjpym5.png (30.68 KiB) Viewed 2953 times

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

- newscalper

- rank: 1000+ posts

- Posts: 1068

- Joined: Tue Oct 19, 2010 5:58 pm

- Reputation: 7

- Gender:

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

Keeping the losses small and stacking when im right is starting to pay off.

- Attachments

-

- currentstatement.png (52.62 KiB) Viewed 3089 times

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

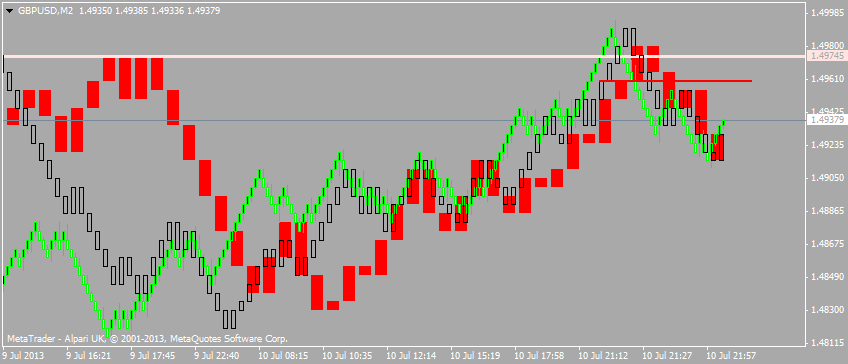

Well I am starting to get the hang of stacking. Took a trade tonight on Asian session. Stacked 5 times. Record trade for me.

36.5 percent added to my account. It was intense!

.gif)

36.5 percent added to my account. It was intense!

.gif)

- Attachments

-

- 2013-07-10_2303.png (21.53 KiB) Viewed 3115 times

-

- 2013-07-10_2251.png (210.23 KiB) Viewed 3112 times

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

- westcountry

- rank: 150+ posts

- Posts: 195

- Joined: Wed Jul 25, 2012 1:43 pm

- Reputation: 109

- Gender:

Hi Doji -

Great job....you are rocking it! Keep up the great work.

All the posts, diagrams, charts, markups here in Kreslik really help as I am a visual learner. I keep going back through this thread and learn more each time from everyone. I am having my first successful week, thanks to employing strategies I am learning here in Kreslik threads, and letting go of pet ideas in my head I thought would work for me but don't. LOL.

Westcountry

Great job....you are rocking it! Keep up the great work.

All the posts, diagrams, charts, markups here in Kreslik really help as I am a visual learner. I keep going back through this thread and learn more each time from everyone. I am having my first successful week, thanks to employing strategies I am learning here in Kreslik threads, and letting go of pet ideas in my head I thought would work for me but don't. LOL.

Westcountry

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

Done!

One last trade tonight.

Now at 48.6 percent for day.

5 more stacks

One last trade tonight.

Now at 48.6 percent for day.

5 more stacks

- Attachments

-

- 2013-07-11_0110.png (194.48 KiB) Viewed 3103 times

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.