Postby dojirock » Sat Mar 30, 2013 4:48 am

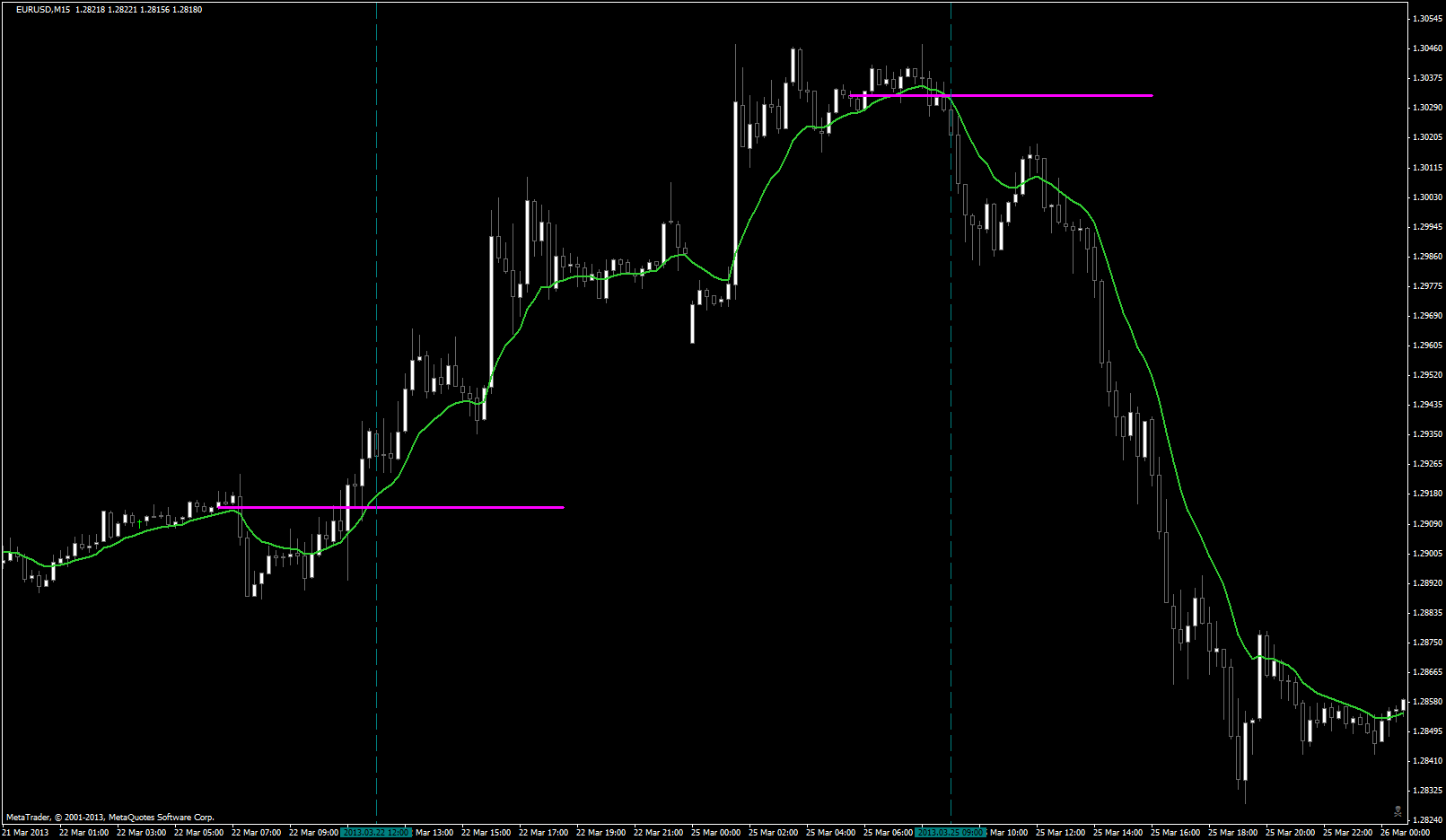

We have a hourly candle closing over our zline, making our bias zline active. I marked the close of the hourly candle with the vertical dashed lines.

Now drop to a 15 min chart and observe.

You guys already know, I love the ema pullback entries. They are there. The 1st zline is longs only....I take entry right at the close of the houlry and add to my position every time price drops below the ema.

The second zline is shorts only.... I take entry right at the close of the hourly and add to my position every time price climbs above the ema.

observe...

drop to a 5 min and look... you will see many opps to enter a trade with the bias.

-

Attachments

-

- eurusdm15kr.png (57.76 KiB) Viewed 2566 times

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"