The ideas that I trade by:

Posted: Thu Jan 12, 2012 3:10 pm

The ideas that I trade by:

Body in the direction of profit, wick in the direction of loss; if price is closing higher than something

then it is probably not going lower. -MO

S/R is a line that price may cross as long as it is home in time for dinner.-MO

There is only ONE highest high or lowest low & price will move a hundred or hundreds of pips from one (daily+)

extreme to the other (if this is so then what is stopping you from making hundreds of pips?) -MO

A Zero-Line is the idea that if you can see loss then you can see profit. -MO

Anything beyond a scalp and you are waiting for a range expansion (time &/or price); since this is statistical, the

focus must shift from candles to a gamble that price will indeed expand to completion in the desired direction. -MO

In order of importance: SPACE, VALUE, PIPS.

Space contains initial risk, value is position sizing, & a pip is only as valuable as space + value. -MO

Trading is about comparisons, ideas, space manipulation/money management, and taking action. -MO

"Now, 2 patterns of market behavior happen on a regular basis:

1) the price breaks to new high's (or low's)

2) the price reverses from new high's (or low's)

They happen regardless of time frame (with the obvious limitations explained above)

They are phenomena that can be exploited without the fear if found out by others, that they might cease to exist." - H.Rearden

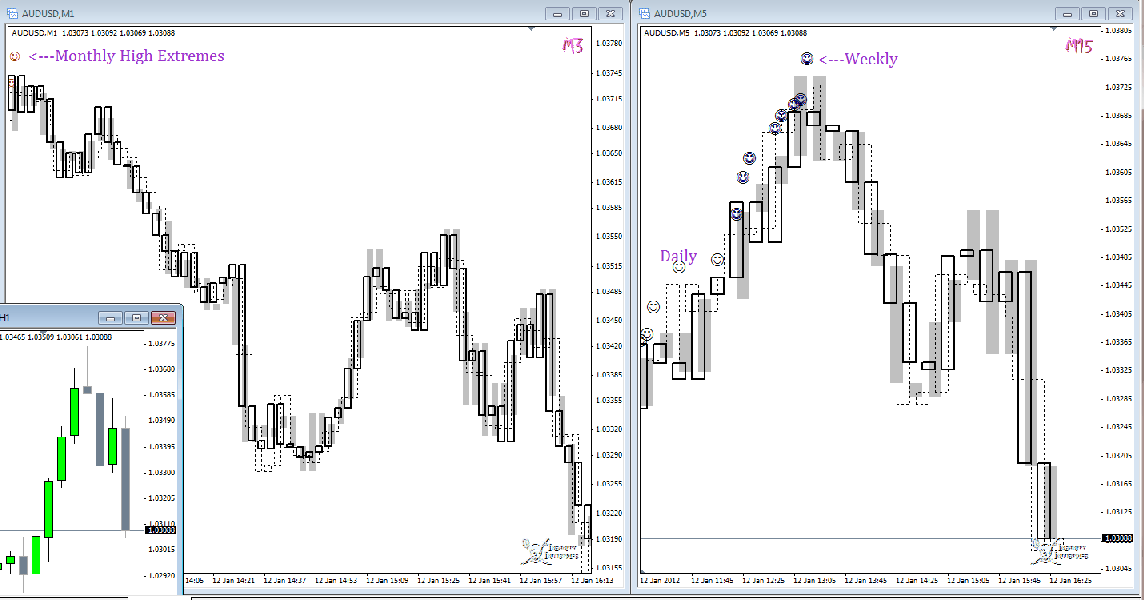

"Price is the same on all time frames" - The Rumpled One (bothered the $#!@ out of me until I finally accepted it)

"Trading is guessing, if it wasn't then why would you need to (limit your risk)" - The Rumpled One

"What would you do if you knew that you could not fail?" Robert H. Schuller

Body in the direction of profit, wick in the direction of loss; if price is closing higher than something

then it is probably not going lower. -MO

S/R is a line that price may cross as long as it is home in time for dinner.-MO

There is only ONE highest high or lowest low & price will move a hundred or hundreds of pips from one (daily+)

extreme to the other (if this is so then what is stopping you from making hundreds of pips?) -MO

A Zero-Line is the idea that if you can see loss then you can see profit. -MO

Anything beyond a scalp and you are waiting for a range expansion (time &/or price); since this is statistical, the

focus must shift from candles to a gamble that price will indeed expand to completion in the desired direction. -MO

In order of importance: SPACE, VALUE, PIPS.

Space contains initial risk, value is position sizing, & a pip is only as valuable as space + value. -MO

Trading is about comparisons, ideas, space manipulation/money management, and taking action. -MO

"Now, 2 patterns of market behavior happen on a regular basis:

1) the price breaks to new high's (or low's)

2) the price reverses from new high's (or low's)

They happen regardless of time frame (with the obvious limitations explained above)

They are phenomena that can be exploited without the fear if found out by others, that they might cease to exist." - H.Rearden

"Price is the same on all time frames" - The Rumpled One (bothered the $#!@ out of me until I finally accepted it)

"Trading is guessing, if it wasn't then why would you need to (limit your risk)" - The Rumpled One

"What would you do if you knew that you could not fail?" Robert H. Schuller