Hi everyone this start new topic for " Zlines"

I have read NLA about this topic here my first steps. I working through the

http://kreslik.com/forums/viewtopic.php ... start=2440 topic step by step and documenting some my thoughts etc.

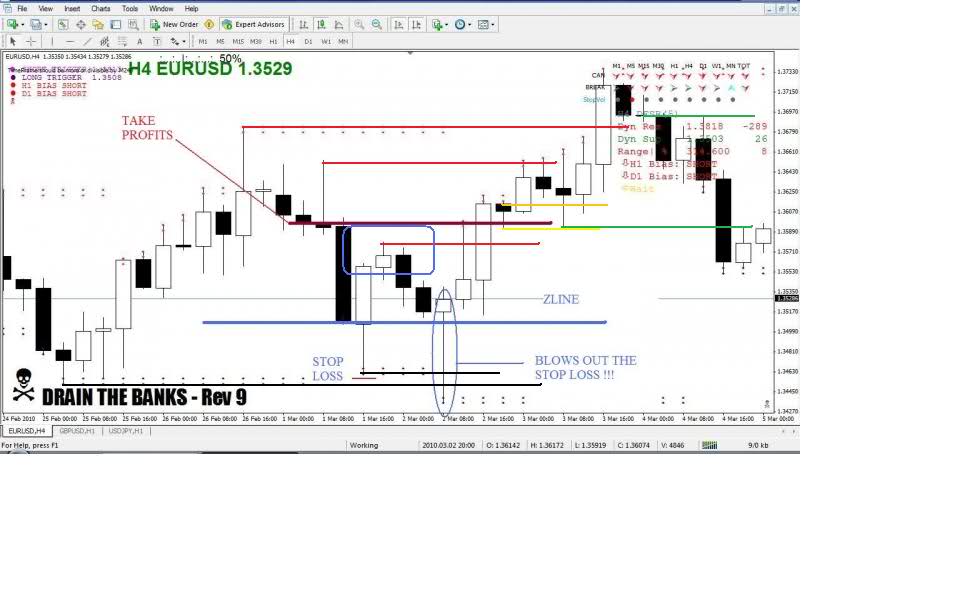

On attached chart i have circled and drawn lines area i want to talk about 1,2,3,4 and ABC and black circle

So at first circle label 1 in picture we can see quite clearly the price made a high and retraced. There was some selling and this stalled. At circle 2 we see very slow momentum , bodys of candles are showing the direction of price and long shadows . I can see why you have take profit here. Then we have burst of momentum from 2 to 3. Were price stalls again and again some selling but nothing major.

Now with my basic knowledge so far i would all so consider this a take profit area? not sure why he picked lower take profit area over this 1.Maybe someone like mightone can answer my question.

anyway prices bursts out from 3 to 4 but this time it wasnt as strong as play from 2 to 3. I wonder is this market slowing down

. Notice around and just few candles beyond 4 there long shadows appearing.

Is the market exploring the possbililty of reversals or Big boys fooling novice into thinking that?

anyway price has finial push to high and stalls again.

But whats different from this stall to all other stalls inprice ie 1,2,3,4?

Ok im jsut going say i see for moment it might help me?

at the line labelled A. what do i see? i see a red candle ie close lower than open. Ok so what.

I also noted its closed 50% into last 4 hours consildated in to one bar. This is interest.

moving on to bar labelled B what do i see? again its red bar with little less momentum from A.

But is not closed in lower 1/3 of the pervious 4 hour conslidated bar.

looking at other stall areas 1,2,3,4 the price never retraced that far. That only thing i see differently.ok this could be clue. noted and logged lets go on,

umm interesting bar labelled C is small green barm close higher than open, what else do i see?

its close at 50% into bar labelled B. ok so what.

bar labelled D is interesting it gapped up pushed price up but stalled ended up closing as red candle into 50% on bar labelled C. So market though price was going to going up and do another breakout but it failed.

ok moving on to black circle what do i see red and green candles of course but i also see price attempting to contining going up and then been slapped back down at rougly the same price level.I see top wicks and see strong momentum moves to downside. moving out i see the price level were the price is stalling in the black circle is roughly in lower third of the consildated 4 hour candles that formed previous high

So some big differences in price actions from 1,2,3,4 and ABCD and blacks circle. Can i draw an conclusions no sorry its too early in learning step for me do that.

any comment or advice would be greatly appreicated

BB

addition thought the price retracements in 1,2,3,4 stay in top 1/3 or top half of the major momtentum moves. just observations.