PRICE IS THE SAME ON ALL TIMEFRAMES...but there is much that is different.

1) a candle can be green in one period and red in another.

Is price going up or down? In relation to what, the previous tick? That's not significant! SO what is?

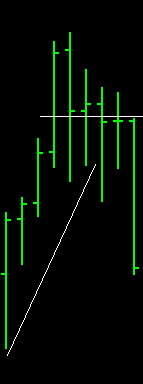

2) an M5 bar does not have the same historical significance as a monthly bar. Take this little section of chart for example:

-price returned to the same level 4 months in a row & that is much different than M5 bars returning to

the same level (think of all the eyes that see that little section of chart vs the eyes that see the same section of M5 chart).

-the long outside bar with a weak close and the lower high is a short on a monthly chart but it doesn't

really mean much on an M5.

-from a long-term perspective you are accumulating a large size through these months for the inevitable

decline where as from a short-term perspective you are either looking for a reason to get out of a trade or

for some sign that price might continue to rise.

-if this were an M5 then you would not consider the 2nd bar from the highest high to be a trend-line break.

You use TL, you don't use TL, it doesn't matter! What matters is the way in which they are used, in different chart periods, by

other people.

- EURUSD_MN.png (2.06 KiB) Viewed 3280 times

3) the ranges that you have to wait through, if you decide to hold a trade, are different.

Splashing about in 7 pip bars is not the same as heading into the great deep of 700 pip bars.

Through position sizing, you can give two charts the same financial consequence and thus treat them the same but the fact

remains that, from a technical perspective, everything is different about larger charts: position sizing, strategy, objectives, interpretation, etc.

Scalpers have trouble with large charts because they were sold that little line that "a chart is a chart".

This is not an M5 bar, this is: 30 days of mans life, his hopes, his dreams, and where he stands today; all in one bar.