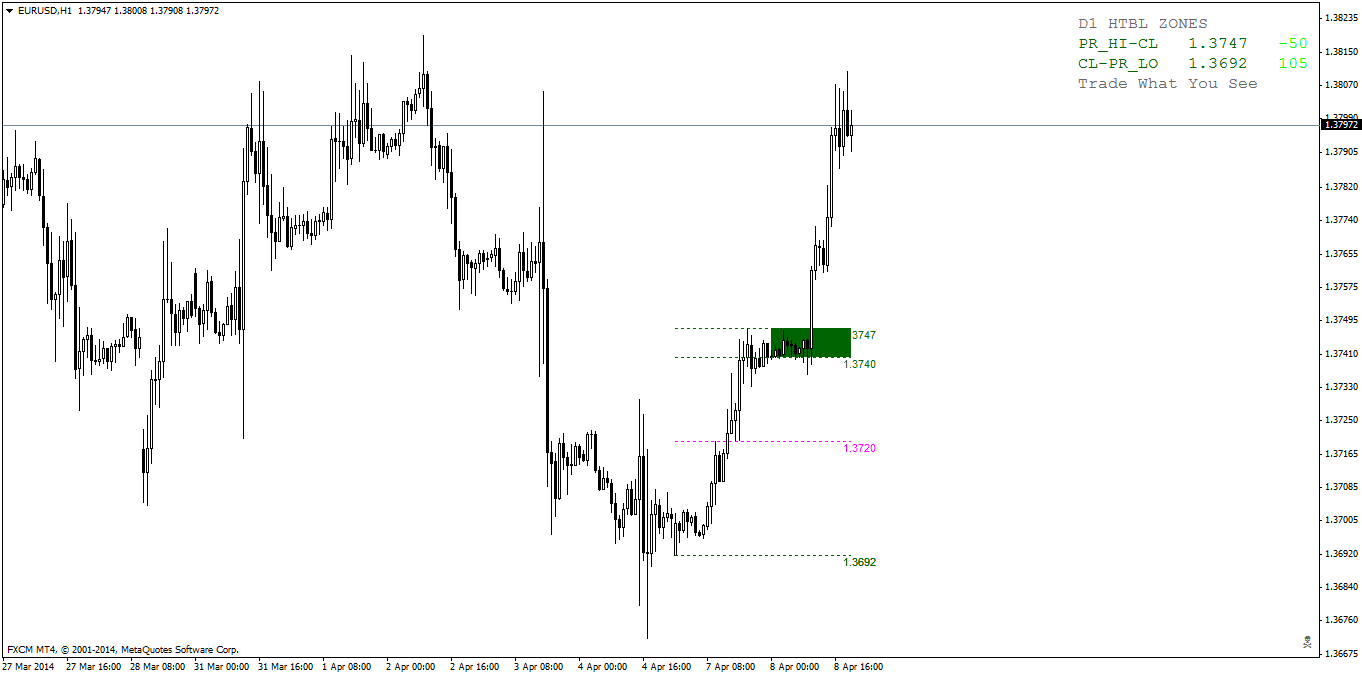

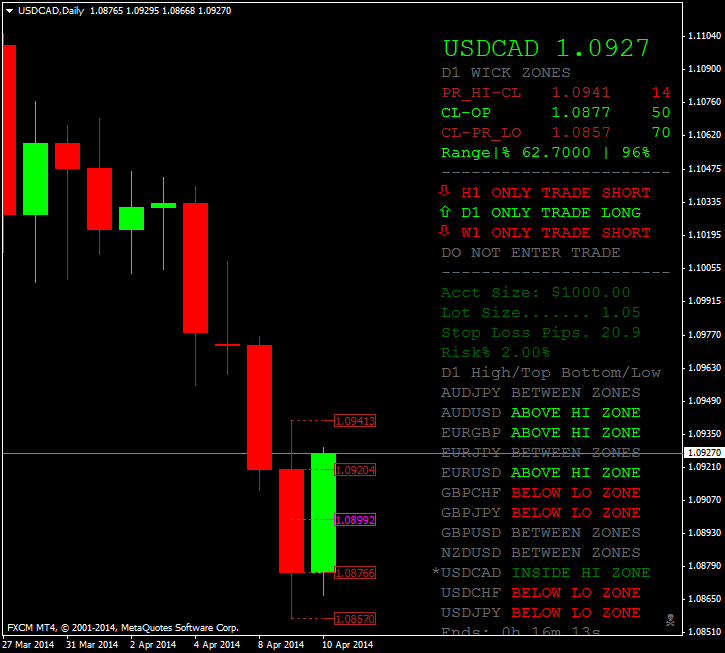

If price goes into the previous day's high-candle top or previous day's bottom-low zone, it usually LEAVES THE ZONE.

I had this idea and wrote a frequency distribution indicator. You can see this happened over 70% of the time!

All you have to do is trade in the direction of the zone exit..