Postby MightyOne » Thu Jan 05, 2017 5:51 am

RISK = DOLLARS / STOP LOSS.

SPACE = DOLLARS / %R

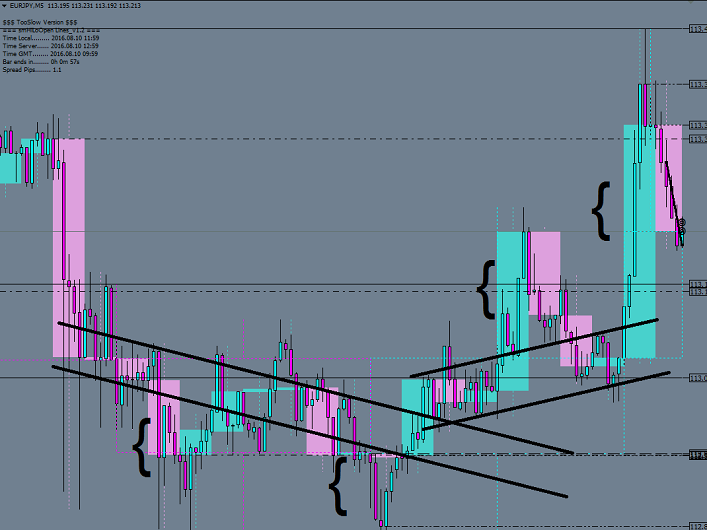

Risk is comprised of lines, between & the sum of which is 'space', that are at intervals which are based on a percentage of a pairs weekly median range.

Because space is the same for all pairs, say 2% of the median weekly range, every pair moves at the same 'monetary speed'; DOLLARS / %R or dollars per segment of range. Again, it does not matter which currency is strong or which is weak as the median range of each pair is divided into the same number of segments so that each pair has roughly the same profit potential.

You should, from the perspective of a swing trader, be able to look down at the chart and use 2 or 3 lines as your risk without feeling like your stop is too tight.

%R is set to what works for M5 to H1 charts, if you want to use something smaller then you might use (2/3)%R . As a general rule, you cut your position size in half and double the width of the lines to trade the next largest chart(H1-H4-D1-etc); you don't have to concern yourself with how many pips you should risk on a larger chart as you have the same number of lines and you risk them in the same way as the other periods.

If you can think of a line as if it were a pip then you can begin to understand why the lines are widened on larger charts:

if you see 64 lines on the H1, turn to the H4 and see 64 lines, turn to the D1 and see 64 lines, turn to the W1 and see 64 lines, & turn to the MN and see 64 lines then you can say that every chart is visually the same, and thus traded in the same manner, regardless of time frame; there would be no smaller or larger period, just uniformity. The trade results will come at a faster or slower pace, but isn't that the case no matter what; albeit not to the same degree?

PROGRESSIONS/'ADDING'/CREATING NEW POSITIONS:

Let's say that you are adding size using the progression '1 + 1 + 1 + 1 + 1 + 1 + 2 + 2 + 3 + 4 + 5' & that your current position size is 8x your initial size.

You would move to the next largest chart by cutting your current size in half, but you will still be in the same spot in the progression; the only difference is that each 'addition' is 1/2 of what it was before.

The first three entries is the scaling in stage & your stop loss remains unchanged. The additions that follow reduce the risk-space to the 75 RET of the previous stop loss and the entry price, creating an entirely new position.

The risk-space is reduced, but the width of the lines remains the same. Imagine a sheet of lined paper as your total risk, tearing it in half will reduce the total risk-space but it will not change the width of the lines that are printed onto the paper; you can reduce your position size to tape on more paper, but you cannot change the width of the lines without changing periods.

IS A LIE__________

IS A LIE__________