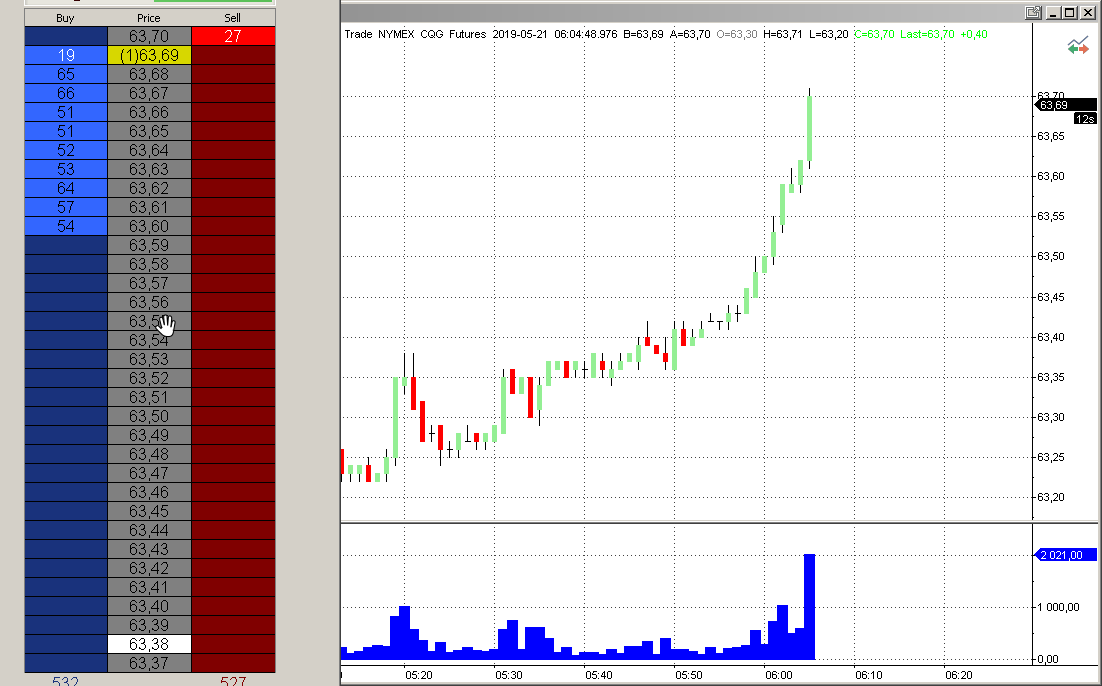

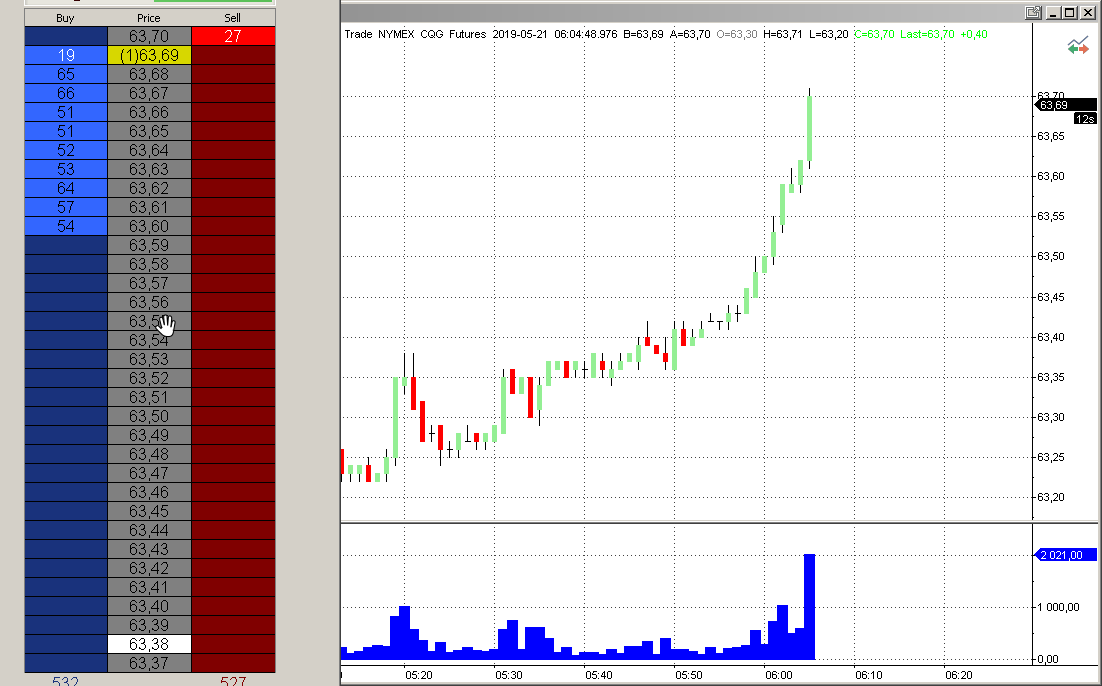

will probably reverse that

EDIT:

or not?

i feel like we are few seconds from sellers taking a fkn big loss

EDIT:

and they did

the last moment where the position fits on the screen

took +36 home

Moderator: moderators

paweldobkowski wrote:this is it from me for today

60+ ticks

Alias got me thinking yesterday

i really dont have to push myself so much

this is a marathon not a sprint

also im still studying yesterdays pa

i think we got a new market maker

paweldobkowski wrote:aliassmith wrote:paweldobkowski wrote:

you are back man?

i mean from the trip?

Ya I can only burn so much skin off of my body.

I recommend the Cayman Islands

what was the weather?

the temperatures are bearable?

its probably easier for you

since you're from the US

aliassmith wrote:Glad I can help

In these markets and your talent you shouldn't need/have to trade for 12 hours a day.

In crude you can put decent size on and with 60 ticks make good money without beating yourself up.

Its just relative to what an individuals goals are and how that market accommodates those goals.

60 ticks Crude is equal to 48 ticks ES/DAX is equal to 120 ticks NQ/YM.

If you are a 10 contract trader you can trade any of those markets

If you are a 100 contract trader your options decrease depending on your style

I'm fairly certain one of the reasons you get into trading isn't because you want to work more than a 9 to 5 job.

aliassmith wrote:paweldobkowski wrote:aliassmith wrote:

Ya I can only burn so much skin off of my body.

I recommend the Cayman Islands

what was the weather?

the temperatures are bearable?

its probably easier for you

since you're from the US

I didn't look at the weather so much but I think it was high 80's and the water was a nice temp also.

The drinks were about 35 degrees F.

paweldobkowski wrote:aliassmith wrote:Glad I can help

In these markets and your talent you shouldn't need/have to trade for 12 hours a day.

i can retire now lol

thanks Alias!In crude you can put decent size on and with 60 ticks make good money without beating yourself up.

Its just relative to what an individuals goals are and how that market accommodates those goals.

60 ticks Crude is equal to 48 ticks ES/DAX is equal to 120 ticks NQ/YM.

If you are a 10 contract trader you can trade any of those markets

If you are a 100 contract trader your options decrease depending on your style

I'm fairly certain one of the reasons you get into trading isn't because you want to work more than a 9 to 5 job.

that is true

20 contracts is my upper limit ---- i trade much smaller on the daily basis tho

i really dont have to go above that to reach my long term goals

so the liquidity is not an issue 99% of the time for me

the thing is/ was

that it took SO MUCH for me to get consistent

that ever since i got the "edge" i go really hard

and it served me well so far

while i was working at one of the prop trading firms ive seen the guy who was clipping 200 lots

meaning ---- his one click was 200 ---- most of the time he was trading 400

he was killing it for almost 2 years

then he started showing up late to the office

ending the days early

and the next thing you know the dude couldnt stop losing money

i mean it was certainly some kind of psychological issue aswell (not only a technical one)

but it made me really respect the markets ---- hence i dont like the "phone trading"

i just feel ultra lucky to be able to do this

we all know dozens of soldiers lost in the battle

but i need to reevaluate stuff for sure

and as i already said

i like to see you guys killing it here because it gives me a good perspective

aliassmith wrote:paweldobkowski wrote:aliassmith wrote:Glad I can help

In these markets and your talent you shouldn't need/have to trade for 12 hours a day.

i can retire now lol

thanks Alias!In crude you can put decent size on and with 60 ticks make good money without beating yourself up.

Its just relative to what an individuals goals are and how that market accommodates those goals.

60 ticks Crude is equal to 48 ticks ES/DAX is equal to 120 ticks NQ/YM.

If you are a 10 contract trader you can trade any of those markets

If you are a 100 contract trader your options decrease depending on your style

I'm fairly certain one of the reasons you get into trading isn't because you want to work more than a 9 to 5 job.

that is true

20 contracts is my upper limit ---- i trade much smaller on the daily basis tho

i really dont have to go above that to reach my long term goals

so the liquidity is not an issue 99% of the time for me

the thing is/ was

that it took SO MUCH for me to get consistent

that ever since i got the "edge" i go really hard

and it served me well so far

while i was working at one of the prop trading firms ive seen the guy who was clipping 200 lots

meaning ---- his one click was 200 ---- most of the time he was trading 400

he was killing it for almost 2 years

then he started showing up late to the office

ending the days early

and the next thing you know the dude couldnt stop losing money

i mean it was certainly some kind of psychological issue aswell (not only a technical one)

but it made me really respect the markets ---- hence i dont like the "phone trading"

i just feel ultra lucky to be able to do this

we all know dozens of soldiers lost in the battle

but i need to reevaluate stuff for sure

and as i already said

i like to see you guys killing it here because it gives me a good perspective

Sounds like he caught his self a case of the superman complex. You still have to respect the markets.

LeMercenaire wrote:aliassmith wrote:paweldobkowski wrote:

i can retire now lol

thanks Alias!

that is true

20 contracts is my upper limit ---- i trade much smaller on the daily basis tho

i really dont have to go above that to reach my long term goals

so the liquidity is not an issue 99% of the time for me

the thing is/ was

that it took SO MUCH for me to get consistent

that ever since i got the "edge" i go really hard

and it served me well so far

while i was working at one of the prop trading firms ive seen the guy who was clipping 200 lots

meaning ---- his one click was 200 ---- most of the time he was trading 400

he was killing it for almost 2 years

then he started showing up late to the office

ending the days early

and the next thing you know the dude couldnt stop losing money

i mean it was certainly some kind of psychological issue aswell (not only a technical one)

but it made me really respect the markets ---- hence i dont like the "phone trading"

i just feel ultra lucky to be able to do this

we all know dozens of soldiers lost in the battle

but i need to reevaluate stuff for sure

and as i already said

i like to see you guys killing it here because it gives me a good perspective

Sounds like he caught his self a case of the superman complex. You still have to respect the markets.

There's also the flip side to the Superman Complex, The Gunslinger Syndrome.

With Superman, they don't tend to die a slow death at the office (as Pavel says, turning up late, leaving early) but instead they blow it all in one spectacular f***up. Witness Mr Leeson and that guy who claimed he had fat-fingered a gazillion bucks away (only to finally own up that he had simply kept chasing a dying market that never turned). One big BOOM! and they are done.

With the Gunslinger Syndrome, they begin to sleep with one eye open, lives his life constantly looking over his shoulder, knowing that there is someone out there - younger, fitter, faster, hungrier - who is coming for him. He gets twitchy, starts trying to milk trades too long. Or conversely goes in too heavy so he can get back out safely quicker. He never knows when that shootout that takes him down is coming, so he treats every trade like it could be his last. He gets gun shy. Triggers too early, bails too late.

They are the ones who get into the bottle or blow their nose membranes and begin to shy away from actually working at all (in late, leave early etc, blitzed 5 mins after they step out of the building).