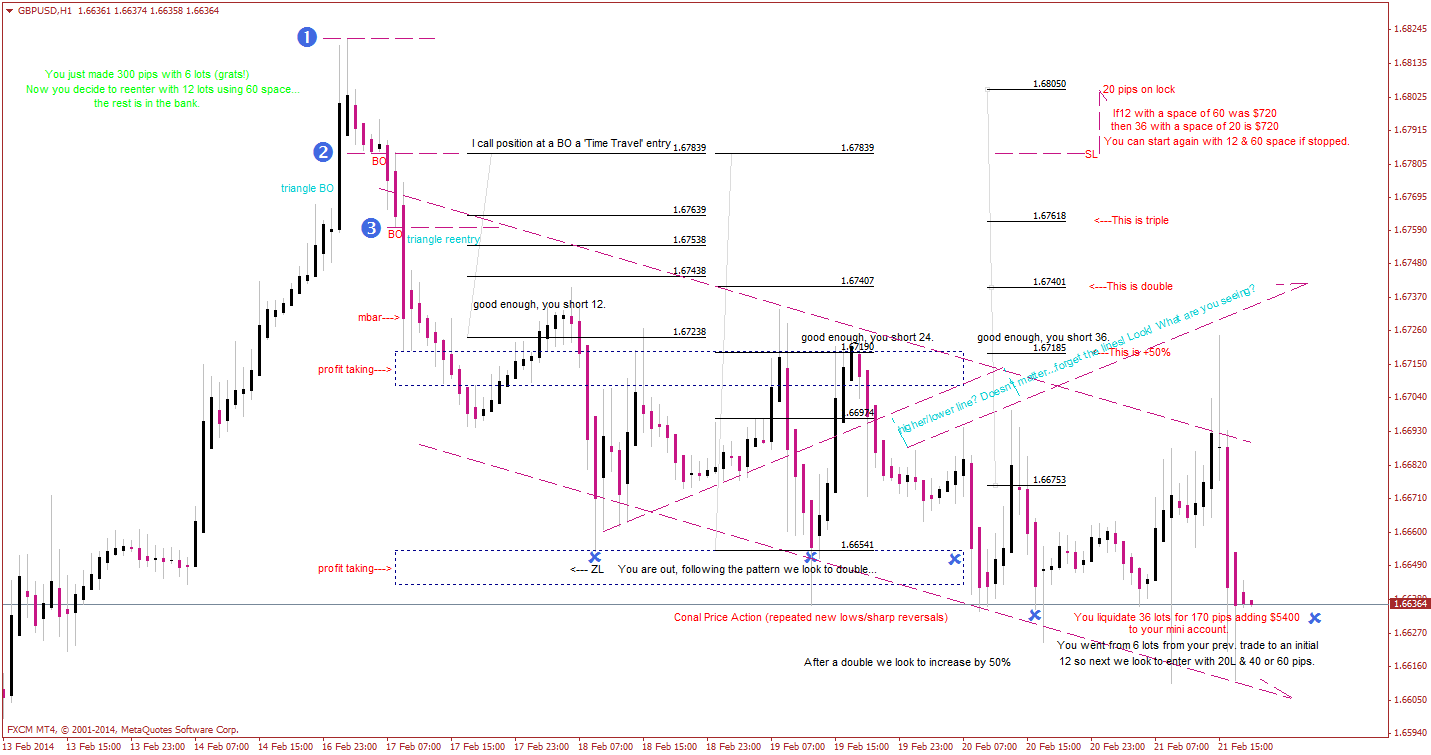

MightyOne wrote:Some of the more 'ballsy' methods:

I understand using a stop to save your last few pips once you get your lot

size up so you can unfold it back to a larger distance with a smaller lot size

and start over.

But what's the play when price moves close to your position right of the bat before you have had a chance to get your lot size up? seems to happen to me more often then id like

Is it better to just be willing to lose your initial risk and hope your position weathers the storm if price starts to get close or should you still take a partial stop and try to unfold what's left and start over even though it may not be much?