TheRumpledOne wrote:TRO004.png

This is what I meant, MO.

Indicator attached.

Thanks, TRO, I'll look at it more later on today.

Moderator: moderators

TheRumpledOne wrote:TRO004.png

This is what I meant, MO.

Indicator attached.

MightyOne wrote:TheRumpledOne wrote:TRO004.png

This is what I meant, MO.

Indicator attached.

Thanks, TRO, I'll look at it more later on today.

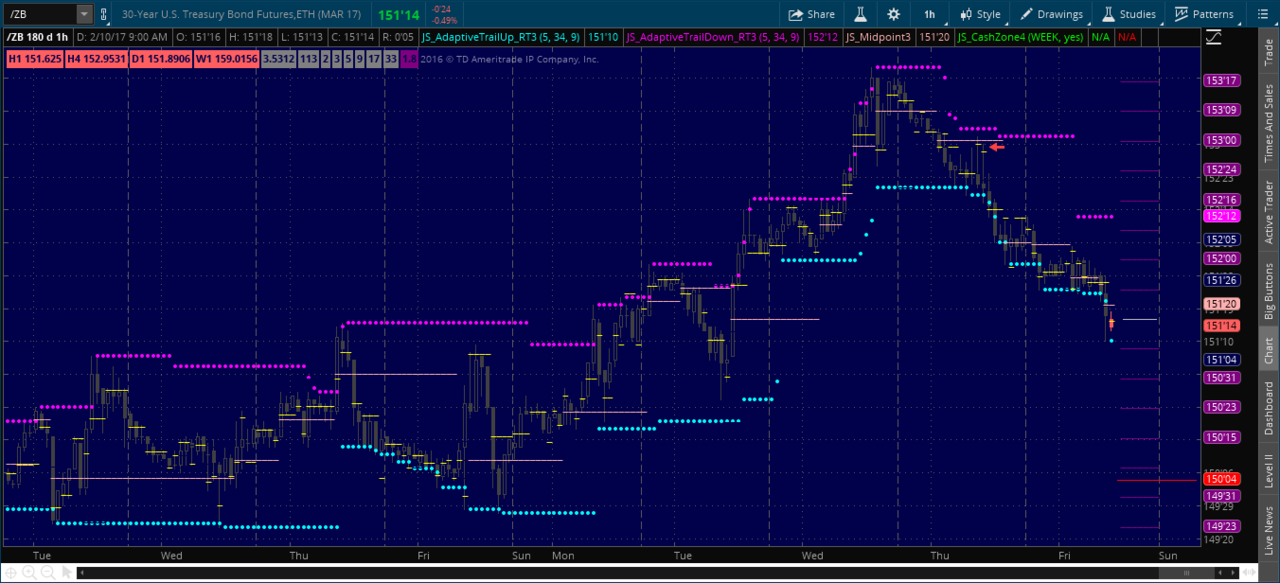

jscar wrote:I was going to post this with the previous entry, but I forgot. This is basically the same picture as the H1 chart in my last post.

I just wanted to note how the wick dolls on these two H1 bars respected the HAGO lines. Quite cool.

MightyOne wrote:jscar wrote:I was going to post this with the previous entry, but I forgot. This is basically the same picture as the H1 chart in my last post.

I just wanted to note how the wick dolls on these two H1 bars respected the HAGO lines. Quite cool.

I like your "next higher HAGO" idea.

jscar wrote:MightyOne wrote:jscar wrote:I was going to post this with the previous entry, but I forgot. This is basically the same picture as the H1 chart in my last post.

I just wanted to note how the wick dolls on these two H1 bars respected the HAGO lines. Quite cool.

I like your "next higher HAGO" idea.

Thanks MO!

It wasn't quite by accident, but almost. While I was putting in the code to highlight the active HAGO line, I decided to give this a whirl. It turned out that HAGO holds up really well as you move to smaller time frames.

Anything smaller than H1 is tied to the HAGO for H1. So even though M5 and H1 have the same line spacing (as they should), M5 works with H1 HAGO. It looks good for early warning, and possibly for better timing on those wick dolls! I'm still studying this.

I'm keeping an eye on stuff like the H1 wick dolls, where price retraces back to the next HAGO line and then resumes the original direction. It looks like it could be a good spot to load up additional lots for the short term on an existing trade, or just to collect a few lines if you're not already in a trade. After all, an H1 bar alone is generally good for at least 3-4 lines.

EDIT: Of course it can also be a good method for adding lots and trailing your stop on a higher time frame as well.

IS A LIE__________

IS A LIE__________

IS A LIE__________

IS A LIE__________

MightyOne wrote:Changes:

1) automatically sets line width to 2/3 of the hourly's 48 ATR if LineWidth = 0.

2) if you want the lines to be spaced by 2/3 of the current width then you can set LineAdjust to 0.6667

3) modified the comments

SweetSpotsGOLD_EIGHTS_V4.mq4

[EDIT] Indicator crashes when changing periods.

HKDJPYH1.png

IS A LIE__________

IS A LIE__________