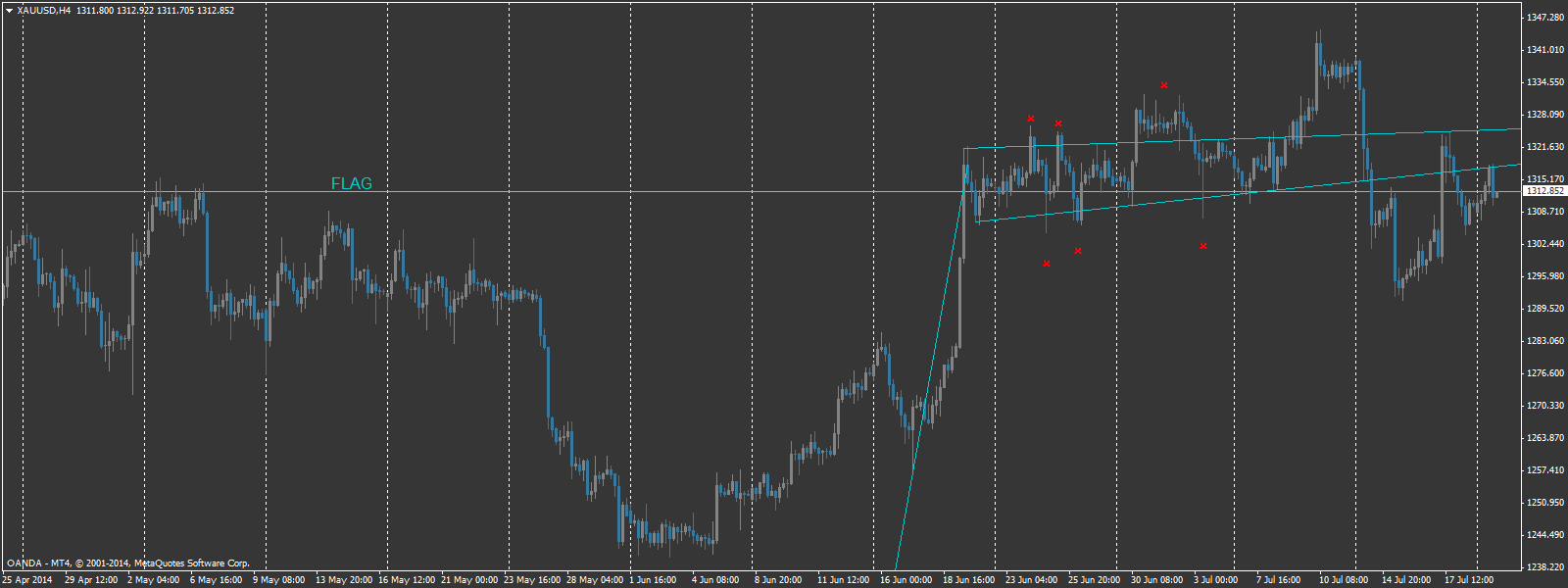

adaseb wrote:Here are the charts. My main question is. How are you suppose to trade this in real-time? Because these lines are difficult to draw when they are forming in real-time. It looks simple in hindsight but how do you apply it to real-time trading.

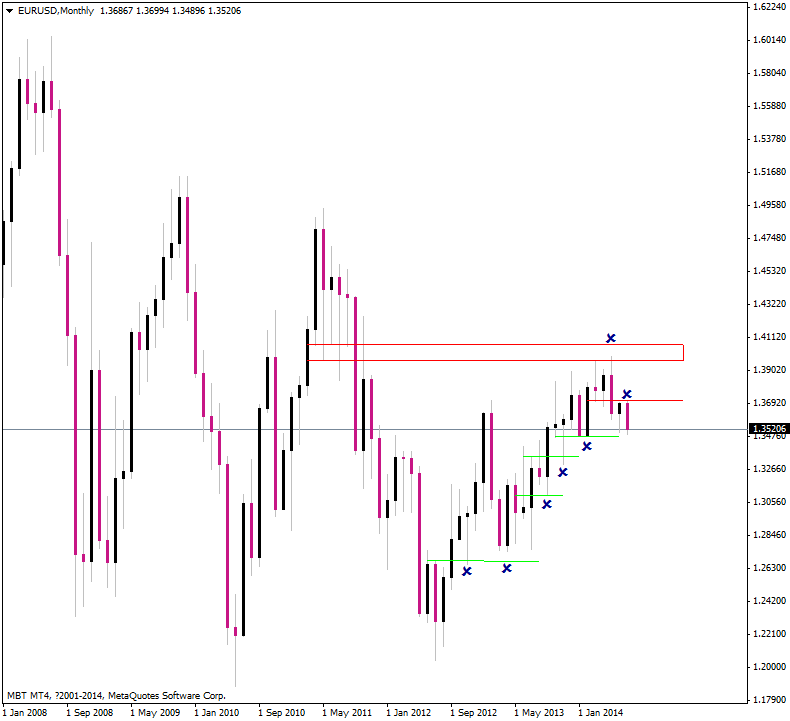

Always get a position off of a LARGE TF

that way if you are wrong at the moment you May be eventually right

so down scale riskk and scale in aggressively when you are right

Find your POSITION off of a Large TF

Reposition Space to a Extreme trading from a Large TF POSITION

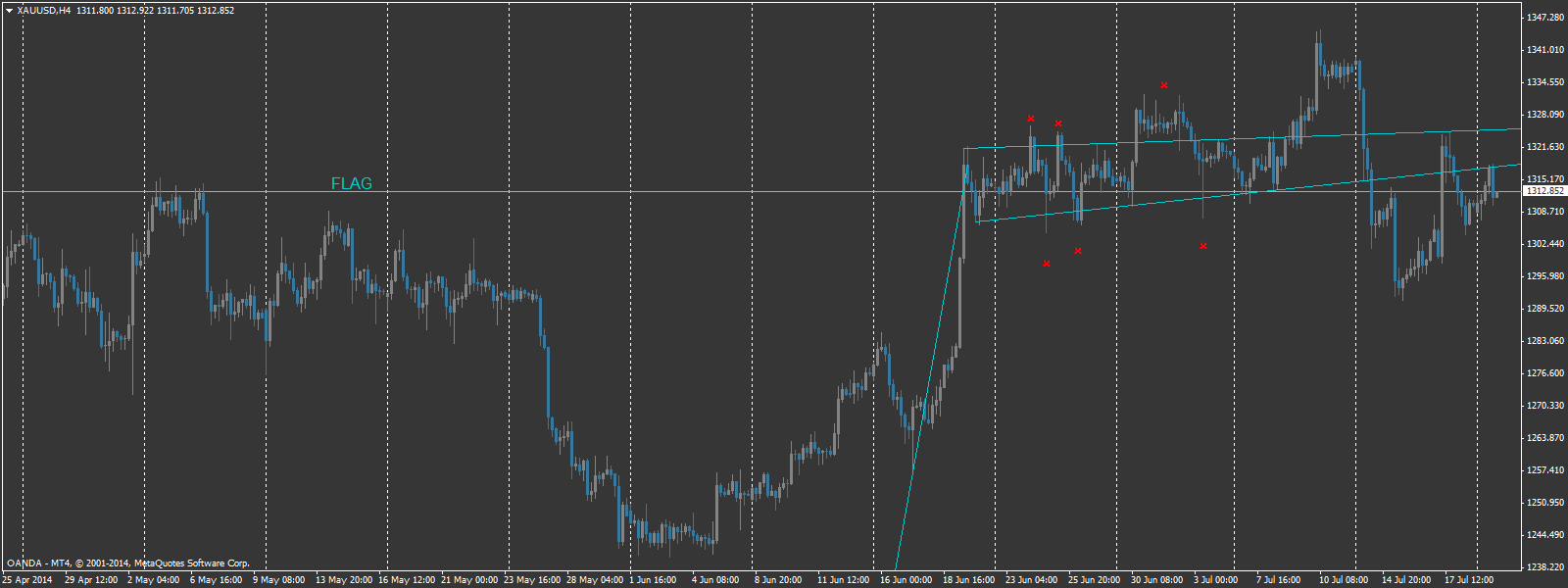

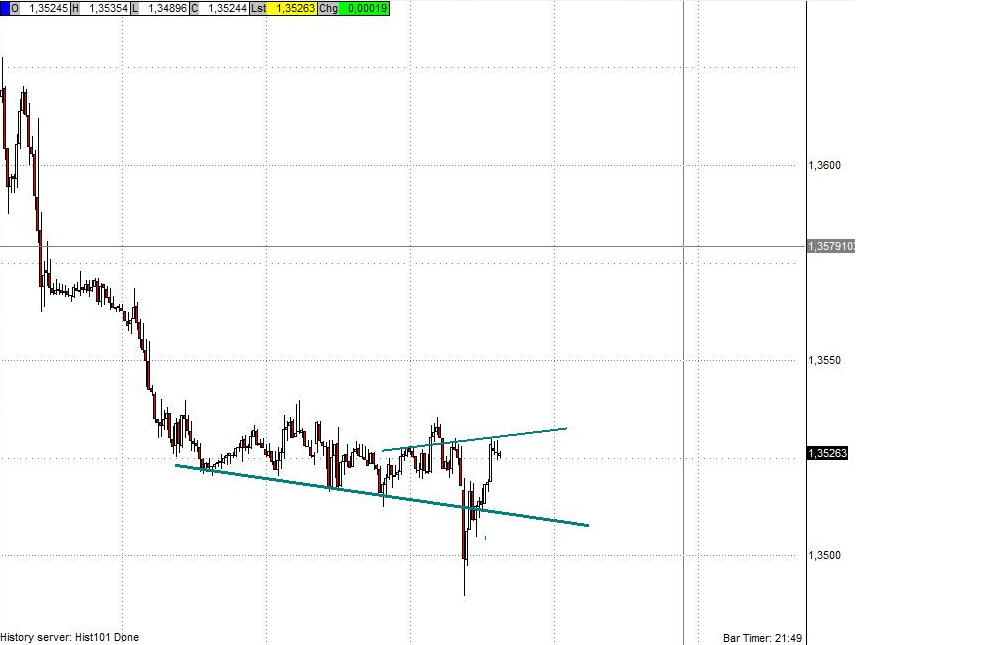

Next draw some cones...

establish cone or pennant?

Cone is HIGHER HIGHS... eventually

Pennant is a compression

PA definately coning... Meaning look to enter on extremes or cone break returns

Now to take you through a thought process... in hindsight I know... but the realtime application want you looking for happens when you can establish CONE or Pennant PA

Now we trade into the Wick doll EX on the High TF

I don't know if any of this makes sense...

but base you areas of interest off higher TF levels and then discect PA as it enters / exits and interacts in a level...

You basically look to the diamond and see if price is coning or making a pennant and then you position yourself accordingly...