Remember that the true triangle/channel can only be seen when you do everything to not use a breakout as part of a channel.

You want more? What should I give you...

How about this:

Moderator: moderators

TRO wrote:You cannot control the probabilities of wining or losing.

You cannot control your average win size.

MightyOne wrote:It looks like your post is to yourself Jala, don't you just love exploration?

Remember that the true triangle/channel can only be seen when you do everything to not use a breakout as part of a channel.

You want more? What should I give you...

How about this:

Jalarupa wrote: - Thank you to the new comers to the discussion for prompting MO to reveal such powerful simplistic realizations that have given me the most wonderful AHA moment! Please continue along this journey with us]

Jalarupa wrote:On a side note, I guess that is what it means to be at a 2+ Daily Extreme... The Cone High/Low has already been established... Yeah I know.... really stating the obvious today...

MightyOne wrote:forextrading wrote:MightyOne, are you playing extreme in the direction of the main trend or playing in both directions?

I am trading the large chart.

Short term I might reverse with min. size.

Long term I might reverse with max. size.

Large charts, large size.

Small charts, small size.

The more lots you accumulate the easier your decisions will be.

Example:

Q: I started with 2 units & now have 16, what is the cost (risk) to reverse with 2 units and 25 space?

A: (2/16) * 25 or 3.2 pips.

I hope that answers your question

Captain Pugwash wrote:Jalarupa wrote:On a side note, I guess that is what it means to be at a 2+ Daily Extreme... The Cone High/Low has already been established... Yeah I know.... really stating the obvious today...

AHA that makes sense - so the market has already taken out the buy stops from the extreme sellers - and made new pa to define our new entry.

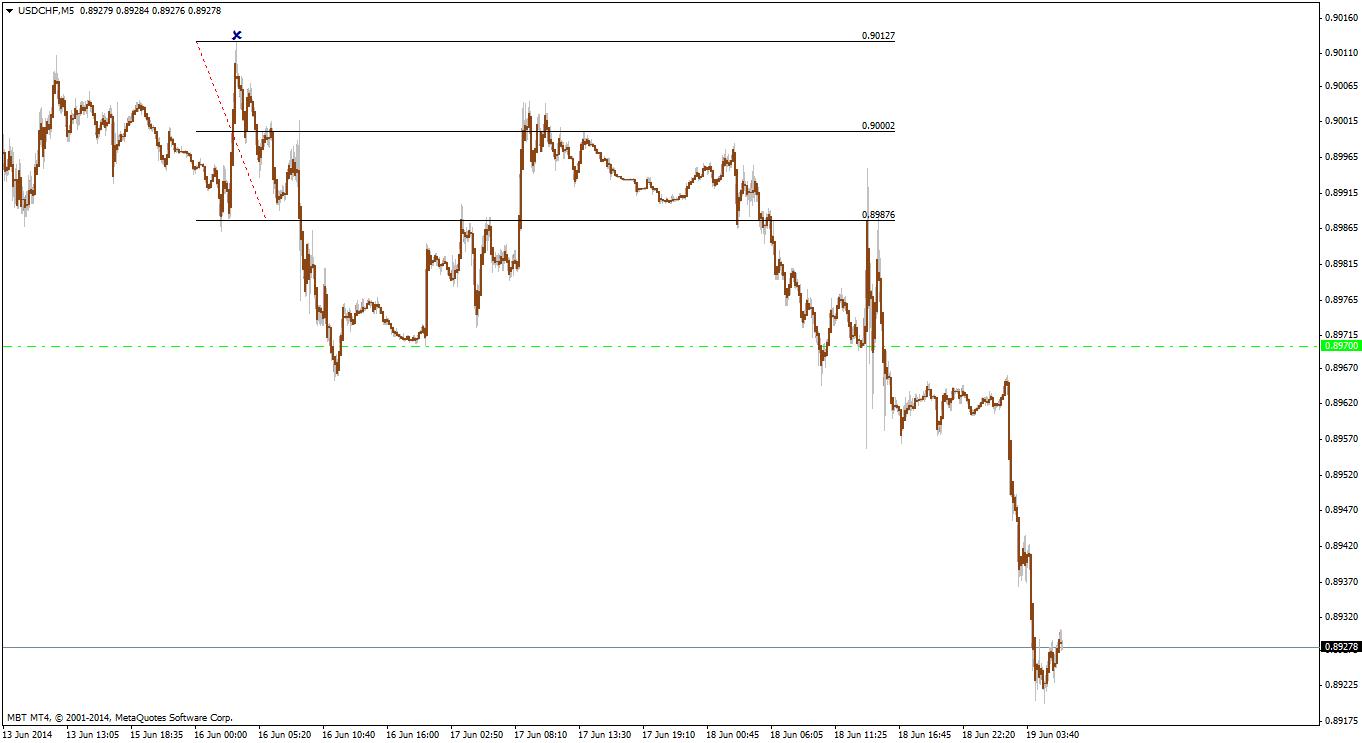

Its the final entry on this chart that eludes me.

The adds and space manipulation on the first two space expansions I sort of get

But that last one just looks like a pending on the bottom line - unless its the second spike up to the body of the first spike - although I'm sure mo's gonna make me sweat