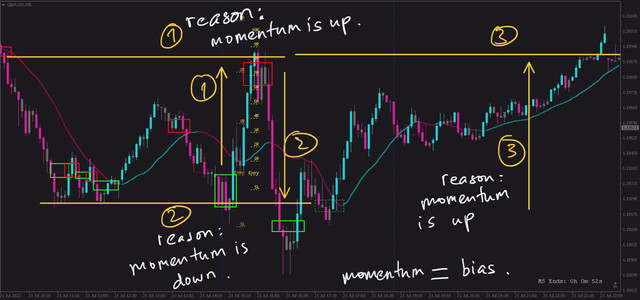

In an effort to try and understand context. This is the only way I know how to read it, or at least attempt to.

I know how to draw those zones like that, using opposing candles that close over their previous extremes to create turning points.

I'd only mark them when price creates a new low or high, until they break. Not to mark everything in between and get completely lost.

I guess it's a mix between something from doji and this quote from H. Rearden that I read through TRO:

"Now, 2 patterns of market behavior happen on a regular basis:

1) the price breaks to new high's (or low's)

2) the price reverses from new high's (or low's)

They happen regardless of time frame (with the obvious limitations explained above)

They are phenomena that can be exploited without the fear if found out by others, that they might cease to exist."

So taking the example from today this is how I would look at the session.

In hindsight I can see they are zones of very little risk and one could trade from one zone to another. Even the last 'bearish zone' at the end would have small risk when price came back to it. But on regards to bias I'd be completely all over the place, there's so many things I could give me a 'bias' reason.

This is how I see the chart:

I see the first short momentum at the left. I'd consider that run as strong. That created a bearish zone which held. I guess the bias, considering the zone and momentum, is short.

Then momentum ended and there was another zone at the bottom, but it didn't have as much strength as the short momentum. So that's another zone and price is reversing, but bias is still short I suppose.

Then price goes up, then down, then up again between the zones.

But then the bearish zone, which was backed by the stronger momentum, broke. And now I have the largest momentum I can see on the chart, which is now bullish. So my bias is now bullish?

Then I see that maybe price will turn, but it doesn't, until it finally does, but with weaker momentum if I compare it to the bullish momentum.

So is my bias still long? Is there any way I could use this in conjunction with the SMA? Because if I take the first two zones, the SMA is pointing at the other side, so there's a conflict of bias.

---

Maybe my mind would be at ease if I could say "now bias is long, now bias is short". At first the idea would be to use the SMA, but how can I use the overall context of the chart in conjunction with the SMA?

I know context is really important and another wall I need to break to progress.

(If this chart reading is way off, please let me know)

Scalping: 3LZZ DSR

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

Re: Scalping: 3LZZ DSR

The more I look at these charts the less I understand what I need to look for. Bias is still an issue and I can't seem to grasp what makes a good trade good and a bad trade bad. I don't know how to put it together or if it's even the right direction.

This is another example on getting lost as price unfolds.

This is another example on getting lost as price unfolds.

Re: Scalping: 3LZZ DSR

Jhx wrote:Don_xyZ wrote:Jhx wrote:

Well, for sure you know how to follow price.

I've spent some time looking at your chart to understand how you mark those areas. I have no clue how you manage to get the most out of those runs without exiting sooner. I thought that you maybe waited for a close over the box in the opposing direction but maybe not.

Or if you enter at the break or wait for price to retest, but looking at the 2nd large swing (long) that doesn't seem to be the case.

The only way I know how to mark those turning points is by using bullish and bearish candles that close over their previous extremes.

GU Turns How.png

GU Turns When.png

In answer to the question. To achieve big R I assume you need to trade at the swings and/or be able to reduce the SL in terms of distance to maximize how the move will 'pay'. But there is the trade off of getting stopped out, unless you're doing some kind of entry using a smaller timeframe but it's not the case here since you're only using the M5

GU RR.png

GU Move Example.png

Still wondering how you're able to grab moves like that off a single timeframe and not get out on every single turn

As I said, the 1st bluebox trade failed.

To better explain…

Why those TPs and not hold longer? Simple answer, volatility. Long answer, my WIL is long so I can’t detail them all here. Then again, I already mentioned a lot of thing between the threads in this forum. Anyone diligent enough must already know how to piece my puzzle.

You know well to see the trees but you can’t yet tell the forest that’s why every turns look “equal” to you. Well yes, the minor turns are good formscalping but even then, not all of them must be taken. There is a thing called trade grading. As your screen time increase you’ll be able to differentiate different grades of trades.

You partly answered well. Take a big move, use a small SL. But how to put those ideas to work is what makes the difference. But my question is how to make those 2 ideas to work when the situation is not favorable to you. The chart showed big entry candles for entries but I said you can get roughly 30 R from all move combined. This, you still haven’t answered. Well, don’t answer. Think.

I trade according to the market condition. Sometimes I hold the trade (anchor trade) the rest I scalp. I don’t like to waste food & pips.

If I go down to a smaller tf, the R might go up considerably.

Thanks Don. I always appreciate the good (good is an understatement) traders here commenting on my thread.You know well to see the trees but you can’t yet tell the forest that’s why every turns look “equal” to you.

That is very true, and I know it's important. I've been wanting to do that but I can't never really nail a 'good' reading of the chart.

I might see something that I think is relevant but isn't, or ignore something that it's actually important and missing it out.

Don’t sweat it. It comes with experience as your screen time increases. Take it one step at a time and they will eventually pop up to you.

Maybe it's because I'm trying to incorporate too much? There's so much to see, support and resistance, areas of congestion, price failing to close over a certain high, low, momentum, zlines, but when you don't know what you're doing, doing everything at the same time is a recipe for disaster. This has resulted in me getting over-analytical and getting paralysis by analysis.

But I could try focusing on one thing at a time, like identifying the areas of momentum in my chart to see if they back up my trades to start somewhere.

You are confused. Yes there is a lot of thing that you can expect the market to do. However, the price comes one tick at a time and a candle only one at a time. You never see three 1 minute candles forming at the same time do you? That’s why there is another thing called chart progression. It all started with a diagonal line followed by another one and it continuesnto eventually form something. The game is about waiting patiently for something to happen and take action based on it.You partly answered well. Take a big move, use a small SL. But how to put those ideas to work is what makes the difference. But my question is how to make those 2 ideas to work when the situation is not favorable to you. The chart showed big entry candles for entries but I said you can get roughly 30 R from all move combined. This, you still haven’t answered. Well, don’t answer. Think.

I'll still try to answer lol. I don't think I understood what you meant when the situation wasn't favorable. Was it because you'd use the 'large' candle as the entry?

Yes. You see, my play is always about getting optimum result out of almost everything in the market and it require me to use a very tight SL. A portion of my trades have a 0.5 or 0.3 pips SL on them so even if the price only move 5 pips I already bank at least 10 R. So now, if the entry candle is big (comparatively) then I won’t get that sub 1 pip SL, right? What should I do if the SL is 7 or 10 pips wide? Well, I already have my answer. What is your solution? This question will help you expand your What Ifs List.

But, to answer the question:

1) You could add as the trade moves (moving the stop to normalize risk), wouldn't know where other than on the breaks if you're only using a single timeframe but you could add I suppose.

2) Go to a smaller timeframe and pinpoint an entry with a -very- small stop and with more size.

3) 1 and 2?

Good solutions. Keep them in your WIL. Use them when the opportunity arises.

Replies’ in blue.

Now, for the chart progression…

The point is, as the chart progresses from one line to another, it will form a pattern and if that pattern fail to form it will still form a different pattern. At some point during the formation of a pattern, there is a window of time for you to analyze which pattern is likely to form and then take the risk. The more the chart becomes a hindsight the better your chance is to get it right but with lesser profit potential. The less hindsight, the better the profit potential. This is already an advanced stuff.

For now, stick to taking a continuation trade instead of taking both continuation and reversal trades and when the time is ripe, revisit my posts. Or better yet, save it.

My threads

Patterns Observation

post148989#p148989

BONZ

post151670#p151670

MENTAL FORTIFICATION

post168148#p168148

Patterns Observation

post148989#p148989

BONZ

post151670#p151670

MENTAL FORTIFICATION

post168148#p168148

Re: Scalping: 3LZZ DSR

Jhx wrote:In an effort to try and understand context. This is the only way I know how to read it, or at least attempt to.

I know how to draw those zones like that, using opposing candles that close over their previous extremes to create turning points.

I'd only mark them when price creates a new low or high, until they break. Not to mark everything in between and get completely lost.

I guess it's a mix between something from doji and this quote from H. Rearden that I read through TRO:

"Now, 2 patterns of market behavior happen on a regular basis:

1) the price breaks to new high's (or low's)

2) the price reverses from new high's (or low's)

They happen regardless of time frame (with the obvious limitations explained above)

They are phenomena that can be exploited without the fear if found out by others, that they might cease to exist."

So taking the example from today this is how I would look at the session.

GU_07222022_Context.png

In hindsight I can see they are zones of very little risk and one could trade from one zone to another. Even the last 'bearish zone' at the end would have small risk when price came back to it. But on regards to bias I'd be completely all over the place, there's so many things I could give me a 'bias' reason.

This is how I see the chart:

I see the first short momentum at the left. I'd consider that run as strong. That created a bearish zone which held. I guess the bias, considering the zone and momentum, is short.

Then momentum ended and there was another zone at the bottom, but it didn't have as much strength as the short momentum. So that's another zone and price is reversing, but bias is still short I suppose.

Then price goes up, then down, then up again between the zones.

But then the bearish zone, which was backed by the stronger momentum, broke. And now I have the largest momentum I can see on the chart, which is now bullish. So my bias is now bullish?

Then I see that maybe price will turn, but it doesn't, until it finally does, but with weaker momentum if I compare it to the bullish momentum.

So is my bias still long? Is there any way I could use this in conjunction with the SMA? Because if I take the first two zones, the SMA is pointing at the other side, so there's a conflict of bias.

---

Maybe my mind would be at ease if I could say "now bias is long, now bias is short". At first the idea would be to use the SMA, but how can I use the overall context of the chart in conjunction with the SMA?

I know context is really important and another wall I need to break to progress.

(If this chart reading is way off, please let me know)

There are different ways to get a market bias. Using MA is one of them and zooming out to a bigger tf is another. Mine is a combination.

My post count is not that much, even if you read them one by one it wouldn’t take that long.

My threads

Patterns Observation

post148989#p148989

BONZ

post151670#p151670

MENTAL FORTIFICATION

post168148#p168148

Patterns Observation

post148989#p148989

BONZ

post151670#p151670

MENTAL FORTIFICATION

post168148#p168148

Re: Scalping: 3LZZ DSR

Don_xyZ wrote:

There are different ways to get a market bias. Using MA is one of them and zooming out to a bigger tf is another. Mine is a combination.

My post count is not that much, even if you read them one by one it wouldn’t take that long.

The moving average is a line chart of a larger chart period. . .

of course you are going to generally trade long above and short below, as the average lags behind price, but one should not forget that the MA as a whole is telling its own story.

You might find that 'bias' is simply you deciding to focus on one direction until you catch "the move";

it might be more about dedication and determination than an indication.

M5 BTC with an MA overlay:

"Everything Should Be Made As Simple As Possible, But Not Simpler!"

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

Re: Scalping: 3LZZ DSR

Don_xyZ wrote:Jhx wrote:In an effort to try and understand context. This is the only way I know how to read it, or at least attempt to.

I know how to draw those zones like that, using opposing candles that close over their previous extremes to create turning points.

I'd only mark them when price creates a new low or high, until they break. Not to mark everything in between and get completely lost.

I guess it's a mix between something from doji and this quote from H. Rearden that I read through TRO:

"Now, 2 patterns of market behavior happen on a regular basis:

1) the price breaks to new high's (or low's)

2) the price reverses from new high's (or low's)

They happen regardless of time frame (with the obvious limitations explained above)

They are phenomena that can be exploited without the fear if found out by others, that they might cease to exist."

So taking the example from today this is how I would look at the session.

GU_07222022_Context.png

In hindsight I can see they are zones of very little risk and one could trade from one zone to another. Even the last 'bearish zone' at the end would have small risk when price came back to it. But on regards to bias I'd be completely all over the place, there's so many things I could give me a 'bias' reason.

This is how I see the chart:

I see the first short momentum at the left. I'd consider that run as strong. That created a bearish zone which held. I guess the bias, considering the zone and momentum, is short.

Then momentum ended and there was another zone at the bottom, but it didn't have as much strength as the short momentum. So that's another zone and price is reversing, but bias is still short I suppose.

Then price goes up, then down, then up again between the zones.

But then the bearish zone, which was backed by the stronger momentum, broke. And now I have the largest momentum I can see on the chart, which is now bullish. So my bias is now bullish?

Then I see that maybe price will turn, but it doesn't, until it finally does, but with weaker momentum if I compare it to the bullish momentum.

So is my bias still long? Is there any way I could use this in conjunction with the SMA? Because if I take the first two zones, the SMA is pointing at the other side, so there's a conflict of bias.

---

Maybe my mind would be at ease if I could say "now bias is long, now bias is short". At first the idea would be to use the SMA, but how can I use the overall context of the chart in conjunction with the SMA?

I know context is really important and another wall I need to break to progress.

(If this chart reading is way off, please let me know)

There are different ways to get a market bias. Using MA is one of them and zooming out to a bigger tf is another. Mine is a combination.

My post count is not that much, even if you read them one by one it wouldn’t take that long.

Thanks Don for taking the time to answer all that, point by point. It was all very well laid out. To keep my sanity I'll do what you suggest and only take continuation trades to not drive myself crazy, taking it one step at a time.

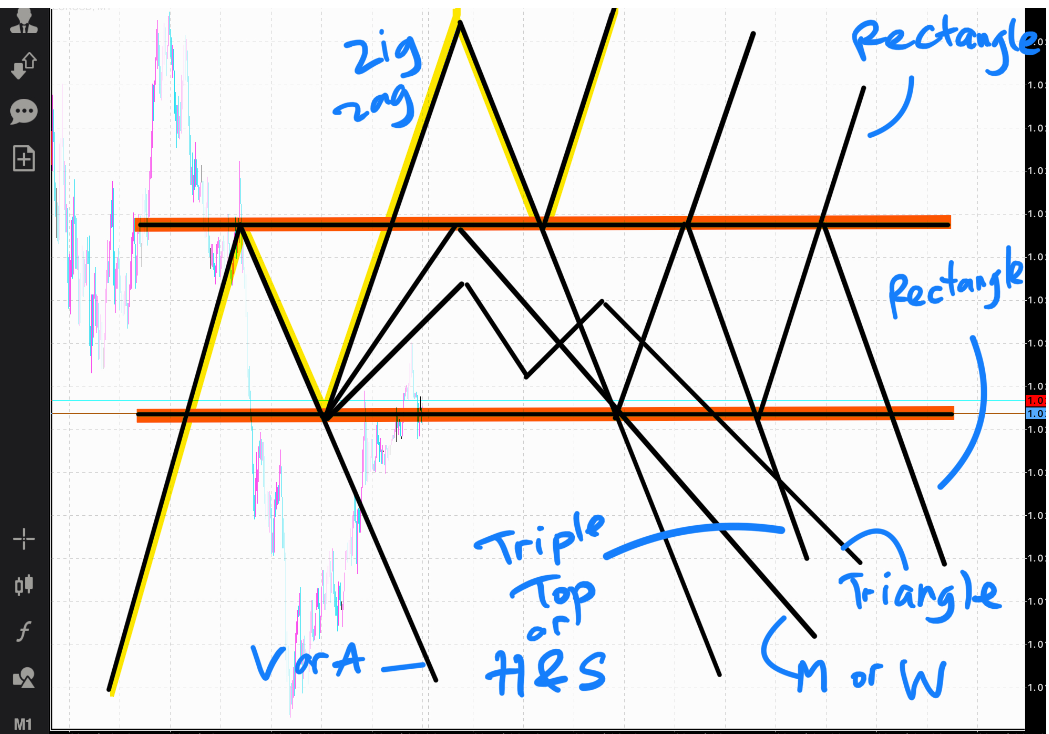

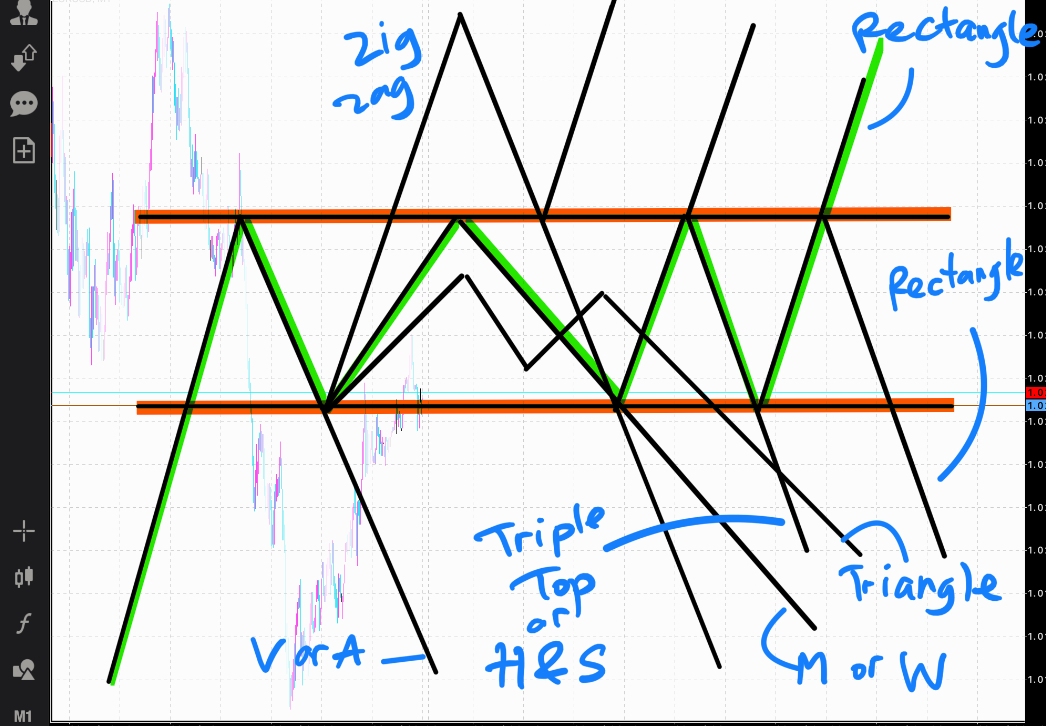

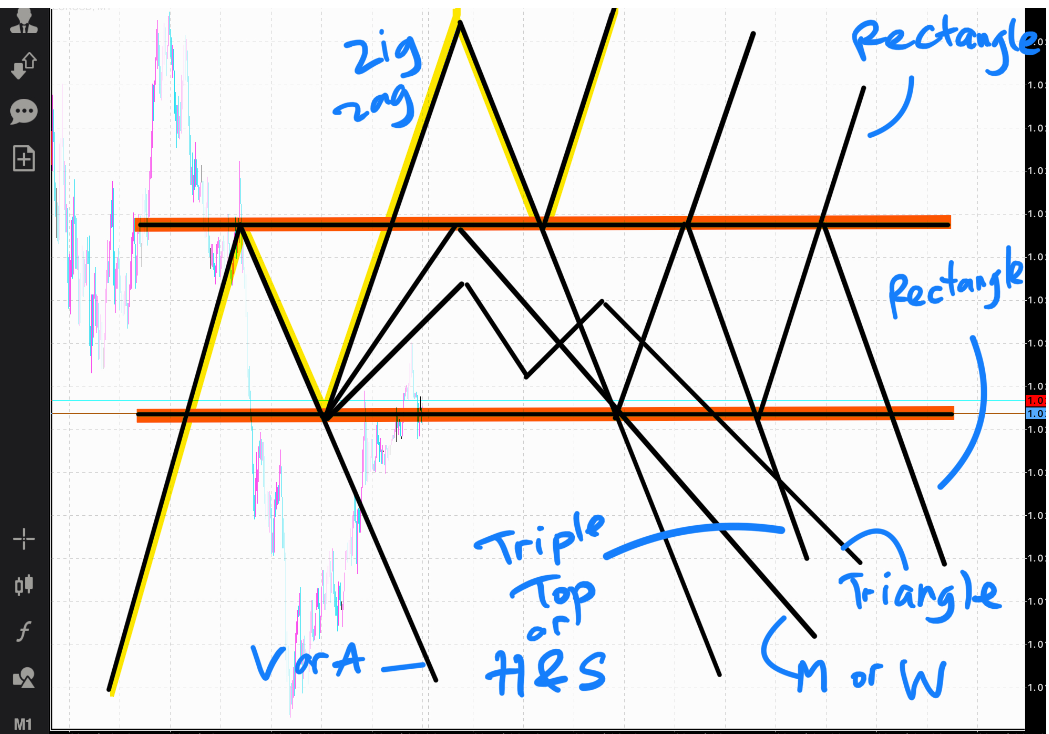

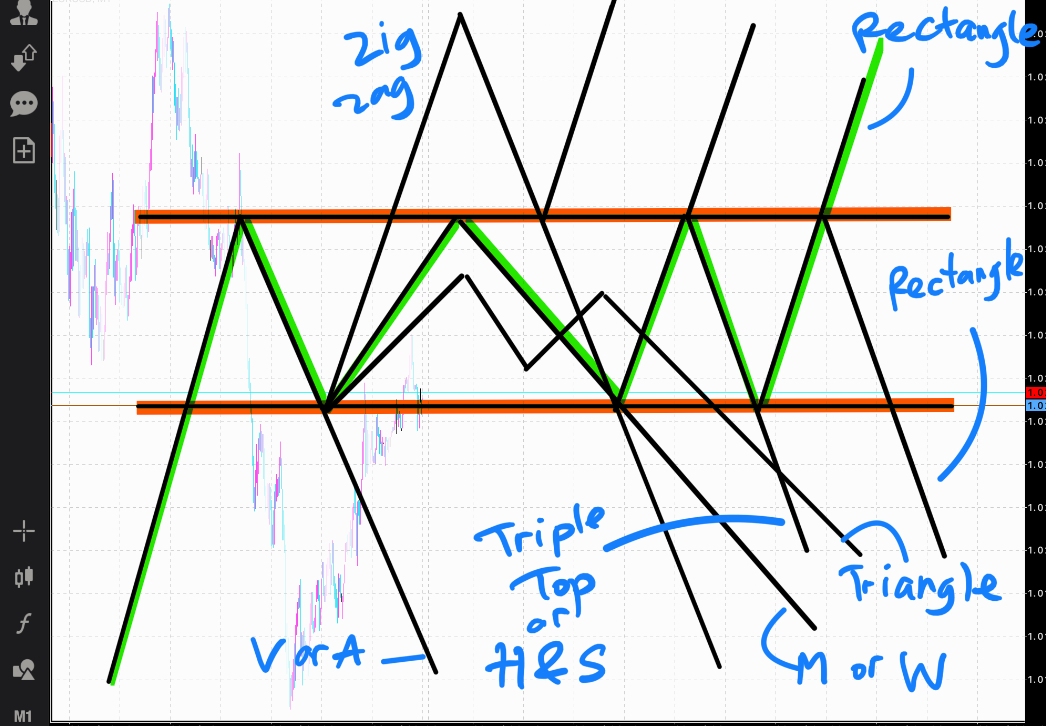

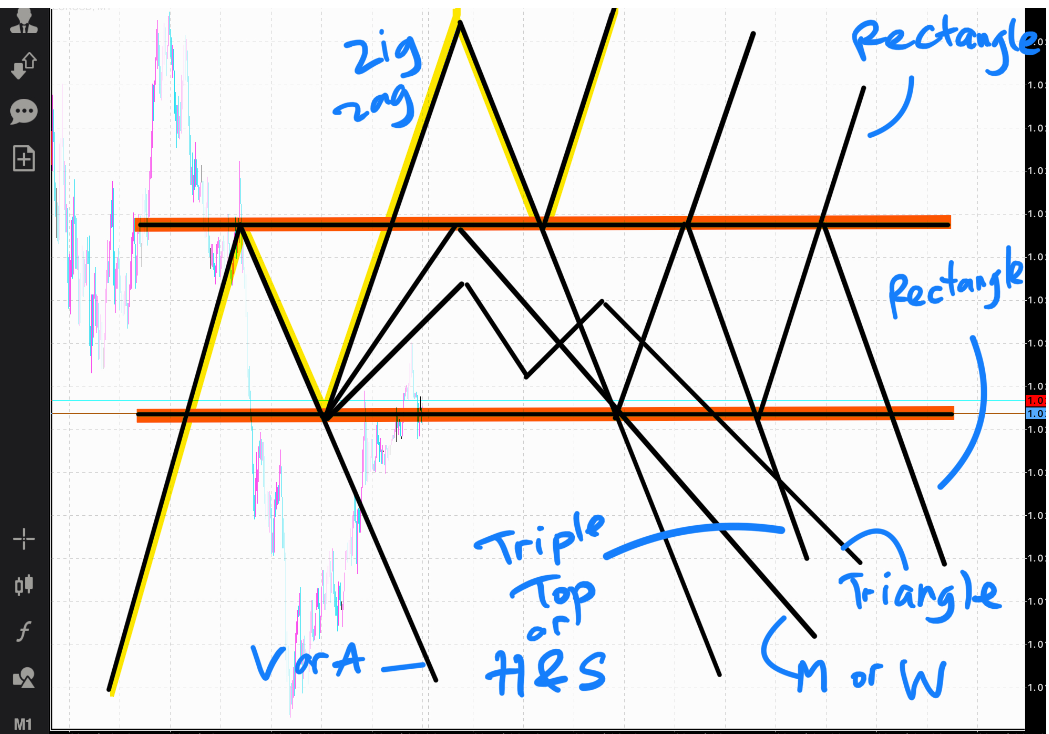

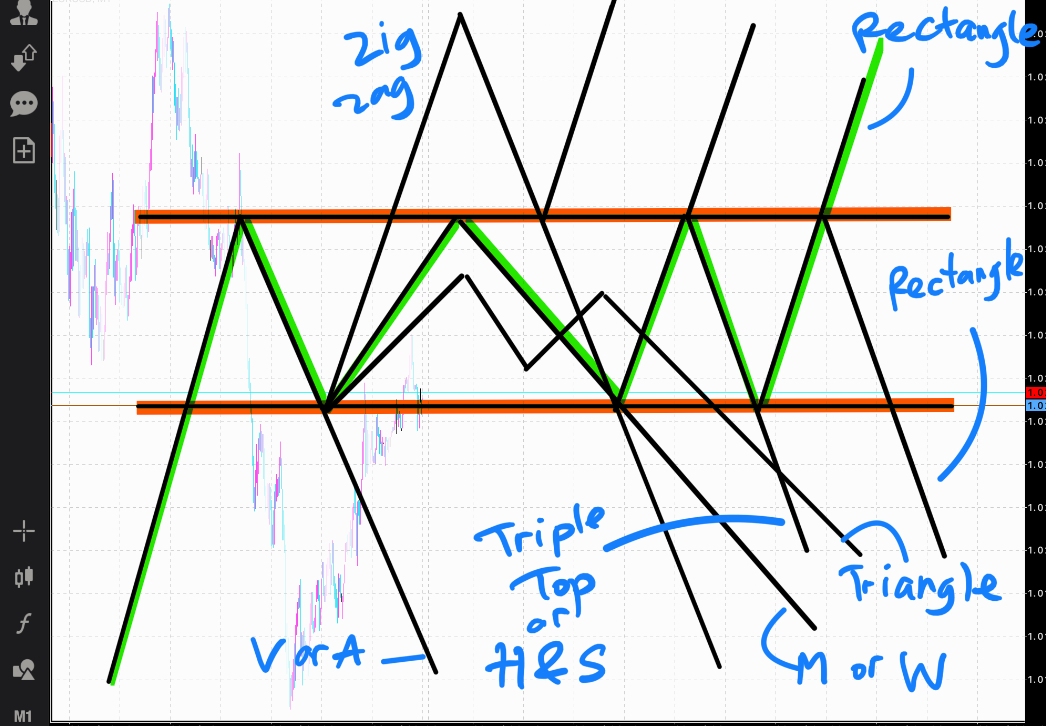

That last pic regarding the patterns is a bit confusing but not because of the pic itself, I'm just not familiar with the different types of patterns. I guess it goes back when I first started and saw people showing all those patterns and setups and didn't know if they were truly necessary for my trading or if they would just add complexity, but I get the idea of what you're showing with that pic.

Re: Scalping: 3LZZ DSR

Jhx wrote:Don_xyZ wrote:Jhx wrote:In an effort to try and understand context. This is the only way I know how to read it, or at least attempt to.

I know how to draw those zones like that, using opposing candles that close over their previous extremes to create turning points.

I'd only mark them when price creates a new low or high, until they break. Not to mark everything in between and get completely lost.

I guess it's a mix between something from doji and this quote from H. Rearden that I read through TRO:

"Now, 2 patterns of market behavior happen on a regular basis:

1) the price breaks to new high's (or low's)

2) the price reverses from new high's (or low's)

They happen regardless of time frame (with the obvious limitations explained above)

They are phenomena that can be exploited without the fear if found out by others, that they might cease to exist."

So taking the example from today this is how I would look at the session.

GU_07222022_Context.png

In hindsight I can see they are zones of very little risk and one could trade from one zone to another. Even the last 'bearish zone' at the end would have small risk when price came back to it. But on regards to bias I'd be completely all over the place, there's so many things I could give me a 'bias' reason.

This is how I see the chart:

I see the first short momentum at the left. I'd consider that run as strong. That created a bearish zone which held. I guess the bias, considering the zone and momentum, is short.

Then momentum ended and there was another zone at the bottom, but it didn't have as much strength as the short momentum. So that's another zone and price is reversing, but bias is still short I suppose.

Then price goes up, then down, then up again between the zones.

But then the bearish zone, which was backed by the stronger momentum, broke. And now I have the largest momentum I can see on the chart, which is now bullish. So my bias is now bullish?

Then I see that maybe price will turn, but it doesn't, until it finally does, but with weaker momentum if I compare it to the bullish momentum.

So is my bias still long? Is there any way I could use this in conjunction with the SMA? Because if I take the first two zones, the SMA is pointing at the other side, so there's a conflict of bias.

---

Maybe my mind would be at ease if I could say "now bias is long, now bias is short". At first the idea would be to use the SMA, but how can I use the overall context of the chart in conjunction with the SMA?

I know context is really important and another wall I need to break to progress.

(If this chart reading is way off, please let me know)

There are different ways to get a market bias. Using MA is one of them and zooming out to a bigger tf is another. Mine is a combination.

My post count is not that much, even if you read them one by one it wouldn’t take that long.

Thanks Don for taking the time to answer all that, point by point. It was all very well laid out. To keep my sanity I'll do what you suggest and only take continuation trades to not drive myself crazy, taking it one step at a time.

That last pic regarding the patterns is a bit confusing but not because of the pic itself, I'm just not familiar with the different types of patterns. I guess it goes back when I first started and saw people showing all those patterns and setups and didn't know if they were truly necessary for my trading or if they would just add complexity, but I get the idea of what you're showing with that pic.

Complexity = knowledge + screentime

When you have knowledge about something and see it many, many times you're bound to nail it the next time it happens. It's the exact same feeling when you first learn foreign writing system. When is the last time you see a Korean letter and understand it on the spot when you don't have any prior knowledge about it? Just chill. You'll get there.

My threads

Patterns Observation

post148989#p148989

BONZ

post151670#p151670

MENTAL FORTIFICATION

post168148#p168148

Patterns Observation

post148989#p148989

BONZ

post151670#p151670

MENTAL FORTIFICATION

post168148#p168148

- aliassmith

- rank: 5000+ posts

- Posts: 5057

- Joined: Tue Jul 28, 2009 9:50 pm

- Reputation: 2847

- Gender:

Re: Scalping: 3LZZ DSR

IgazI wrote:Don_xyZ wrote:

There are different ways to get a market bias. Using MA is one of them and zooming out to a bigger tf is another. Mine is a combination.

My post count is not that much, even if you read them one by one it wouldn’t take that long.

The moving average is a line chart of a larger chart period. . .

of course you are going to generally trade long above and short below, as the average lags behind price, but one should not forget that the MA as a whole is telling its own story.

You might find that 'bias' is simply you deciding to focus on one direction until you catch "the move";

it might be more about dedication and determination than an indication.

M5 BTC with an MA overlay:

lc.png

The 1MA is a line chart of closes at the current timeframe.

A higher MA isnt simply an MA of a higher timeframe. It is an algo of x amount of closed positions of the current TF.

If you are on the M1 chart a 1MA would be a line chart.

To represent the M5 chart on the same M1 chart you would connect the close of every five candles.

Trade Your Way as Long as It Makes Money!

Re: Scalping: 3LZZ DSR

Thanks Don for taking the time to answer all that, point by point. It was all very well laid out. To keep my sanity I'll do what you suggest and only take continuation trades to not drive myself crazy, taking it one step at a time.

That last pic regarding the patterns is a bit confusing but not because of the pic itself, I'm just not familiar with the different types of patterns. I guess it goes back when I first started and saw people showing all those patterns and setups and didn't know if they were truly necessary for my trading or if they would just add complexity, but I get the idea of what you're showing with that pic.[/quote]

JHX,

I was going to PM this to you in you in our Discord group, but I decided to put it here because you have a really informative thread going. I'm learning from your charts and the interactions with Don and Alias. The chart progression pic that Don posted is one of the more valuable pics ever posted in this forum for folks at our level. To help with your confusion, drop the word "pattern" from your brain for a moment. What he has depicted are the various possible movements that "may" occur after price has made a strong bullish move (momentum or possibly what DojiRock calls the initial run) into an area. You already know that at some point price will pull back --- but how far? for how long? After the pullback is complete, will it make another bullish move? Will it be strong or weak? Or will price consolidate before moving up or reversing? And on and on and on.

I highlighted a few of the possibilities for you.

Bullish continuation (breakouts forming support)

Consolidation followed by continuation (aka Rally-Base-Rally)

Break Out - Break In Reversal (aka Head & Shoulders) --- see the red lines as your DojiZone!

Now, if you reintroduce "pattern" back into your mind you can see that as price moves we are anticipating the possible formation of some "pattern" that will suggest the probable/possible direction of future price movement. Thus, Don also stated that further the "pattern" has progressed in its formation the more reliable the direction but the worse the R:R because we are getting in later --- and vice versa.

Again, I commend you on this thread and the work you are putting in. You are not alone in trying to decipher Don's charts.

That last pic regarding the patterns is a bit confusing but not because of the pic itself, I'm just not familiar with the different types of patterns. I guess it goes back when I first started and saw people showing all those patterns and setups and didn't know if they were truly necessary for my trading or if they would just add complexity, but I get the idea of what you're showing with that pic.[/quote]

JHX,

I was going to PM this to you in you in our Discord group, but I decided to put it here because you have a really informative thread going. I'm learning from your charts and the interactions with Don and Alias. The chart progression pic that Don posted is one of the more valuable pics ever posted in this forum for folks at our level. To help with your confusion, drop the word "pattern" from your brain for a moment. What he has depicted are the various possible movements that "may" occur after price has made a strong bullish move (momentum or possibly what DojiRock calls the initial run) into an area. You already know that at some point price will pull back --- but how far? for how long? After the pullback is complete, will it make another bullish move? Will it be strong or weak? Or will price consolidate before moving up or reversing? And on and on and on.

I highlighted a few of the possibilities for you.

Bullish continuation (breakouts forming support)

Consolidation followed by continuation (aka Rally-Base-Rally)

Break Out - Break In Reversal (aka Head & Shoulders) --- see the red lines as your DojiZone!

Now, if you reintroduce "pattern" back into your mind you can see that as price moves we are anticipating the possible formation of some "pattern" that will suggest the probable/possible direction of future price movement. Thus, Don also stated that further the "pattern" has progressed in its formation the more reliable the direction but the worse the R:R because we are getting in later --- and vice versa.

Again, I commend you on this thread and the work you are putting in. You are not alone in trying to decipher Don's charts.

Re: Scalping: 3LZZ DSR

trojoh68 wrote:Thanks Don for taking the time to answer all that, point by point. It was all very well laid out. To keep my sanity I'll do what you suggest and only take continuation trades to not drive myself crazy, taking it one step at a time.

That last pic regarding the patterns is a bit confusing but not because of the pic itself, I'm just not familiar with the different types of patterns. I guess it goes back when I first started and saw people showing all those patterns and setups and didn't know if they were truly necessary for my trading or if they would just add complexity, but I get the idea of what you're showing with that pic.

JHX,

I was going to PM this to you in you in our Discord group, but I decided to put it here because you have a really informative thread going. I'm learning from your charts and the interactions with Don and Alias. The chart progression pic that Don posted is one of the more valuable pics ever posted in this forum for folks at our level. To help with your confusion, drop the word "pattern" from your brain for a moment. What he has depicted are the various possible movements that "may" occur after price has made a strong bullish move (momentum or possibly what DojiRock calls the initial run) into an area. You already know that at some point price will pull back --- but how far? for how long? After the pullback is complete, will it make another bullish move? Will it be strong or weak? Or will price consolidate before moving up or reversing? And on and on and on.

I highlighted a few of the possibilities for you.

Bullish continuation (breakouts forming support)

Consolidation followed by continuation (aka Rally-Base-Rally)

Break Out - Break In Reversal (aka Head & Shoulders) --- see the red lines as your DojiZone!

Now, if you reintroduce "pattern" back into your mind you can see that as price moves we are anticipating the possible formation of some "pattern" that will suggest the probable/possible direction of future price movement. Thus, Don also stated that further the "pattern" has progressed in its formation the more reliable the direction but the worse the R:R because we are getting in later --- and vice versa.

Again, I commend you on this thread and the work you are putting in. You are not alone in trying to decipher Don's charts.

That. Finally.

Those things are also taken into consideration when I'm doing my trade grading.

The thing with patterns is you don't always get a clear textbook formation. There will also be crooked ones.

To put them into practice, see the sketch below...

Question time!

(Close the remaining lines, only show line #1) What will you do after line #1 is formed?

(Close the remaining lines, only show line #1 and #2) What will you do after line #2 is formed?

(Close the remaining lines, only show up to line #3) What will you do after line #3 is formed?

and so on...

I didn't put all of the breakout lines to simplify the practice. I also didn't mark anything from line #20.

The goal of this practice is to become familiar with the patterns.

My threads

Patterns Observation

post148989#p148989

BONZ

post151670#p151670

MENTAL FORTIFICATION

post168148#p168148

Patterns Observation

post148989#p148989

BONZ

post151670#p151670

MENTAL FORTIFICATION

post168148#p168148

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.