Pro,

I know you are struggling some with accepting losses right now. A few ideas for you to think about.

My mentor once told me, "The best traders are great losers." I thought he was crazy at the time and it took awhile for me to understand what exactly that meant, but it is completely true.

I preach and preach about money management. Any time someone wants me to teach them how to trade, or when they come to sit and watch me for the day, it's all I emphasize and often times people walk away unimpressed by my lectures because they have no idea how important it is. The true fact is that even if a new trader tells me they understand MM, they will still screw up repeatedly and after listening to their thoughts on trading they are still always looking for a better entry/exit method. Management is not sexy, nobody wants to think about it, it doesn't fit into the idea of a holy grail.

Everyone needs to understand this: Money Management IS your entry and exit method. Good management= a trade with positive expectancy which has a tolerable risk. Bad management= a trade with unknown expectancy, intolerable risk, or both. I don't care if you throw darts at your computer screen to choose your trade direction, as long as you manage it properly and that includes choosing whether take the trade in the first place....guess what? You will profit...consistently!

Now where does this fit in to our discussion? You will lose....it's not unfortunate, that's just how it is. Back to my mentor's message. If you don't lose when you are supposed to, you are a bad manager and will be at some point, a broke trader. In your list of stop options, A. Was definitely the correct choice, always live to fight another day. If you are wounded you can heal. If you are dead, well you're just dead.

Be happy about hitting the trade button to close a losing position, because it means only one thing.........your broker didn't have to close it for you.

ProchargedMopar's Trading Trilogy

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- prochargedmopar

- rank: 10000+ posts

- Posts: 12048

- Joined: Sat Dec 20, 2008 6:07 am

- Reputation: 1790

- Location: Granbury, TX

- Gender:

- Contact:

jhtumblin wrote:Pro,

I know you are struggling some with accepting losses right now. A few ideas for you to think about.

My mentor once told me, "The best traders are great losers." I thought he was crazy at the time and it took awhile for me to understand what exactly that meant, but it is completely true.

I preach and preach about money management. Any time someone wants me to teach them how to trade, or when they come to sit and watch me for the day, it's all I emphasize and often times people walk away unimpressed by my lectures because they have no idea how important it is. The true fact is that even if a new trader tells me they understand MM, they will still screw up repeatedly and after listening to their thoughts on trading they are still always looking for a better entry/exit method. Management is not sexy, nobody wants to think about it, it doesn't fit into the idea of a holy grail.

Everyone needs to understand this: Money Management IS your entry and exit method. Good management= a trade with positive expectancy which has a tolerable risk. Bad management= a trade with unknown expectancy, intolerable risk, or both. I don't care if you throw darts at your computer screen to choose your trade direction, as long as you manage it properly and that includes choosing whether take the trade in the first place....guess what? You will profit...consistently!

Now where does this fit in to our discussion? You will lose....it's not unfortunate, that's just how it is. Back to my mentor's message. If you don't lose when you are supposed to, you are a bad manager and will be at some point, a broke trader. In your list of stop options, A. Was definitely the correct choice, always live to fight another day. If you are wounded you can heal. If you are dead, well you're just dead.

Be happy about hitting the trade button to close a losing position, because it means only one thing.........your broker didn't have to close it for you.

Be happy about hitting the trade button to close a losing position, because it means only one thing.........your broker didn't have to close it for you.

Funny, but TRUE!!

#1BODY in direction of profit #2INCREASE lot size Obsessively

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

- prochargedmopar

- rank: 10000+ posts

- Posts: 12048

- Joined: Sat Dec 20, 2008 6:07 am

- Reputation: 1790

- Location: Granbury, TX

- Gender:

- Contact:

MightyOne wrote:

It took long enough, but I skinned them alive!

Finished up by ZLing the day traders and I'm calling it a day.

Wow, 10 Month's ago already.

About the same time a took my first trade.

My account should be bustin at the seams.

Hmmmmmm

It took long enough, but I skinned them alive!

Finished up by ZLing the day traders and I'm calling it a day.

Wow, 10 Month's ago already.

About the same time a took my first trade.

My account should be bustin at the seams.

Hmmmmmm

#1BODY in direction of profit #2INCREASE lot size Obsessively

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

- prochargedmopar

- rank: 10000+ posts

- Posts: 12048

- Joined: Sat Dec 20, 2008 6:07 am

- Reputation: 1790

- Location: Granbury, TX

- Gender:

- Contact:

jhtumblin,

Notice the first rule.

1. Never, under any circumstance add to a losing position.... ever! Nothing more need be said; to do otherwise will eventually and absolutely lead to ruin!

But I also like the last......

22. All rules are meant to be broken: The trick is knowing when... and how infrequently this rule may be invoked!

17 is a good one too.

http://www.nobrainertrades.com/2008/10/ ... ading.html

Another good article:

LOSING MONEY TRADING IN FOREX???

Must read for dudes having trouble.

http://www.nobrainertrades.com/2008/10/ ... ng-fx.html

Notice the first rule.

1. Never, under any circumstance add to a losing position.... ever! Nothing more need be said; to do otherwise will eventually and absolutely lead to ruin!

But I also like the last......

22. All rules are meant to be broken: The trick is knowing when... and how infrequently this rule may be invoked!

17 is a good one too.

http://www.nobrainertrades.com/2008/10/ ... ading.html

Another good article:

LOSING MONEY TRADING IN FOREX???

Must read for dudes having trouble.

http://www.nobrainertrades.com/2008/10/ ... ng-fx.html

Last edited by prochargedmopar on Sun Oct 04, 2009 12:47 am, edited 1 time in total.

#1BODY in direction of profit #2INCREASE lot size Obsessively

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

- prochargedmopar

- rank: 10000+ posts

- Posts: 12048

- Joined: Sat Dec 20, 2008 6:07 am

- Reputation: 1790

- Location: Granbury, TX

- Gender:

- Contact:

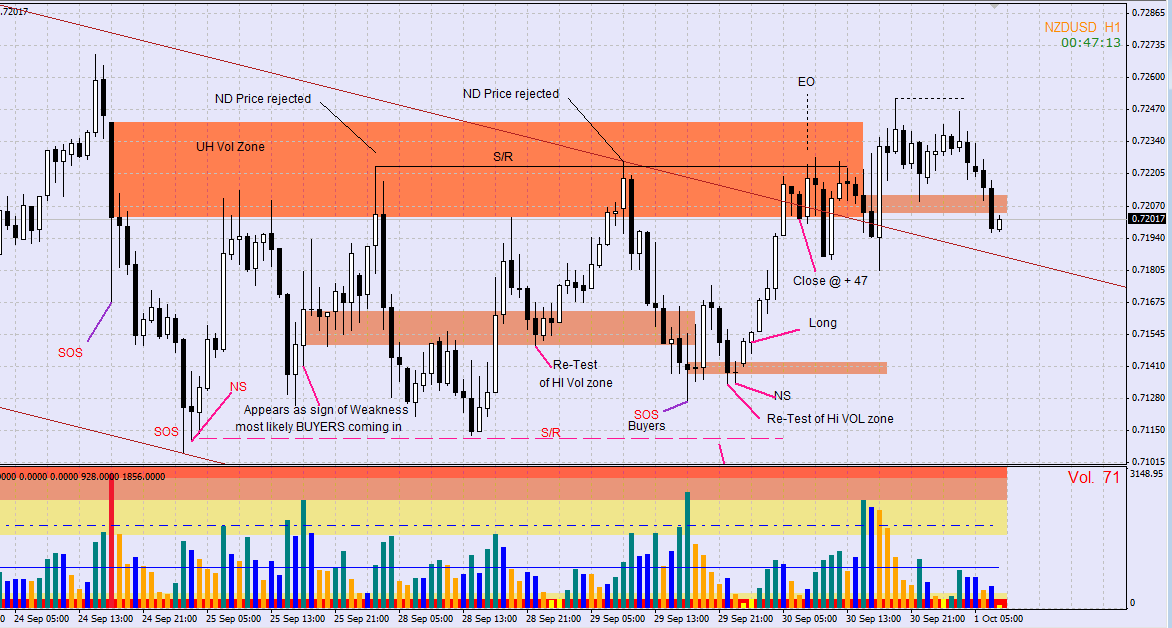

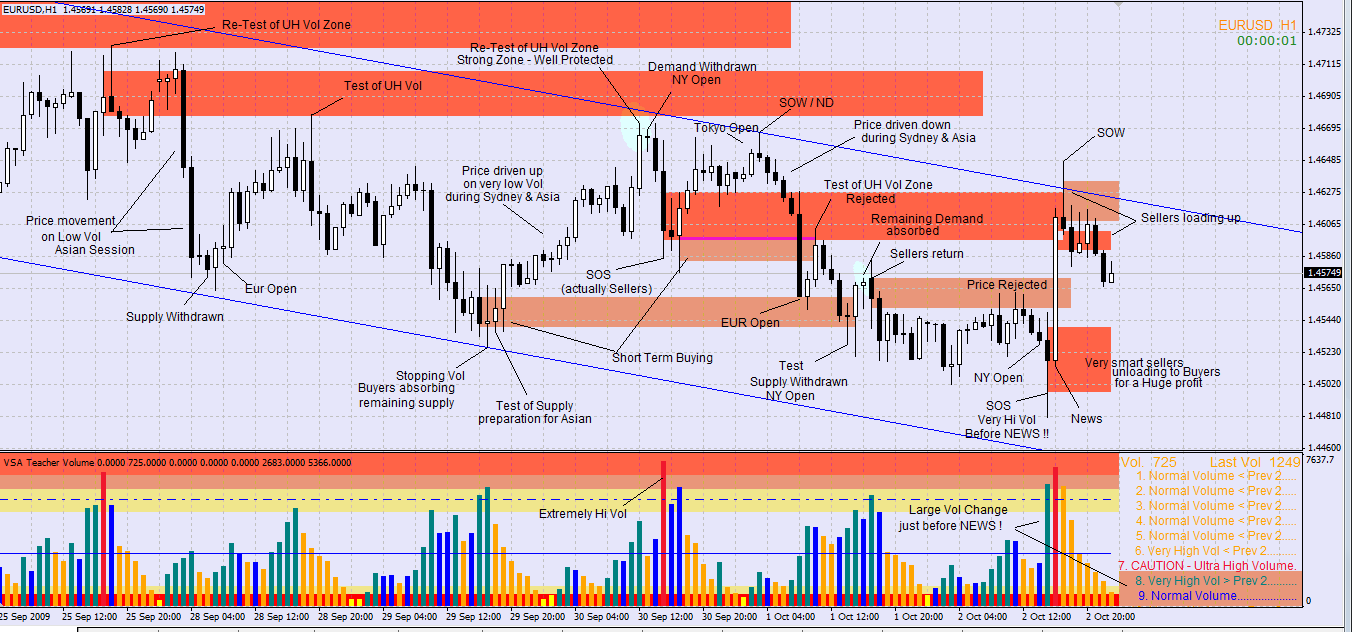

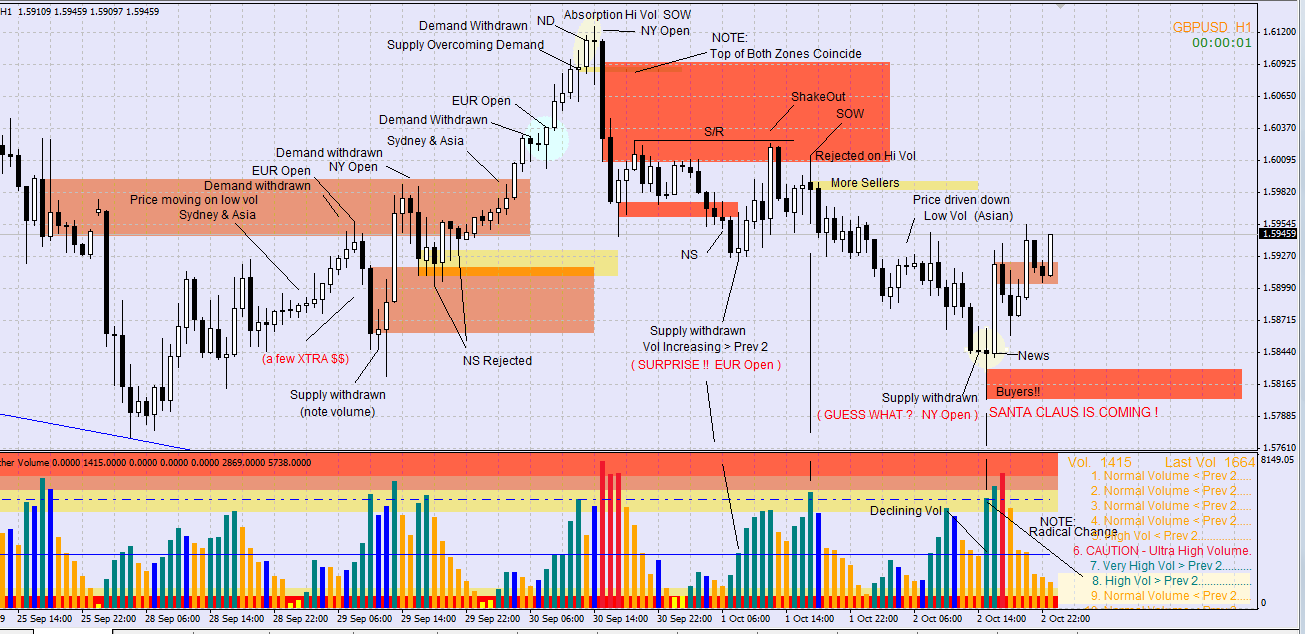

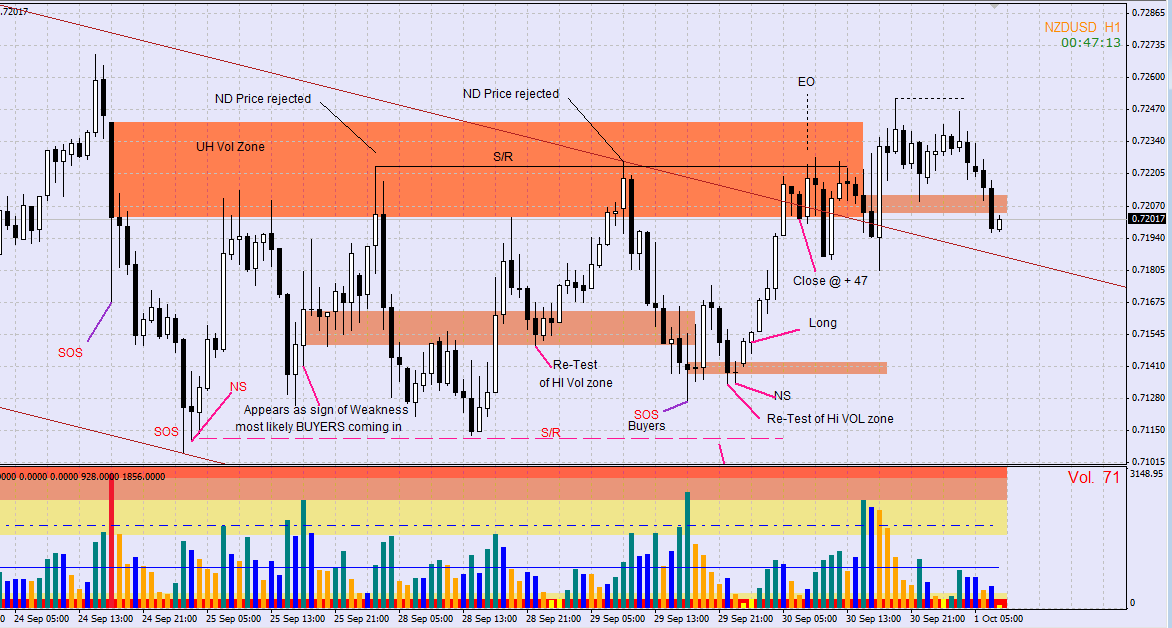

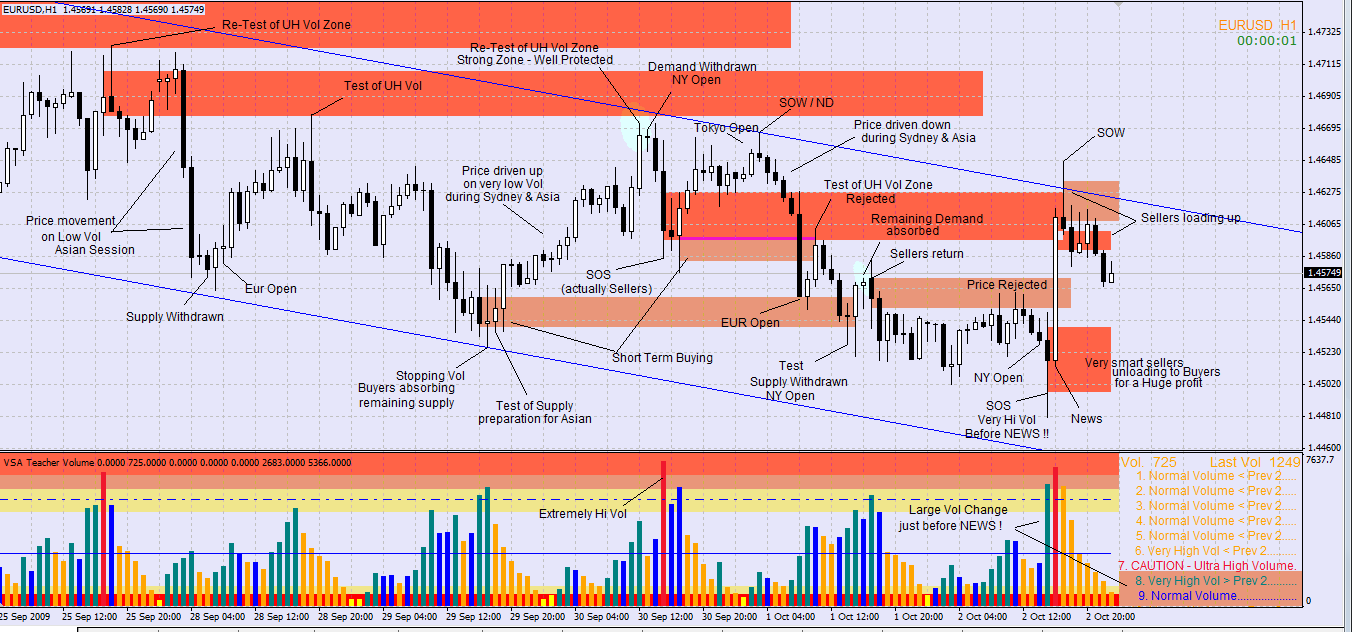

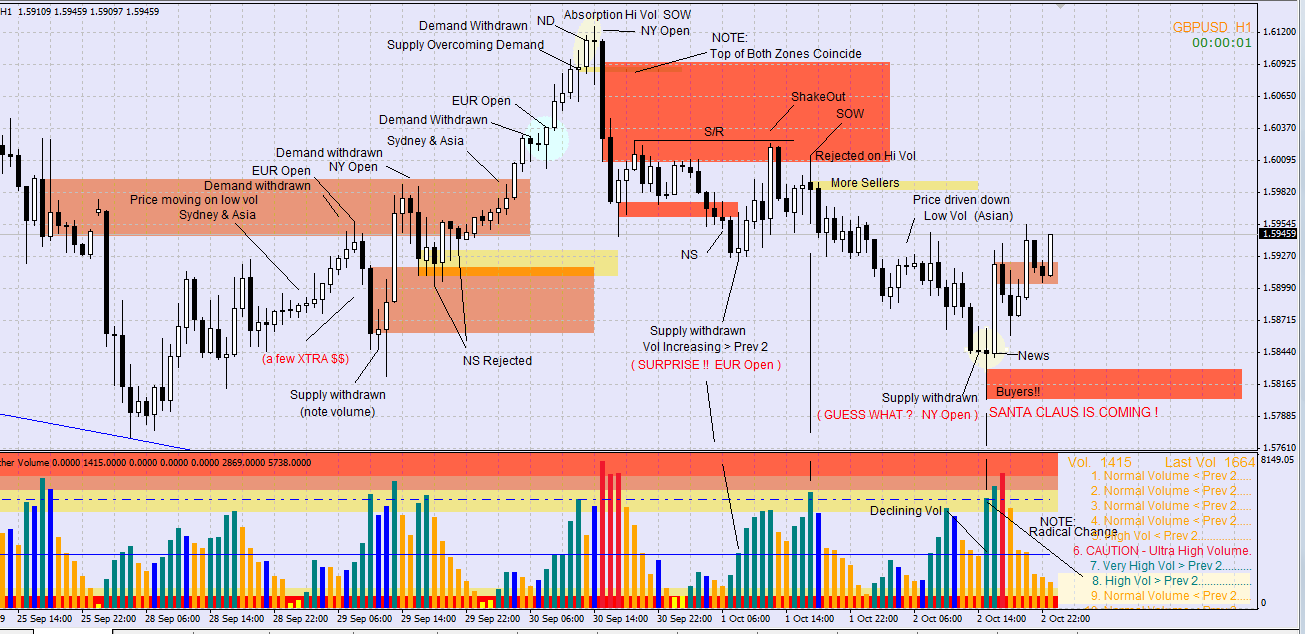

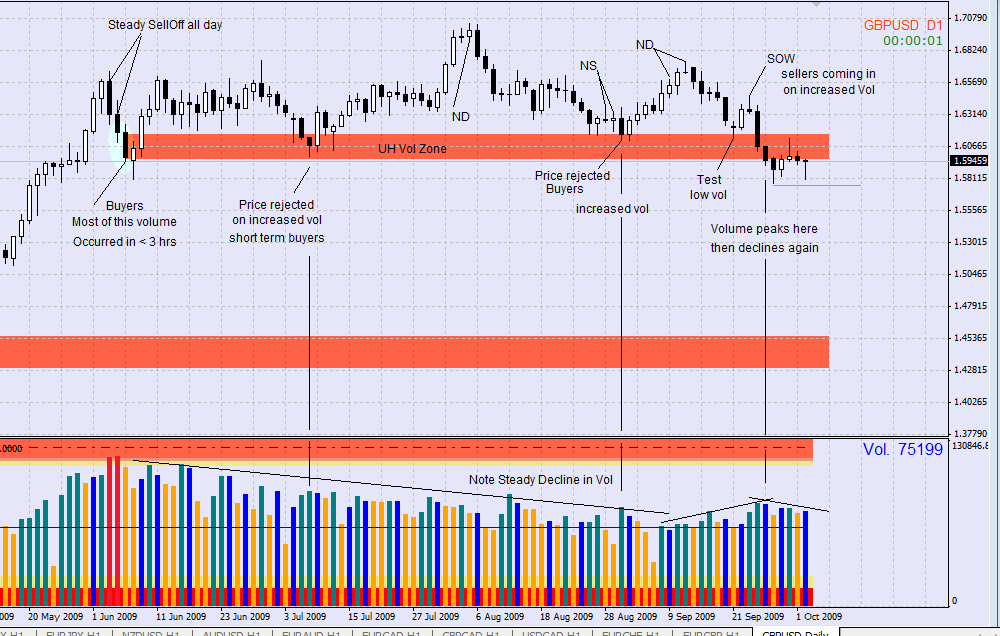

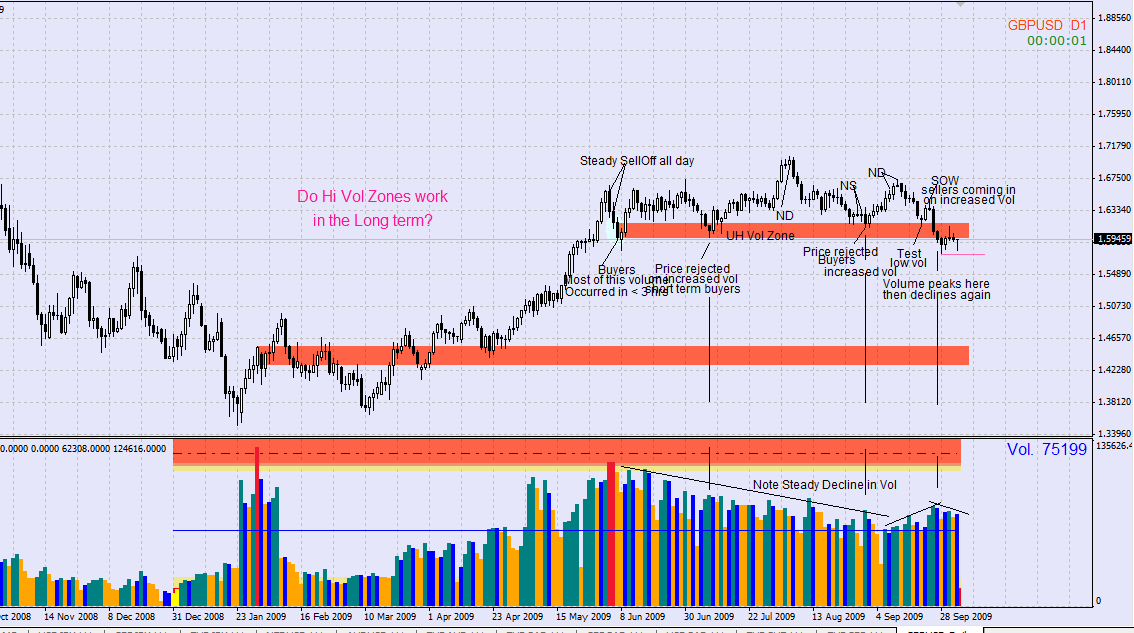

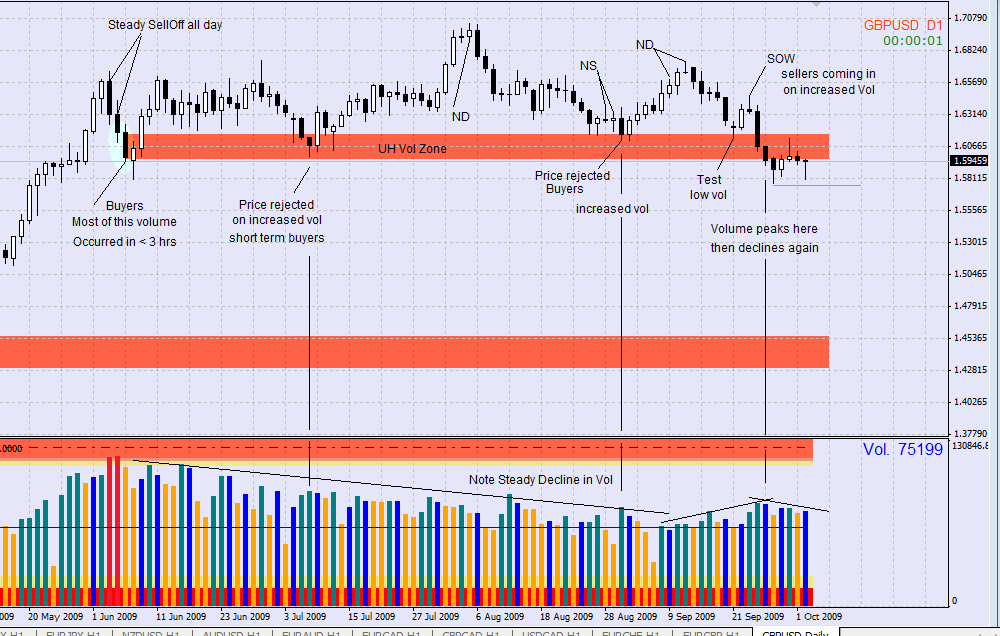

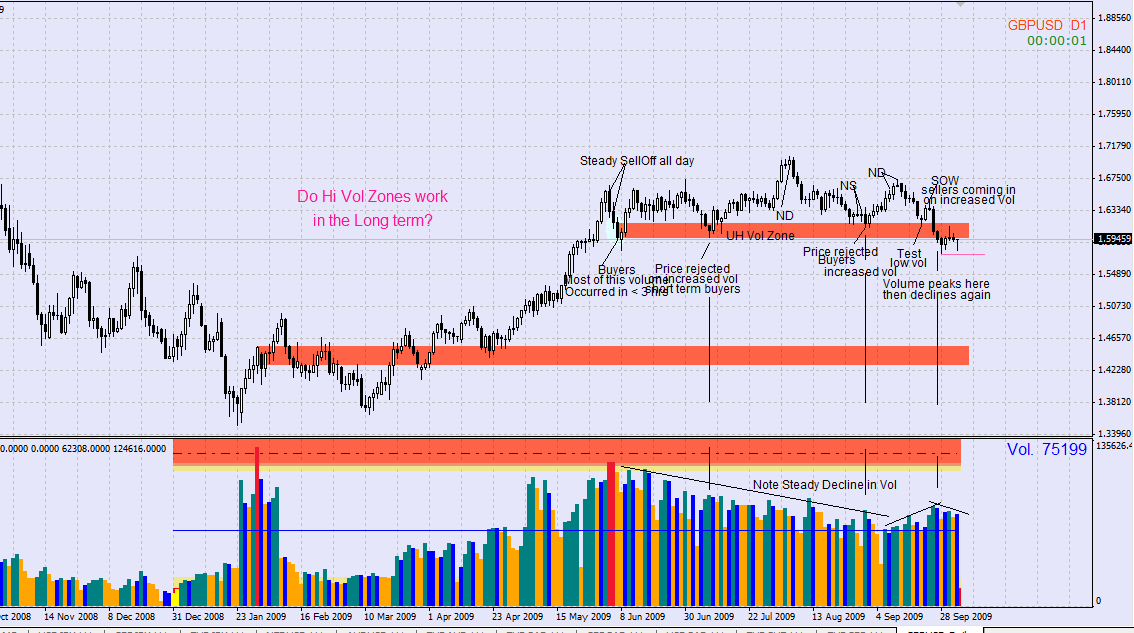

Here are a few pics that a guy (chief1ore) posted on FF in the vsa thread.

Very informative.

I like how in the last pick he says: SANTA CLAUS IS COMING!!!!

LOL

Very informative.

I like how in the last pick he says: SANTA CLAUS IS COMING!!!!

LOL

Last edited by prochargedmopar on Sun Oct 04, 2009 12:15 am, edited 1 time in total.

#1BODY in direction of profit #2INCREASE lot size Obsessively

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- prochargedmopar

- rank: 10000+ posts

- Posts: 12048

- Joined: Sat Dec 20, 2008 6:07 am

- Reputation: 1790

- Location: Granbury, TX

- Gender:

- Contact:

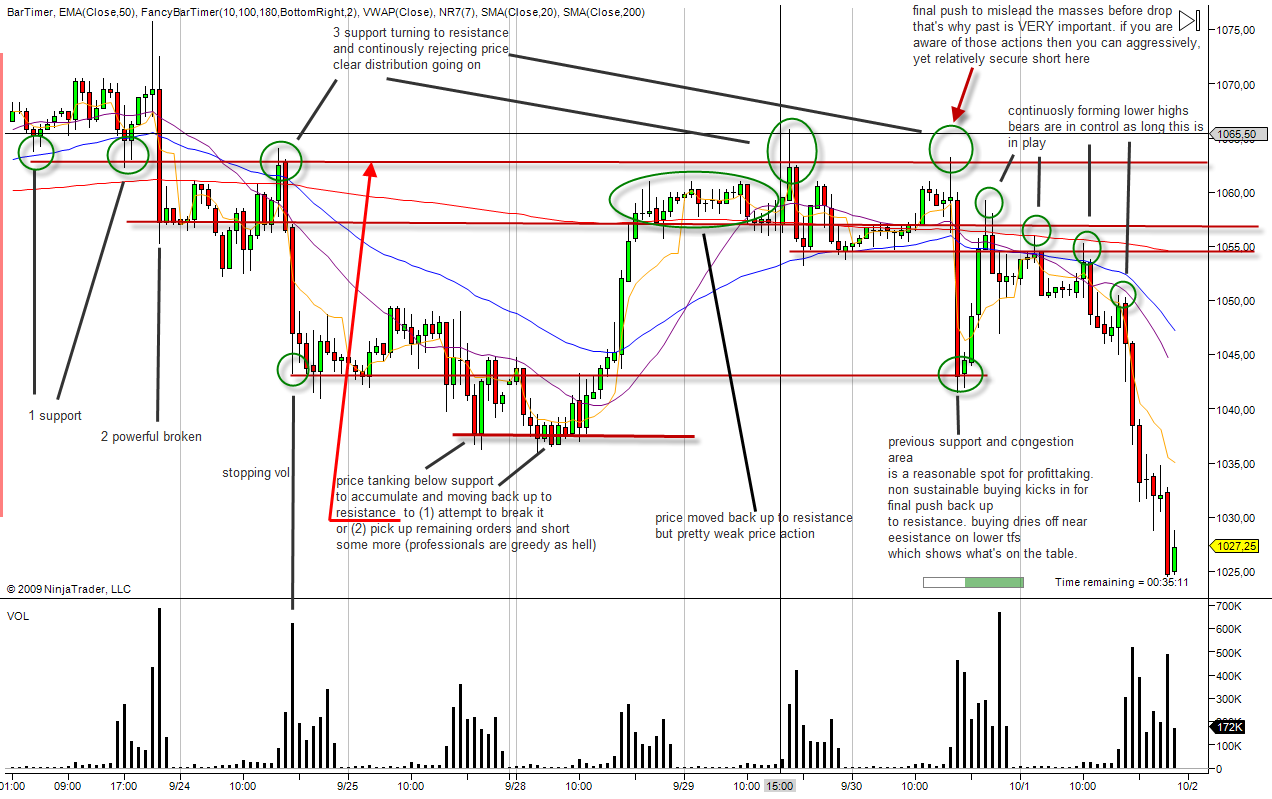

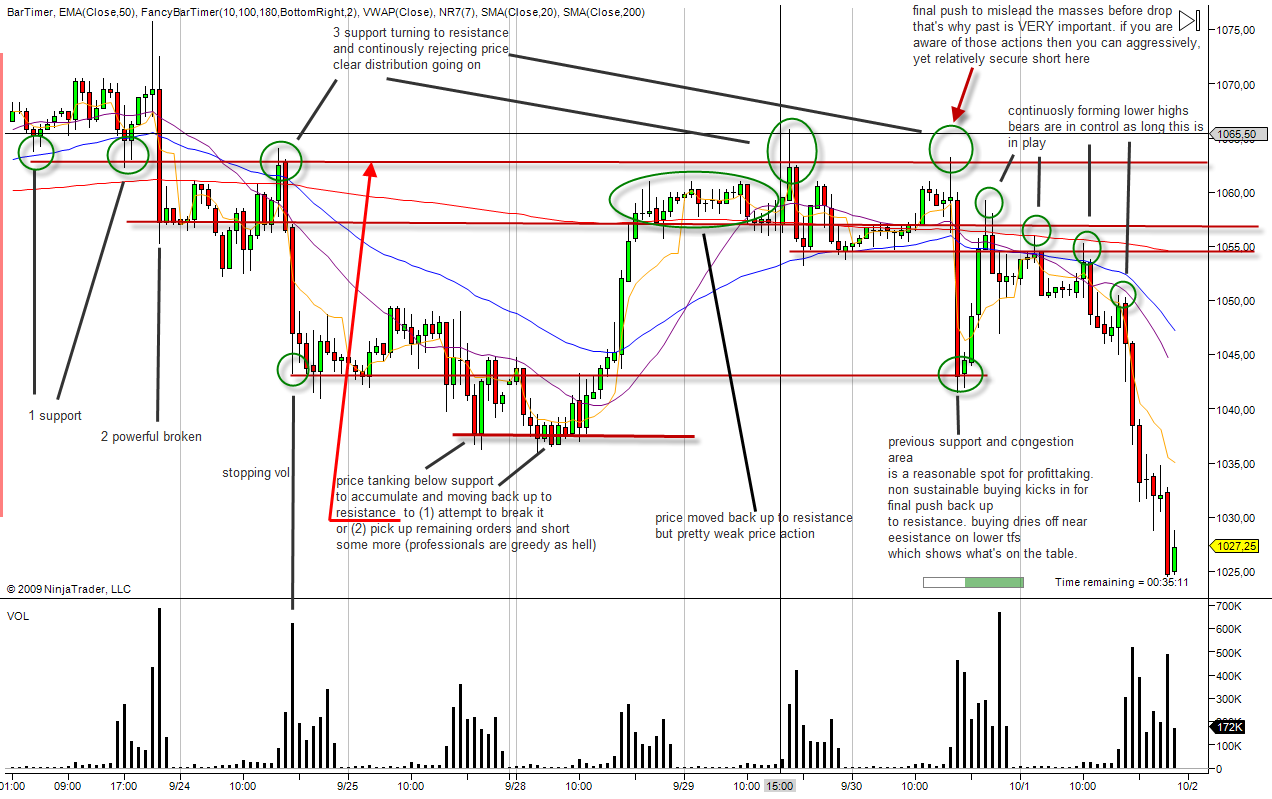

Now you understand why M.O. says MOMO is to be traded at the EXTREMES!!!

#1BODY in direction of profit #2INCREASE lot size Obsessively

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

- prochargedmopar

- rank: 10000+ posts

- Posts: 12048

- Joined: Sat Dec 20, 2008 6:07 am

- Reputation: 1790

- Location: Granbury, TX

- Gender:

- Contact:

Another chart I like posted by DrGeppynius:

See how the momo's work, How some don't, how others hold the "support/resistance" zone for a longer duration??

Ask yourself why!!

A lot of pissers being zeroed out.

He says............."professionals are greedy as hell"

LOL

My car......hehehe

See how the momo's work, How some don't, how others hold the "support/resistance" zone for a longer duration??

Ask yourself why!!

A lot of pissers being zeroed out.

He says............."professionals are greedy as hell"

LOL

My car......hehehe

#1BODY in direction of profit #2INCREASE lot size Obsessively

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

- prochargedmopar

- rank: 10000+ posts

- Posts: 12048

- Joined: Sat Dec 20, 2008 6:07 am

- Reputation: 1790

- Location: Granbury, TX

- Gender:

- Contact:

Most important of all factors.

EDIT: Other than minimizing your losses. LOL

Price over time,

Speed and volatility.

M.O. wrote:

The study of momentum via closed candles lets you know how long it should take price to move your way.

For every hour of momentum you should get two hours of price movement.

When the candle hugging momentum closes into the momentum candle's real body then the momentum is reduced by the close of the hugging candle.

Likewise, when the hugging candle extends further after momentum, the momentum is increased by the close of the hugging candle.

If the momentum is increased by 1 candle then you get 4 hours of price movement.

EDIT: Other than minimizing your losses. LOL

Price over time,

Speed and volatility.

M.O. wrote:

The study of momentum via closed candles lets you know how long it should take price to move your way.

For every hour of momentum you should get two hours of price movement.

When the candle hugging momentum closes into the momentum candle's real body then the momentum is reduced by the close of the hugging candle.

Likewise, when the hugging candle extends further after momentum, the momentum is increased by the close of the hugging candle.

If the momentum is increased by 1 candle then you get 4 hours of price movement.

#1BODY in direction of profit #2INCREASE lot size Obsessively

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

- prochargedmopar

- rank: 10000+ posts

- Posts: 12048

- Joined: Sat Dec 20, 2008 6:07 am

- Reputation: 1790

- Location: Granbury, TX

- Gender:

- Contact:

Just wondering about long Time Frames and volume zones?

Hope this helps

Chief

Hope this helps

Chief

#1BODY in direction of profit #2INCREASE lot size Obsessively

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

My Losses cause me Great Laughter!

Trading Bible here> therumpledone/the-ideas-that-i-trade-by-t3256/page1670

- aliassmith

- rank: 5000+ posts

- Posts: 5057

- Joined: Tue Jul 28, 2009 9:50 pm

- Reputation: 2847

- Gender:

es/pip wrote:you have to get over the fear of losing money on a trade

it is ok to do so it is not the end of the world

i think i had 2(small) losers and 4 b/e today but i made a large amount of pips

but

what you need to realize is whatever you are doing on a small lot size you will do on a large lot size---whether it is good or bad

once you make this work lets say your account is 500k and you are making 10% a day-------- are you going to risk all of that by averaging into a loser and risk everything just so you can get out at b/e and say you didn't have a loser?

i sure as hell hope not

just think about it logically -------- it is just stupid to do that--- so don't do it anymore

you have to treat your small account as u would a large account so when you grow your account you will not do stupid things and have to start over.

from now on if you EVER average down then you punish yourself by not allowing yourself to trade the next day-------------as much as you love trading you will only do it once or twice and then never do it again

make it a rule

and do not trade a system or a method trade discretionary

Maybe just semantics in my mind, but "systems" are mechanical

and "closed loop" in nature.

A "methodology" is more discretionary since it is just a guiding

principle. Possibly still too system(ish).

OK---maybe it is a "Philosophy" of trading that is our guiding light.

" My analysis is post-momentum and current to recent past comparisons ie discretionary. " MightyOne

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.