aliassmith wrote:MightyOne wrote:aliassmith wrote:EUR/USD long

Exited early because of double top areas are normally reversals points

when I try to trade the break out

I do not understand your logic.

If a double top, according to your analysis, is a sign of a possible reversal then why go long at all?

If you do defy that analysis (because you are using another?) and go long then for what reason are you selling out early?

The reason cannot be the double top that you disregarded in the first place.

I have noticed that after the MoMo candle the price would go only to

the extreme of the MoMo candle then reverse. I have been "tricked"

a few times in the recent past with the false breakouts.

I felt there was still ample pips to be had before the reversal.

Bodies show the way...

Momo should unfold in an X-Y-X-Y pattern on some level...

Wicks show the way not (possible reversal) when, after momo, there is a breakout and price fails to close beyond the extreme (hedge).

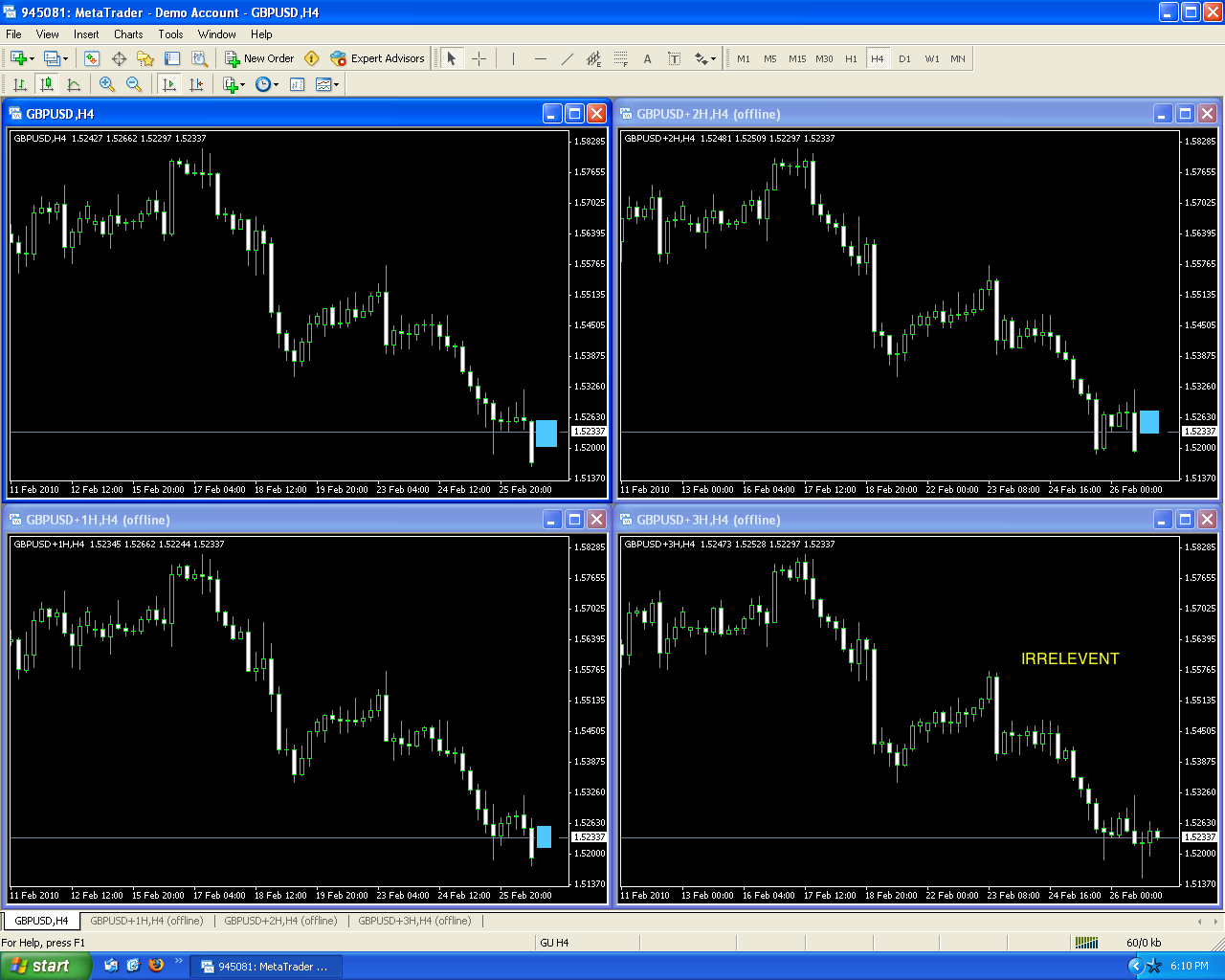

I think that you may be using momo at the most basic level and on small charts (sub 4H charts) where this type of analysis begins to lose value.

If you did not have a trading account would you mentally exit for 19 pips or would you find some technical reason to exit?

How you would trade with paper charts and a pencil is how you should trade live.