pablo101 wrote:adaseb wrote:I would prefer so momo in the direction I want to go. I wouldnt use a doji as a reference candle probably.pablo101 wrote:adaseb wrote:Hey

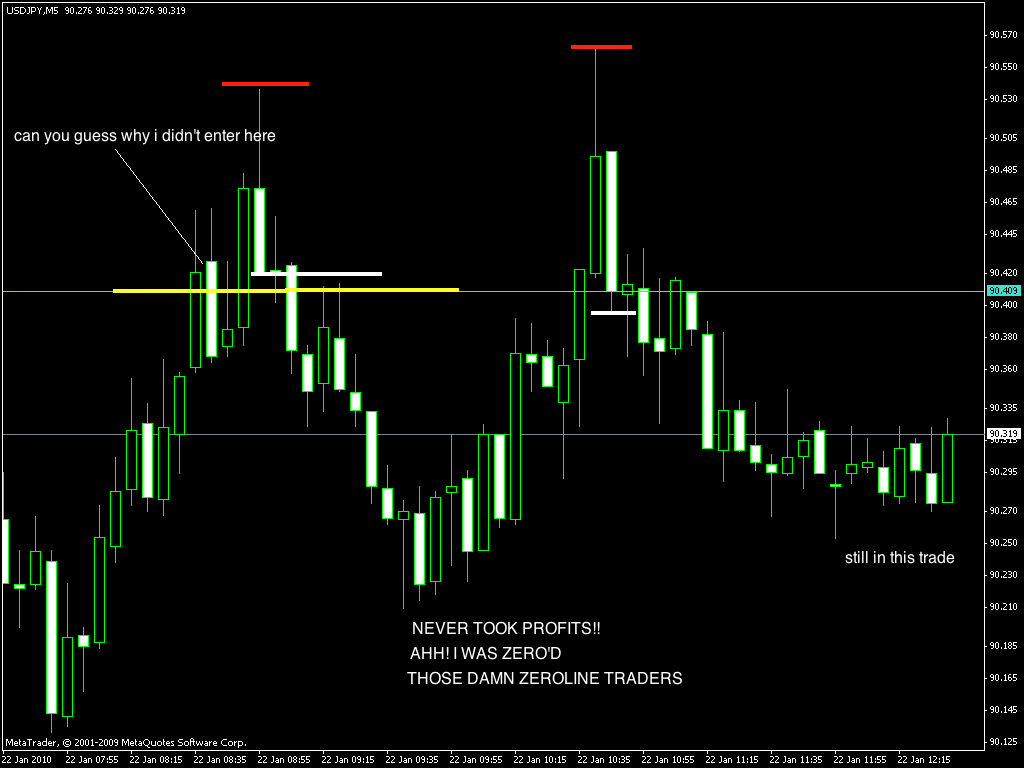

I didn't enter because the next candle didn't go past the previous low.

In the past whenever I would wait for a "wick" in a smaller timeframe based on a "wick" in a larger time frame, I always entered too late.

This way I enter at the white line with half a position and see how it goes. Sometimes it stops me out, like today with GU on the red line.

I've only been trading with this RAT method of entry for a week and seems to be working better... or else I am just having a good week this week.pablo101 wrote:adaseb wrote:

YOU, YES YOU are definitely kicking ass. I'mwith my piddly 45 pips today! Some nice trading

Few questions here:

Why didn't you take that UJ short on those 5 min bull bear bars?

Also it seems you take the first trade going into a MO zone when you see a BB bar regardless of smaller TF momo in the opposite direction, right?

And you are not entering with limit orders too?

Sorry for the questions, just when you think you got it, there seems to more to improve on

So you take the first 5 min BB when price gets into a MO zone, wick or no wick, momo or no momo?

Very aggressive, you've probably have a lot more stop outs than usually but also I guess you still have more opportunities too. 100 pips a day is fantastic, have you tallied you win/loss rate yet from this way?

lukx zline trading log + cfabian p.35 + adaseb p.48

Moderator: moderators

Only been trading like this for a week or so. I will see how it works in the future and let you know.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- pablo101

- rank: 500+ posts

- Posts: 973

- Joined: Tue Jun 30, 2009 3:10 pm

- Reputation: 43

- Real name: Pete

- Gender:

[quote="adaseb"]Only been trading like this for a week or so. I will see how it works in the future and let you know.

Keep posting, very interesting trading

Keep posting, very interesting trading

Last edited by pablo101 on Thu Jul 15, 2010 9:13 am, edited 1 time in total.

Yeah for the past couple of months I've just been trading the Zerolines by the old rule

Body in direction of profit

Wick in the direction of loss

I would find a ZL such as on the H1 then go to the M15/M5 and try to get wicked in. However for me it was not very common to get wicked in nicely on a lower time frame where a M5 candle never closed against me; which is normally where I would try to get out.

Many times when I tried getting "wicked" price already moved 10-20 pips away from the area and entering later increases risk. And many times it would close against me on the M5 and I either get stopped out anyways for -20 pips while waiting to get out at BE or I would get out at BE and it would finally go my direction.

What gave me this idea was Dragon33 with his charts and his comment "A ZEROLINE IS NOT A PLACE TO ENTER BUT A CONFIRMATION OF DIRECTION".

Now I have no idea how next week will be. This RAT method might not work at all. Who knows. This week was one crazy week in the market so maybe getting those multiple 50+ pip trades was just sheer luck.

Body in direction of profit

Wick in the direction of loss

I would find a ZL such as on the H1 then go to the M15/M5 and try to get wicked in. However for me it was not very common to get wicked in nicely on a lower time frame where a M5 candle never closed against me; which is normally where I would try to get out.

Many times when I tried getting "wicked" price already moved 10-20 pips away from the area and entering later increases risk. And many times it would close against me on the M5 and I either get stopped out anyways for -20 pips while waiting to get out at BE or I would get out at BE and it would finally go my direction.

What gave me this idea was Dragon33 with his charts and his comment "A ZEROLINE IS NOT A PLACE TO ENTER BUT A CONFIRMATION OF DIRECTION".

Now I have no idea how next week will be. This RAT method might not work at all. Who knows. This week was one crazy week in the market so maybe getting those multiple 50+ pip trades was just sheer luck.

pablo101 wrote:adaseb wrote:Only been trading like this for a week or so. I will see how it works in the future and let you know.pablo101 wrote:adaseb wrote:I would prefer so momo in the direction I want to go. I wouldnt use a doji as a reference candle probably.pablo101 wrote:adaseb wrote:Hey

I didn't enter because the next candle didn't go past the previous low.

In the past whenever I would wait for a "wick" in a smaller timeframe based on a "wick" in a larger time frame, I always entered too late.

This way I enter at the white line with half a position and see how it goes. Sometimes it stops me out, like today with GU on the red line.

I've only been trading with this RAT method of entry for a week and seems to be working better... or else I am just having a good week this week.pablo101 wrote:adaseb wrote:

YOU, YES YOU are definitely kicking ass. I'mwith my piddly 45 pips today! Some nice trading

Few questions here:

Why didn't you take that UJ short on those 5 min bull bear bars?

Also it seems you take the first trade going into a MO zone when you see a BB bar regardless of smaller TF momo in the opposite direction, right?

And you are not entering with limit orders too?

Sorry for the questions, just when you think you got it, there seems to more to improve on

So you take the first 5 min BB when price gets into a MO zone, wick or no wick, momo or no momo?

Very aggressive, you've probably have a lot more stop outs than usually but also I guess you still have more opportunities too. 100 pips a day is fantastic, have you tallied you win/loss rate yet from this way?

Thanks adaseb, maybe you have something here. The implications are huge, you just look for a BB close to or within the z zone ... not too much thinking involvedhow easy is that!

I was looking at the original dragon notes on page 50ish, if we do what you're doing then there would be 2 stop outs before a big move up, the move covers the losses but does it happen all the time and what if price isn't ready for the move up yet, you'll be stopped out forever if you see what I mean. Anyway I know moves can move fast out of the zone the first time roundKeep posting, very interesting trading

- roger_over

- rank: 50+ posts

- Posts: 85

- Joined: Sun Oct 11, 2009 7:28 am

- Reputation: 0

- Gender:

Quote by Dragon33 "Just build up your trade. The sema isn't always at the right place when it appears. Therefore you draw the zerolines," if they match with the numbers start trading away from it. You always need to wait for a closed candle!!

Hi Dragon (or anyone else who may know) when you get the chance could you please elaborate a bit about drawing ZL and numbers matching , This confuses me , Thank you for taking the time.

Hi Dragon (or anyone else who may know) when you get the chance could you please elaborate a bit about drawing ZL and numbers matching , This confuses me , Thank you for taking the time.

Genius is more often found in a cracked pot than in a whole one.

E. B. White

E. B. White

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

Pema wrote:Hey guys,

Missed the run down because of work. But this one I could manage

Peter

Nice trading Pema it is just like we talked on the phone you take the trade or you chicken out. If your in you either win or lose!

Trading is like cycling, first you need to learn how.

Two options: you either lose or win!

Two options: you either lose or win!

adaseb wrote:Every single trader here got stopped out of that one. Except maybe Dragon33.

I guess it was a trick before the real move. It happens. I think I got like -23 on my first attempt at that.cfabian wrote:Here's the one from last night... Please give comments, I really need your inputs as this particular $#!"#$ trade put my morale on the floor.

I can not tell if i could win or lose it. Didn't see the higher frame but it is still trading and yes i do lose like you guys. Maybe a little less but i'm not trading that intensive like you guys just because i have a much bigger account that's it.

The more you trade the more loser you have to take sooner or later.

The market isn't giving winners all the time.

Trading is like cycling, first you need to learn how.

Two options: you either lose or win!

Two options: you either lose or win!

vane wrote:PTG wrote:vane wrote:when you say bullish-> bearish, is this some kind of pattern, I would like to know more about that, looks interesting.

That's a bearish key reversal bar: higher high, lower close than the previous bar.

A bullish key reversal is a lower low, lower close than the previous bar.

I believe Zapzinig has made a bunch of comments on it in the NLA thread.

FX-Jedi was the teacher of the technique, i did not know that he changed the name..Thanks a lot PTG for the clarification

Key reversal= BB

I make a clarification

Key Reversal is not the same as BB.

Key Reversal is this:

bearish key reversal bar: higher high, lower close than the previous bar.

A bullish key reversal is a lower low, lower close than the previous bar.

and BB is this: is Bullish to Bearish change or Bullish to Bearish in the range of 20 pips before reaching the LOW / HIGH of the Day ( to learn more read Drain the banks-Like a rat)

Drain the banks-Like a rat RULES

TheRumpledOne wrote:

A) Price makes new low for the day or is within 20 pips of low of the day

B) Previous candle is green ( 5 min, 15 min or 60 min )

C) Enter at previous candle high

Look at the chart:

See those 2 red candles near the bottom...

See the next candle was green...

See then next candle break the previous green candle's high - that was your entry...

See the profit!!!

look the picture at the bottom a range of 20 pips from 1.4049 to 1.4028 That is the pattern BB, is the name given from MO and it works very well with the Z lines as dragon say.

in short a BB pattern is this:

A) Price makes new low for the day or is within 20 pips of low of the day

B) Previous candle is green ( 5 min, 15 min or 60 min )

C) Enter at previous candle high

(image: From MO)

BYE

Vannessa

Last edited by vane on Sun Jan 24, 2010 2:13 am, edited 1 time in total.

You see those 2 candles as increasing momentum? I saw them as pivots were up move was failing on 2 consecutive candles, so I was waiting to go short with H1 short move... I did but lasted 4 pips, and then stopped me.

PTG wrote:cfabian wrote:Thanks PTG for your explanation, I have watched some of Seiden's videos. It is hard to grasp everything and remember it during the battle.

I should've waited for a confirmation candle in my direction. Darn!!!!

Thanks for posting your trade and your question.

In hindsight everything is easy. I actually could have invented that saying

Apart from the supply zone thing, the H1 overlay with those two dreaded candles inside indicated increase of momentum where you'd like to see the opposite I suppose.

In general one should have rules for as many situations as possible so that you know what to do when a certain event occurs. All the blanks have to be filled in upfront. That makes the difference between getting in the train and take a ride or getting in front of the train and get squashed

I have started to use the S/D stuff for swing trading. The advantage is that you can set and forget. Find high probability-low risk entries and plan them upfront. Still working on the intraday though. I have issues being consistent because I haven't completely worked out all the rules yet. Having said that, it is important to let the market tell you the direction it is going so that you know if you have a valid trade. That's where a confirmation candle comes in handy. You would have to define exactly what that means, e.g. a candle that closes beyond the body of the last candle in the previous direction, or beyond 2/3 of the body, or so.

It all comes down to having a plan with an edge and then sticking to it.

I'd like to see Dragon's comment on your question.

WILL GET MY MONEY BACK FROM THOSE BASTARDS, AND I MEAN IT !!!!!

"WAIT FOR PRICE, WAIT FOR PRICE, WAIT FOR PRICE"

"WAIT FOR PRICE, WAIT FOR PRICE, WAIT FOR PRICE"

cfabian wrote:You see those 2 candles as increasing momentum? I saw them as pivots were up move was failing on 2 consecutive candles, so I was waiting to go short with H1 short move... I did but lasted 4 pips, and then stopped me.PTG wrote:cfabian wrote:Thanks PTG for your explanation, I have watched some of Seiden's videos. It is hard to grasp everything and remember it during the battle.

I should've waited for a confirmation candle in my direction. Darn!!!!

Thanks for posting your trade and your question.

In hindsight everything is easy. I actually could have invented that saying

Apart from the supply zone thing, the H1 overlay with those two dreaded candles inside indicated increase of momentum where you'd like to see the opposite I suppose.

In general one should have rules for as many situations as possible so that you know what to do when a certain event occurs. All the blanks have to be filled in upfront. That makes the difference between getting in the train and take a ride or getting in front of the train and get squashed

I have started to use the S/D stuff for swing trading. The advantage is that you can set and forget. Find high probability-low risk entries and plan them upfront. Still working on the intraday though. I have issues being consistent because I haven't completely worked out all the rules yet. Having said that, it is important to let the market tell you the direction it is going so that you know if you have a valid trade. That's where a confirmation candle comes in handy. You would have to define exactly what that means, e.g. a candle that closes beyond the body of the last candle in the previous direction, or beyond 2/3 of the body, or so.

It all comes down to having a plan with an edge and then sticking to it.

I'd like to see Dragon's comment on your question.

Yeah I know what you're saying. But then what was the difference with an hour earlier, when you had almost exactly the same situation with two M15 candles down after an upcandle ?

What I was referring to, is the fact that the H1 overlay in which those two candles are, is more than twice the size of the previous H1 overlay. To me that doesn't sound like it improves the odds because long momentum increased.

In order to go short on a breakdown like this without having the market prove to you that it does indeed intend to go south sounds risky to me. In other words, why not let price go south and short the mofo on a pullback. I think you take away some risk of catching the falling knife because that is your confirmation. Then all you would need to do is to define what exactly a breakout/breakdown and consecutive pullback is that allows you to take the trade (maybe also on a smaller TF).

There's no business like [strike]show[/strike] covid19 business.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.