So I have been going thru and doing a lot of reading from the beginning and really been clarifying some ideas that for whatever reason, I didn't understand well before. So I plan to continue that and just start like I'm new here. I know it will help me in the long run. That being said it was a poor week (weak

). I tried to mix in a few classic ZL trades that everyone here makes look so easy and one continuation of my long term Ins Ind type trading. Here is what I did.

- eurjpypro-h1-tradeking-forex-llc.png (17.17 KiB) Viewed 3380 times

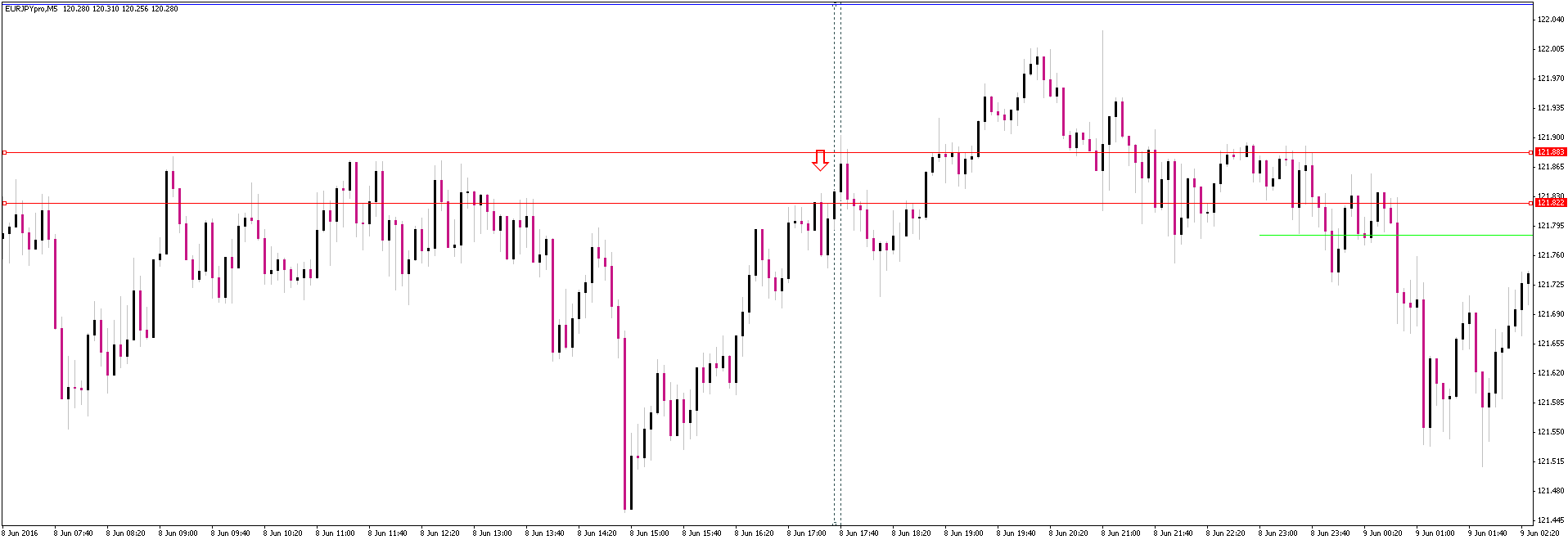

This was my setup for the first trade. It was a nice BDP, and I thought they would come back and zero everyone out. It was below the line I marked as significant. Lets get short. On the dotted line Candle.

- ej5.png (15.82 KiB) Viewed 3380 times

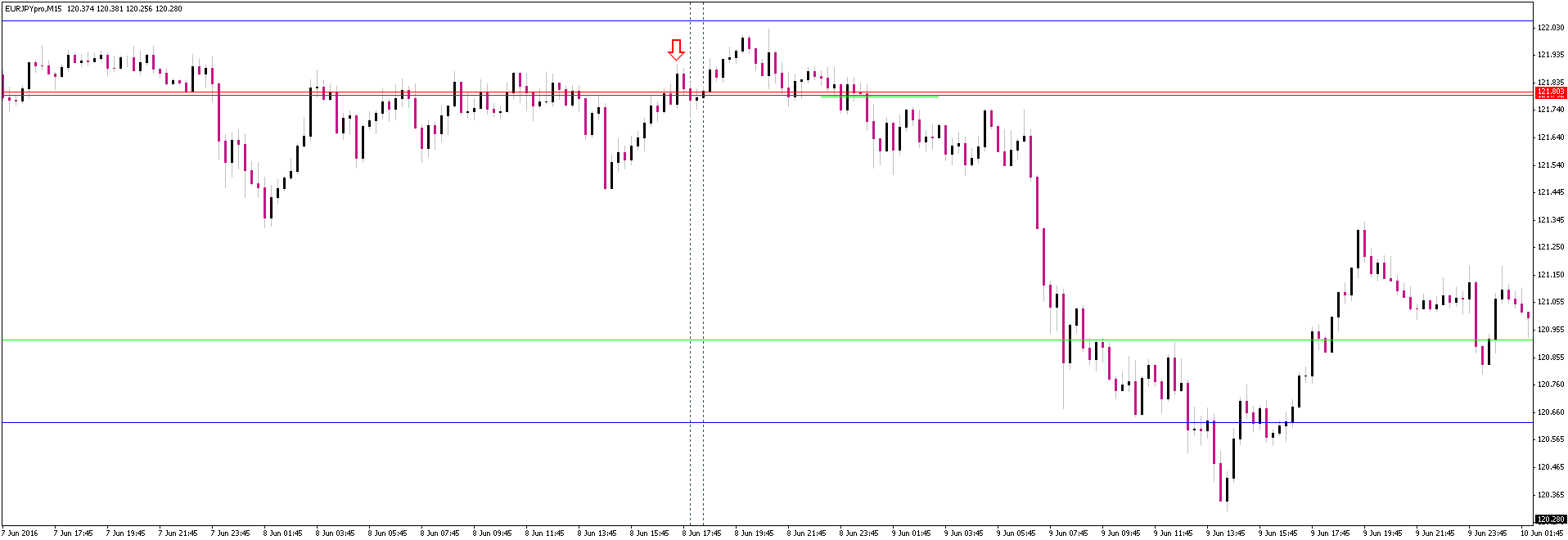

This was what made me get short. Nice 5 min candle, closed lower than something, There was held profit there. Closed above ZL immediately, very small loss.

- ej15.png (15.67 KiB) Viewed 3380 times

I then jump in and said if its not going lower its going higher

nice little BDP, but I chickened out because the above 1hr BDP and what I thought was Wick Doll was still intact and hadn't closed higher, so I said I should get out. At this time I also started to realize Tradeking isn't MB trading and their spreads on limit orders are ATROCIOUS, double+ on EJ, so that makes it tough on a scalper. More on this later.

- ej52.png (15.51 KiB) Viewed 3380 times

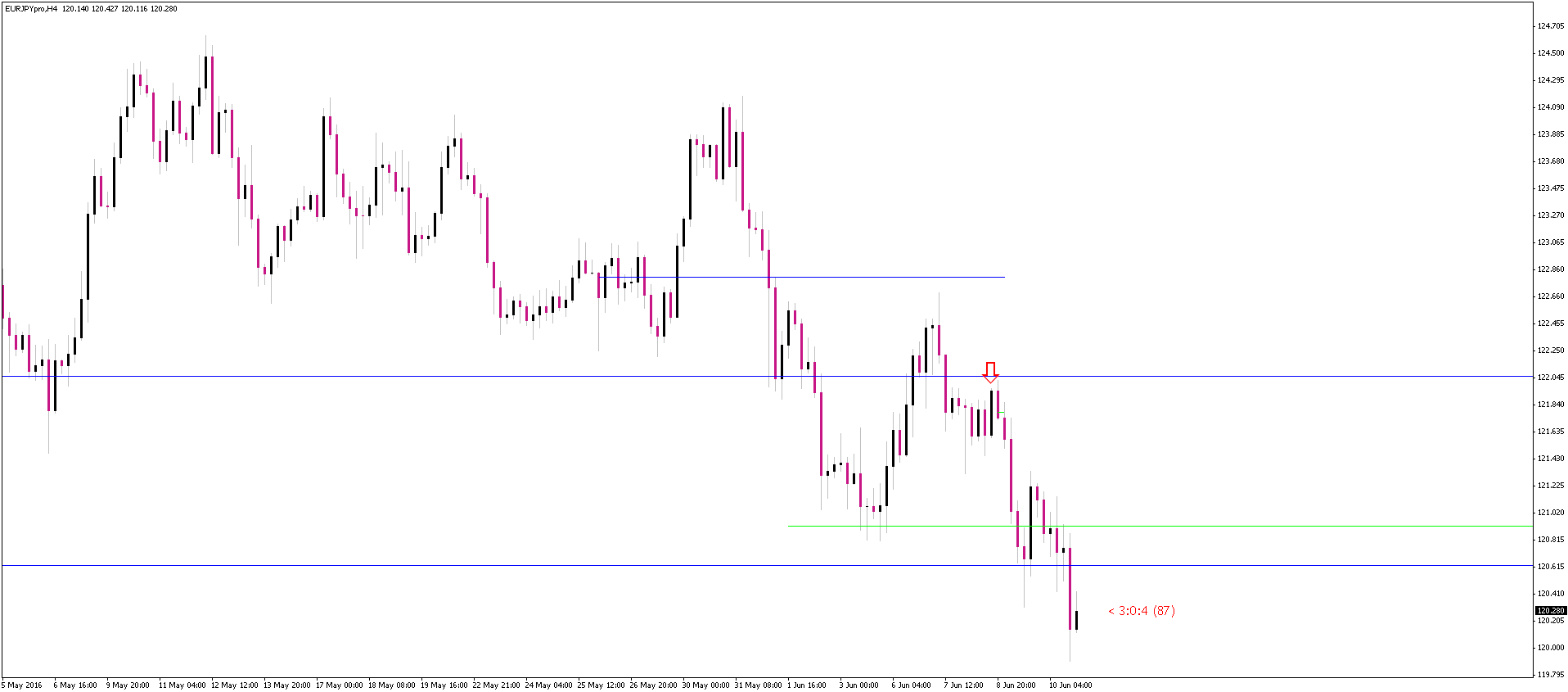

Again, I entered this because the higher (1hr/4hr) hadn't closed against me and I thought I should be short, its dumb to be long and trading against the higher TF, Got a BDP/held profit and thought we'd wick that and move lower (green line), I was wrong it went higher and my exit was terrible. But still only 12 pips+ the atrocious spread.

- ej4.png (16.38 KiB) Viewed 3380 times

So at this point the 4hr had closed higher (and obviously the 1hr had closed beyond my original BDP) So I shifted my bias long.

- ej152.png (16.68 KiB) Viewed 3380 times

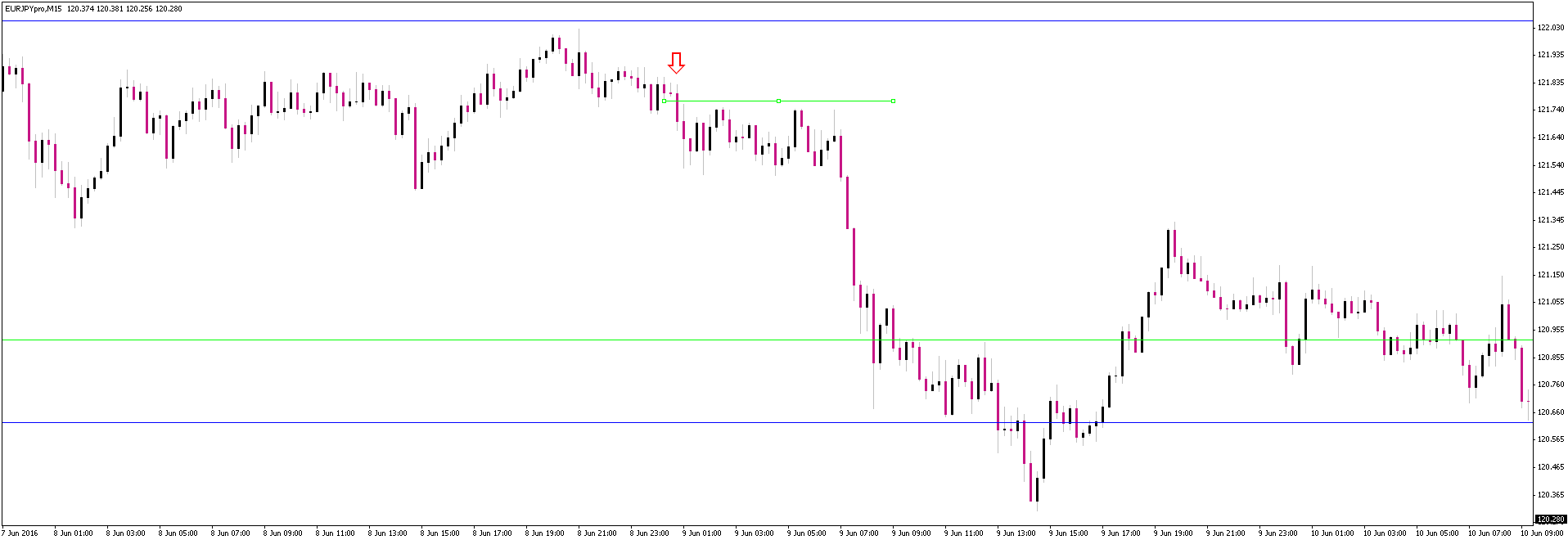

Again, saw what I thought was held profit and had a higher TF close in my direction. Got long. Was wrong. The exit was much better and tighter though. Almost no loss. (except for this MFing spread)

- no trade.png (13.99 KiB) Viewed 3380 times

Last one I promise

I thought I just throw this out there. The 4hr had closed back in and I saw this setup and put a limit order (aka a screw job order) on the Green ZL. Never got filled and price raced away.

Dont you hate when that happens.

So that is the end of this sequence, pretty ugly. At this point I was fuming at Tradeking and the Dodd-Frank act for putting US retail forex customers in such a big brother screw job. We are literally on the can't do business list for most of these brokers with North Korea and Iran? Are you kidding me. So I will close with this thread I found for all my 'merican friends. There are brokers out there who have been vetted and who will stand up to the big bad wolf and give you a decent fill.

http://forums.babypips.com/forex-brokers/36221-going-offshore-escape-cftc.html

? Its not the opens and closes. Edit...Midpoints? Just bias your direction to trade in based on where the candle closes vs previous? Kind of like the original 1/3rd dots idea. Anything for a bias to trade the smaller chart in

? Its not the opens and closes. Edit...Midpoints? Just bias your direction to trade in based on where the candle closes vs previous? Kind of like the original 1/3rd dots idea. Anything for a bias to trade the smaller chart in Dont you hate when that happens.

Dont you hate when that happens.