Leoheart wrote:LeMercenaire wrote:brettnchrism wrote:Ok I am not aware of the 123 entry method or rules. I guess price at a new high or low makes new high or low but closes opposite color that would be a 123 set up. I there rules for that? What indi showing on holo thread paints the supply zone, not sure how that is formed there? thanks

I posted up an explanation / roundup over on Achoo's Daily Forex Trading thread.

The main rules are:

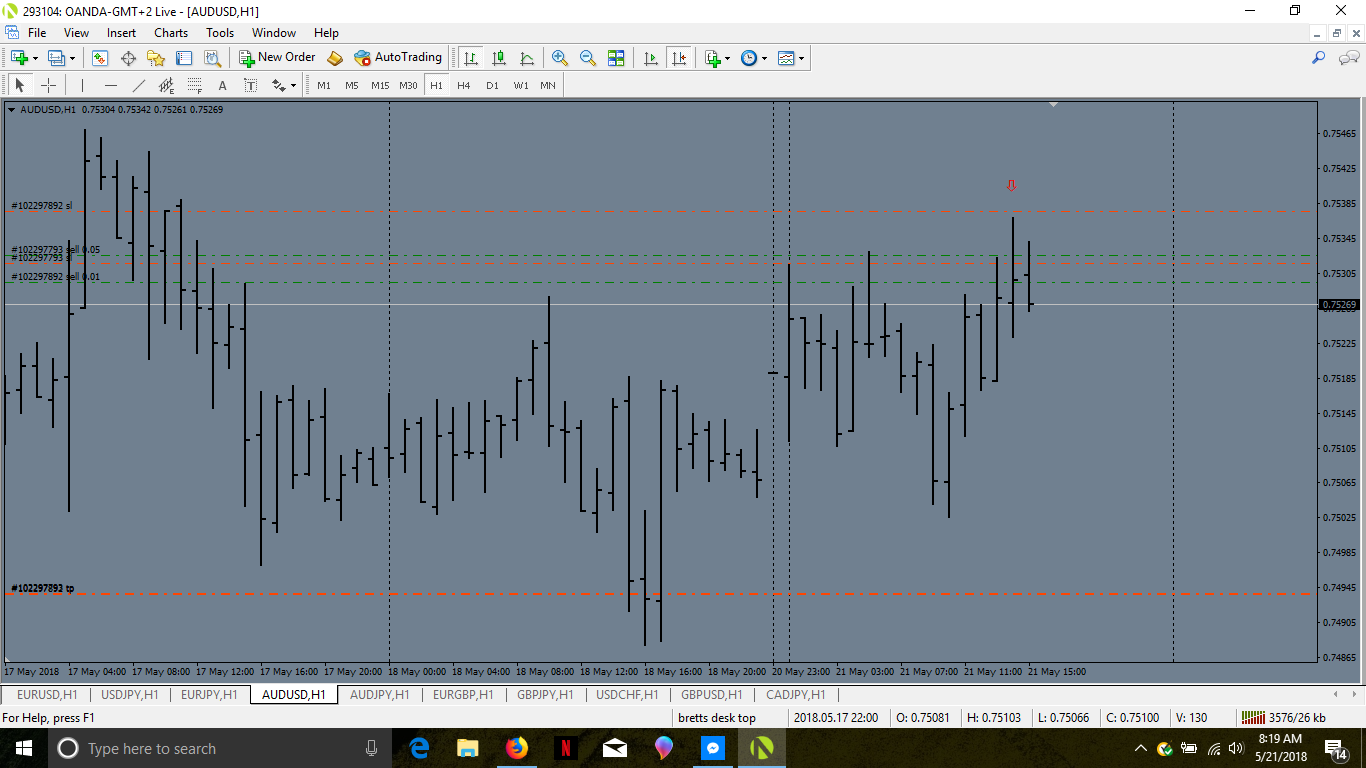

1: Did the H1 bar (#1) make a new High on the day?

If yes, then...

2: Did the following H1 bar (#2) try and fail to make a new High?

If yes, then...

3: Enter SHORT as price crosses back down across the Open Level of Bar #2. (Marked with red circle on the chart below).

Opposite for Long entries.

therumpledone/daily-forex-trading-t19647/page430

The S+D indi is a separate entity of mine.

Why not wait for bar #2 to close and then smash its open with bar3? Considering bar#2 is not a shack out bar. (You know how open bars are, turn on you like pair of cunning Siamese cats aka women).

Yep, that's another method that I call a ''Plopper'' (for reasons I won't get into here, lol). It is basically a ''late-1-2-3''.

I found that these work across m30, H1 and H4 time-frames and when you add an ema 60 (I think it was a 60...may have been a 20, I'd need to go check) and you traded the patterns that had the ''point'' aiming at the line, so away from the sma, they were particularly strong signals.

There was a thread started over in The Other Place that looked at this but it died out as the three of us each liked one particular variant over the others. This was no bad thing - they all worked - but the thread starter ended up moving onto something else on longer time-frames.

This 1-2-3 is fine so long as you use it in combination with a lock-in tp technique, bagging say 90 - 95% at +5 and letting the rest run. As I've mentioned, I also use counter trades if it turns before I am happy to close out.