Breakouts.

Moderator: moderators

- LeMercenaire

- rank: 1000+ posts

- Posts: 3184

- Joined: Tue Sep 27, 2016 12:11 am

- Reputation: 2303

- Gender:

Re: Breakouts.

One other thing I'd maybe mention, is that I have been investigating the effectiveness of TRO's Mid-Dots on the Daily. Might be something you could also look at?

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- LeMercenaire

- rank: 1000+ posts

- Posts: 3184

- Joined: Tue Sep 27, 2016 12:11 am

- Reputation: 2303

- Gender:

Re: Breakouts.

Both UC and EJ look like they would have bagged you something today? Hope so.

Re: Breakouts.

LeMercenaire wrote:Both UC and EJ look like they would have bagged you something today? Hope so.

thanks for your kind words and advice. i stopped trading for the day after those losses i wouldn't want to lose too much too fast. today's a new day though!

i suppose i can use mid dots but i'm not entirely sure how they would help me? trading crossovers of the mid point instead of breakouts? or using the mid pt as a SL? also, by counter-trading do you mean trading reversals from highs/lows, or hedging? i'm living in us, i can't hedge if that's the case. sadly, i don't have access to a frequency distribution indicator either, and i'm not even entirely sure how to use it if i did have access to one.

on a different note, here's something else i've been toying with. breakouts from swing highs/lows.

i'm sure this is nothing new but, my idea is that i should wait for a swing to appear, then wait for a breakout of the swing. after the breakout bar closes, on the next bar if it retraces and hit the breakout bars midpoint, i "trade" in the direction of the breakout bar. just something i'm toying with when i'm not trying to trade daily breakouts. there's a "trade" going on rn i've been watching, and some examples of trades that couldve taken place this week:

the X is where there was a setup, but my trigger wasn't hit, i'm using some ict fibo settings from a video i've seen a while ago. (0,0.5,1,-.62,-.27,-1)

i'll be updating how my daily breakout trades go later today.. hopefully better than yesterday!

Re: Breakouts.

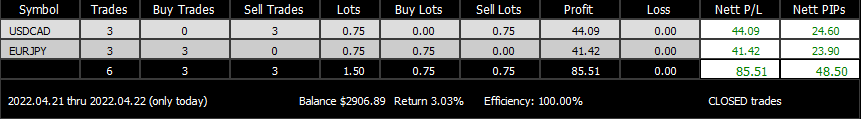

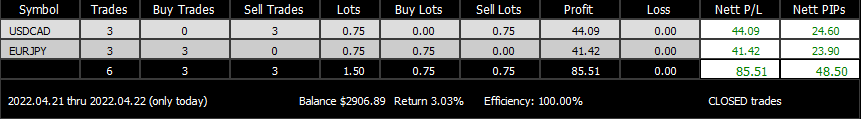

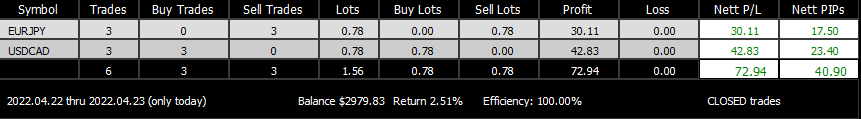

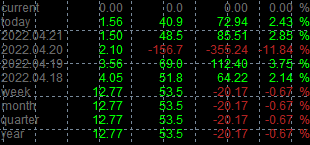

todays trades: both hit my first tp, then hit be+6. good enough for me!

- LeMercenaire

- rank: 1000+ posts

- Posts: 3184

- Joined: Tue Sep 27, 2016 12:11 am

- Reputation: 2303

- Gender:

Re: Breakouts.

pain wrote:LeMercenaire wrote:Both UC and EJ look like they would have bagged you something today? Hope so.

thanks for your kind words and advice. i stopped trading for the day after those losses i wouldn't want to lose too much too fast. today's a new day though!

i suppose i can use mid dots but i'm not entirely sure how they would help me? trading crossovers of the mid point instead of breakouts? or using the mid pt as a SL? also, by counter-trading do you mean trading reversals from highs/lows, or hedging? i'm living in us, i can't hedge if that's the case. sadly, i don't have access to a frequency distribution indicator either, and i'm not even entirely sure how to use it if i did have access to one.

on a different note, here's something else i've been toying with. breakouts from swing highs/lows.

i'm sure this is nothing new but, my idea is that i should wait for a swing to appear, then wait for a breakout of the swing. after the breakout bar closes, on the next bar if it retraces and hit the breakout bars midpoint, i "trade" in the direction of the breakout bar. just something i'm toying with when i'm not trying to trade daily breakouts. there's a "trade" going on rn i've been watching, and some examples of trades that couldve taken place this week:

the X is where there was a setup, but my trigger wasn't hit, i'm using some ict fibo settings from a video i've seen a while ago. (0,0.5,1,-.62,-.27,-1)

i'll be updating how my daily breakout trades go later today.. hopefully better than yesterday!

The Mid-Dots thing is just one of those annoying, nagging things in my mind just now, like I feel there may be something there I can use but I just can't quite put my finger on it.

My counter trading involves hedging, yes, so as you are in the US, as you said...no go - unless you use two brokers. Sorry.

That thingy you are looking at is definitely got the same feeling as I mentioned above - that there may just be something good there. Worthwhile pursuing.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- LeMercenaire

- rank: 1000+ posts

- Posts: 3184

- Joined: Tue Sep 27, 2016 12:11 am

- Reputation: 2303

- Gender:

Re: Breakouts.

One would think that at the most basic function level, Mid-Dots could be used as a bias-finder of some sort. I am sure that was TRO's intention.

- TheRumpledOne

- rank: 10000+ posts

- Posts: 15556

- Joined: Sun May 14, 2006 9:31 pm

- Reputation: 3035

- Location: Oregon

- Real name: Avery T. Horton, Jr.

- Gender:

- Contact:

Re: Breakouts.

LeMercenaire wrote:One would think that at the most basic function level, Mid-Dots could be used as a bias-finder of some sort. I am sure that was TRO's intention.

Mid Dots came from my stock trading days. When I moved to Forex, I traded the previous daily middle crossover. As far as using it as a bias, long above and short below the mid dot. If price opens below the mid dot and fails to cross above, then it is a short. If price opens about the mid dot and fails to cross below, it is a long.

Use the multimeter to see where price is compared to the previous mid point on all time frames.

Basic and simple.

IT'S NOT WHAT YOU TRADE, IT'S HOW YOU TRADE IT!

Please do NOT PM me with trading or coding questions, post them in a thread.

Please do NOT PM me with trading or coding questions, post them in a thread.

Re: Breakouts.

awesome, thanks LeM and TRO!

i'm not sure how to use daily mid dots as a bias for daily breakout trades.. in order for it to break out doesn't it already have to be above/below the previous midpoint?

i'll consider doing some mid point crossover trades as well, but i'm seeing a lot of losses with my tp/sl parameters. not sure if i should commit to doing that yet.

buuuut, good news! i'm almost at my original balance today! both breakout trades for the day both hit tp1, then BE+6.:

days like this make me regret using a BE. couldve hit all 3 targets quite comfortably.. seems to happen a lot more often on usdcad than eurjpy at first glance.

i'm not sure how to use daily mid dots as a bias for daily breakout trades.. in order for it to break out doesn't it already have to be above/below the previous midpoint?

i'll consider doing some mid point crossover trades as well, but i'm seeing a lot of losses with my tp/sl parameters. not sure if i should commit to doing that yet.

buuuut, good news! i'm almost at my original balance today! both breakout trades for the day both hit tp1, then BE+6.:

days like this make me regret using a BE. couldve hit all 3 targets quite comfortably.. seems to happen a lot more often on usdcad than eurjpy at first glance.

- TheRumpledOne

- rank: 10000+ posts

- Posts: 15556

- Joined: Sun May 14, 2006 9:31 pm

- Reputation: 3035

- Location: Oregon

- Real name: Avery T. Horton, Jr.

- Gender:

- Contact:

Re: Breakouts.

pain wrote:....

i'm not sure how to use daily mid dots as a bias for daily breakout trades.. in order for it to break out doesn't it already have to be above/below the previous midpoint? ...

Use the PREVIOUS DAILY MIDPOINT as the bias! Long above, short below.

IT'S NOT WHAT YOU TRADE, IT'S HOW YOU TRADE IT!

Please do NOT PM me with trading or coding questions, post them in a thread.

Please do NOT PM me with trading or coding questions, post them in a thread.

Re: Breakouts.

TheRumpledOne wrote:pain wrote:....

i'm not sure how to use daily mid dots as a bias for daily breakout trades.. in order for it to break out doesn't it already have to be above/below the previous midpoint? ...

Use the PREVIOUS DAILY MIDPOINT as the bias! Long above, short below.

ok, understood.

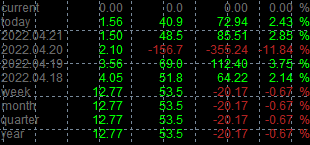

todays breakout trades:

both hit first tp, then be+6. back in the green.

will now start to do some mid dot trades. price above/below daily mid dot= bias, h1 open above/below h1 middot= trigger. will update later, with pictures of trades taken, and the profit/loss. i'll be using different sl, and no tp, and risking .1% max.

10 pip sl, 5 pip scale out+be+1, 10pip be+5, 15pip be+10, after that maybe just a trailing stop.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.