MO, i've been thinking since you dont use a SL for your initial entry

do u consider yourself wrong when (if you're long) a CC closes below something/line of significance under your long entry?

also, since we are building a huge equity position on the weekly chart, would the bear candle on the week of august 8th on eur/usd signal to u an exit, or simply a retracement that needs to be toughed out after which there would be a nice area to stack another entry? or third, exited at the weekly ZL at 1.3303. (transitioning from short term to longer term trader and need some guidance in scope of the trade and planning)

Blind Mouse Strategy

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

-

Pro Trader

- rank: 150+ posts

- Posts: 225

- Joined: Fri Jan 29, 2010 11:13 am

- Reputation: 0

- Gender:

Hi all. I've been looking at this thread now and again but didn't really understand much. Over the weekend I started reading from the start and I think I see whats going on here.

Yesterday I identified what I think are BM setups. They are both off D1+ extremes.

EU

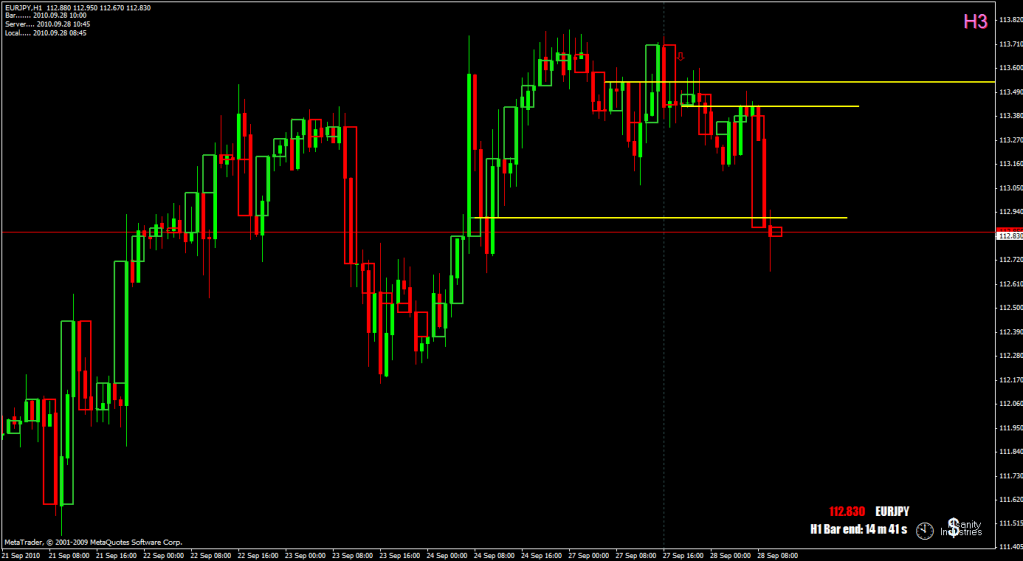

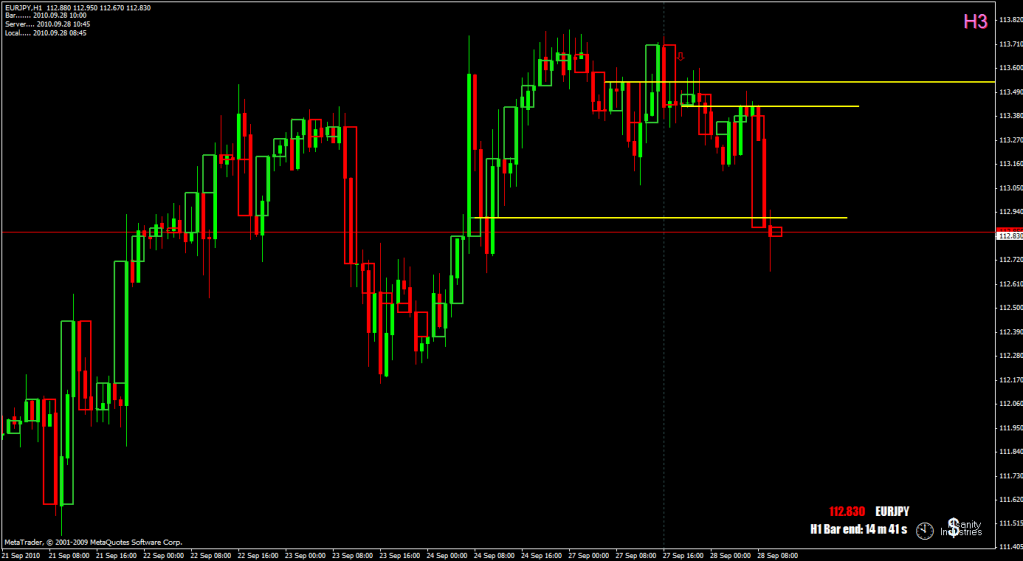

EJ

Today they look like this

EU

EJ

Note I did not take these trades.

Have I identified the right setups here?

Yesterday I identified what I think are BM setups. They are both off D1+ extremes.

EU

EJ

Today they look like this

EU

EJ

Note I did not take these trades.

Have I identified the right setups here?

-

Pro Trader

- rank: 150+ posts

- Posts: 225

- Joined: Fri Jan 29, 2010 11:13 am

- Reputation: 0

- Gender:

Pro Trader wrote:Hi all. I've been looking at this thread now and again but didn't really understand much. Over the weekend I started reading from the start and I think I see whats going on here.

Yesterday I identified what I think are BM setups. They are both off D1+ extremes.

EU

EJ

Today they look like this

EU

EJ

Note I did not take these trades.

Have I identified the right setups here?

If I said yes or no to your question, how would that affect your trade? Now think, how would my opinion affect the market?

Make a line and trade based off of that line. The line isn't biased, but our opinions are. As long as the lines respect the direction you've chose to trade, why would you ever exit

What does that top yellow line tell you?

- newark18

- rank: 500+ posts

- Posts: 562

- Joined: Thu Mar 11, 2010 3:32 am

- Reputation: 21

- Real name: J

- Gender:

MightyOne wrote:erika_bb wrote:i wish i had half of your skills! Mightyone

I think that it is more planning & courage than skill

If you have the time and desire, maybe you can explain more how you move from yearly to hourly charts. I find it to be confusing in that there are a lot of conflicting signals which is why I tend to eyeball LT trend.

I am trying to move away from the eyeball method. And this is what I have come up with. Based on closed over line theory, I was thinking of waiting for a weekly close over a line. Wait again for a D1 retracement and then entry via BM/rat reversal.

Failure is an opportunity to learn.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

i would be interested in this explanation as well. when i move through different time frames i can see some are pointing up. as there are others pointing down. when taking a trade, you can always look for something that makes this trade look stupid on another timeframe. always.  but then i guess this is how the market works? there have to be people on the other side of every trade.

but then i guess this is how the market works? there have to be people on the other side of every trade.

flex wrote:i would be interested in this explanation as well. when i move through different time frames i can see some are pointing up. as there are others pointing down. when taking a trade, you can always look for something that makes this trade look stupid on another timeframe. always.but then i guess this is how the market works? there have to be people on the other side of every trade.

Although you analyze smaller charts, for strategic reasons, you are ultimately trading the high TF charts.

You might see something on the hourly/4H/daily, but if the weekly says differently then guess what...the weekly chart wins.

newark18 wrote:MightyOne wrote:erika_bb wrote:i wish i had half of your skills! Mightyone

I think that it is more planning & courage than skill

If you have the time and desire, maybe you can explain more how you move from yearly to hourly charts. I find it to be confusing in that there are a lot of conflicting signals which is why I tend to eyeball LT trend.

I am trying to move away from the eyeball method. And this is what I have come up with. Based on closed over line theory, I was thinking of waiting for a weekly close over a line. Wait again for a D1 retracement and then entry via BM/rat reversal.

Anything that that requires an in depth discussion is done on Google Talk with those who can receive files through GT.

The people on GT also get to see more of my strategy as I discuss some live trades (and yes, make decisions before the fact

MightyOne wrote:newark18 wrote:MightyOne wrote:erika_bb wrote:i wish i had half of your skills! Mightyone

I think that it is more planning & courage than skill

If you have the time and desire, maybe you can explain more how you move from yearly to hourly charts. I find it to be confusing in that there are a lot of conflicting signals which is why I tend to eyeball LT trend.

I am trying to move away from the eyeball method. And this is what I have come up with. Based on closed over line theory, I was thinking of waiting for a weekly close over a line. Wait again for a D1 retracement and then entry via BM/rat reversal.

Anything that that requires an in depth discussion is done on Google Talk with those who can receive files through GT.

The people on GT also get to see more of my strategy as I discuss some live trades (and yes, make decisions before the fact)

so how do we get in on this? i have some questions id like to ask u as well (about exits). i'm really liking this trading method but it is not completely clear yet. thanks again MO

- newark18

- rank: 500+ posts

- Posts: 562

- Joined: Thu Mar 11, 2010 3:32 am

- Reputation: 21

- Real name: J

- Gender:

MightyOne wrote:newark18 wrote:MightyOne wrote:erika_bb wrote:i wish i had half of your skills! Mightyone

I think that it is more planning & courage than skill

If you have the time and desire, maybe you can explain more how you move from yearly to hourly charts. I find it to be confusing in that there are a lot of conflicting signals which is why I tend to eyeball LT trend.

I am trying to move away from the eyeball method. And this is what I have come up with. Based on closed over line theory, I was thinking of waiting for a weekly close over a line. Wait again for a D1 retracement and then entry via BM/rat reversal.

Anything that that requires an in depth discussion is done on Google Talk with those who can receive files through GT.

The people on GT also get to see more of my strategy as I discuss some live trades (and yes, make decisions before the fact)

Now you're just teasing us...

Failure is an opportunity to learn.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.