GOLD: The commodity closed lower after reversing its Monday gains on Tuesday. This saw it following through lower during early trading on Wednesday. On the downside, support comes in at the 1,280.00 level where a break will turn attention to the 1,270.00 level. Further down, a cut through here will open the door for a move lower towards the 1,260.00 level. Below here if seen could trigger further downside pressure targeting the 1,250.00 level. Conversely, resistance resides at the 1,300.00 level where a break will aim at the 1,310.00 level. A turn above there will expose the 1,320.00 level. Further out, resistance stands at the 1,330.00 level. All in all, GOLD looks to weaken further on bear pressure.

Daily Technical Strategy On Currencies & Commodities

Moderator: moderators

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

GOLD Reverses Gain, Targets Further Weakness

GOLD: The commodity closed lower after reversing its Monday gains on Tuesday. This saw it following through lower during early trading on Wednesday. On the downside, support comes in at the 1,280.00 level where a break will turn attention to the 1,270.00 level. Further down, a cut through here will open the door for a move lower towards the 1,260.00 level. Below here if seen could trigger further downside pressure targeting the 1,250.00 level. Conversely, resistance resides at the 1,300.00 level where a break will aim at the 1,310.00 level. A turn above there will expose the 1,320.00 level. Further out, resistance stands at the 1,330.00 level. All in all, GOLD looks to weaken further on bear pressure.

GOLD: The commodity closed lower after reversing its Monday gains on Tuesday. This saw it following through lower during early trading on Wednesday. On the downside, support comes in at the 1,280.00 level where a break will turn attention to the 1,270.00 level. Further down, a cut through here will open the door for a move lower towards the 1,260.00 level. Below here if seen could trigger further downside pressure targeting the 1,250.00 level. Conversely, resistance resides at the 1,300.00 level where a break will aim at the 1,310.00 level. A turn above there will expose the 1,320.00 level. Further out, resistance stands at the 1,330.00 level. All in all, GOLD looks to weaken further on bear pressure.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

CRUDE OIL Remains Bullish, Resumes its Broader Medium Term Uptrend

CRUDE OIL: With the commodity bullish and resuming its broader medium term uptrend on Thursday, further strength is expected in the days ahead. On the downside, support resides at the 52.00 level where a break will expose the 51.50 level. A cut through here will set the stage for a run at the 51.00 level. Further down, support resides at the 50.50 level. On the upside, resistance resides at the 53.00 level. Further out, resistance comes in at the 53.50 level. A break above here will aim at the 54.00 level and then the 54.50 level followed by the 55.00 level. Its daily RSI is bullish and pointing higher suggesting further strength. All in all, CRUDE OIL remains biased to the upside medium term.

CRUDE OIL: With the commodity bullish and resuming its broader medium term uptrend on Thursday, further strength is expected in the days ahead. On the downside, support resides at the 52.00 level where a break will expose the 51.50 level. A cut through here will set the stage for a run at the 51.00 level. Further down, support resides at the 50.50 level. On the upside, resistance resides at the 53.00 level. Further out, resistance comes in at the 53.50 level. A break above here will aim at the 54.00 level and then the 54.50 level followed by the 55.00 level. Its daily RSI is bullish and pointing higher suggesting further strength. All in all, CRUDE OIL remains biased to the upside medium term.

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

USDJPY: Vulnerable On Loss Of Upside Pressure

USDJPY: The pair closed lower on Thursday leaving risk on further downside on the cards. On the downside, support comes in at the 112.00 level where a break if seen will aim at the 111.50 level. A cut through here will turn focus to the 111.00 level and possibly lower towards the 110.50 level. On the upside, resistance resides at the 113.00 level. Further out, we envisage a possible move towards the 113.50 level. Further out, resistance resides at the 114.00 level with a turn above here aiming at the 114.50 level. On the whole, USDJPY now faces further bear pressure

USDJPY: The pair closed lower on Thursday leaving risk on further downside on the cards. On the downside, support comes in at the 112.00 level where a break if seen will aim at the 111.50 level. A cut through here will turn focus to the 111.00 level and possibly lower towards the 110.50 level. On the upside, resistance resides at the 113.00 level. Further out, we envisage a possible move towards the 113.50 level. Further out, resistance resides at the 114.00 level with a turn above here aiming at the 114.50 level. On the whole, USDJPY now faces further bear pressure

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

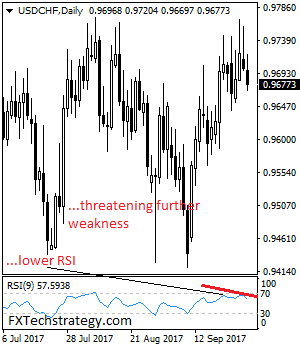

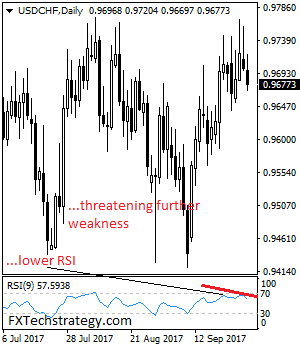

USDCHF Sets Up To Weaken Further On Loss Of Momentum

USDCHF: With the pair rejecting higher prices to close lower the past week, more weakness is envisaged in the new week. On the downside, support lies at the 0.9600 level. A turn below here will open the door for more weakness towards the 0.9550 level and then the 0.9500 level. Its daily RSI is bearish and pointing higher suggesting further weakness. On the upside, resistance resides at the 0.9700 level where a break will clear the way for more strength to occur towards the 0.9750 level. Further out, resistance comes in at the 0.9800 level. Above here if seen will turn attention to 0.9850. All in all, USDCHF faces further downside pressure on price rejection.

USDCHF: With the pair rejecting higher prices to close lower the past week, more weakness is envisaged in the new week. On the downside, support lies at the 0.9600 level. A turn below here will open the door for more weakness towards the 0.9550 level and then the 0.9500 level. Its daily RSI is bearish and pointing higher suggesting further weakness. On the upside, resistance resides at the 0.9700 level where a break will clear the way for more strength to occur towards the 0.9750 level. Further out, resistance comes in at the 0.9800 level. Above here if seen will turn attention to 0.9850. All in all, USDCHF faces further downside pressure on price rejection.

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

EURUSD Closes Lower For The Week But With Caution

EURUSD: With the pair closing lower the past week, more weakness should follow. However, we may see a recovery higher following its Friday recovery (see daily chart). Resistance comes in at 1.1850 level with a cut through here opening the door for more upside towards the 1.1900 level. Further up, resistance lies at the 1.1950 level where a break will expose the 1.2000 level. Conversely, support lies at the 1.1750 level where a violation will aim at the 1.1700 level. A break of here will aim at the 1.1650 level. Below here will open the door for more weakness towards the 1.1600. All in all, EURUSD continues to face further corrective weakness threats but with caution.

EURUSD: With the pair closing lower the past week, more weakness should follow. However, we may see a recovery higher following its Friday recovery (see daily chart). Resistance comes in at 1.1850 level with a cut through here opening the door for more upside towards the 1.1900 level. Further up, resistance lies at the 1.1950 level where a break will expose the 1.2000 level. Conversely, support lies at the 1.1750 level where a violation will aim at the 1.1700 level. A break of here will aim at the 1.1650 level. Below here will open the door for more weakness towards the 1.1600. All in all, EURUSD continues to face further corrective weakness threats but with caution.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

GBPUSD: The pair weakened strongly on Monday opening the door for more price extension. Support lies at the 1.3250 level where a break will turn attention to the 1.3200 level. Further down, support lies at the 1.3150 level. Below here will set the stage for more weakness towards the 1.3100 level. Its daily RSI is bearish and pointing lower suggesting further weakness. Conversely, resistance stands at the 1.3350 levels with a turn above here allowing more strength to build up towards the 1.3400 level. Further out, resistance resides at the 1.3450 level followed by the 1.3500 level. On the whole, GBPUSD continues to face further downside pressure

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

GOLD Puts In Temporary Bottom, Eyes More Recovery

GOLD: The commodity put in a temporary bottom and triggered a corrective recovery on Wednesday. This development has opened the door for more strength. On the downside, support comes in at the 1,270.00 level where a break will turn attention to the 1,260.00 level. Further down, a cut through here will open the door for a move lower towards the 1,250.00 level. Below here if seen could trigger further downside pressure targeting the 1,240.00 level. Conversely, resistance resides at the 1,280.00 level where a break will aim at the 1,290.00 level. A turn above there will expose the 1,300.00 level. Further out, resistance stands at the 1,320.00 level. All in all, GOLD looks to strengthen further on bull pressure.

GOLD: The commodity put in a temporary bottom and triggered a corrective recovery on Wednesday. This development has opened the door for more strength. On the downside, support comes in at the 1,270.00 level where a break will turn attention to the 1,260.00 level. Further down, a cut through here will open the door for a move lower towards the 1,250.00 level. Below here if seen could trigger further downside pressure targeting the 1,240.00 level. Conversely, resistance resides at the 1,280.00 level where a break will aim at the 1,290.00 level. A turn above there will expose the 1,300.00 level. Further out, resistance stands at the 1,320.00 level. All in all, GOLD looks to strengthen further on bull pressure.

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

GBPJPY: The cross remains vulnerable to the downside on further weakness as it retains its bearish bias. On the downside, support comes in at the 148.00 level where a violation will aim at the 147.50 level. A break below here will target the 147.00 level followed by the 146.50 level. Conversely, resistance is seen at the 149.00 level followed by the 149.50 level. A cut through that level will set the stage for a move further higher towards the 150.00 level. Further out, resistance resides at the 150.50 level. All in all, GBPJPY remains weak and vulnerable to the downside.

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

USDCHF Closes Lower On Bull Price Rejection

USDCHF: With the pair rejecting higher prices to close flat on Friday, more weakness is envisaged in the new week. On the downside, support lies at the 0.9550 level. A turn below here will open the door for more weakness towards the 0.9500 level and then the 0.9450 level. On the upside, resistance resides at the 0.9650 level where a break will clear the way for more strength to occur towards the 0.9700 level. Further out, resistance comes in at the 0.9750 level. Above here if seen will turn attention to 0.9800. All in all, USDCHF faces downside pressure on price rejection.

USDCHF: With the pair rejecting higher prices to close flat on Friday, more weakness is envisaged in the new week. On the downside, support lies at the 0.9550 level. A turn below here will open the door for more weakness towards the 0.9500 level and then the 0.9450 level. On the upside, resistance resides at the 0.9650 level where a break will clear the way for more strength to occur towards the 0.9700 level. Further out, resistance comes in at the 0.9750 level. Above here if seen will turn attention to 0.9800. All in all, USDCHF faces downside pressure on price rejection.

-

FXTechstrategy

- rank: 50+ posts

- Posts: 72

- Joined: Mon Sep 18, 2017 4:05 pm

- Reputation: 8

- Gender:

Re: Daily Technical Strategy On Currencies & Commodities

EURUSD Closes Lower But With Warning Of Correction

EURUSD: With the pair extending its weakness other past week, more decline is envisaged. However, we should see a recovery higher in the new week. Resistance comes in at 1.1800 level with a cut through here opening the door for more upside towards the 1.1850 level. Further up, resistance lies at the 1.1900 level where a break will expose the 1.1950 level. Conversely, support lies at the 1.1700 level where a violation will aim at the 1.1650 level. A break of here will aim at the 1.1600 level. Below here will open the door for more weakness towards the 1.1550. All in all, EURUSD continues to face further bear threats but with caution.

EURUSD: With the pair extending its weakness other past week, more decline is envisaged. However, we should see a recovery higher in the new week. Resistance comes in at 1.1800 level with a cut through here opening the door for more upside towards the 1.1850 level. Further up, resistance lies at the 1.1900 level where a break will expose the 1.1950 level. Conversely, support lies at the 1.1700 level where a violation will aim at the 1.1650 level. A break of here will aim at the 1.1600 level. Below here will open the door for more weakness towards the 1.1550. All in all, EURUSD continues to face further bear threats but with caution.

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.