ETHUSD: Pola Palu Di Atas $1596

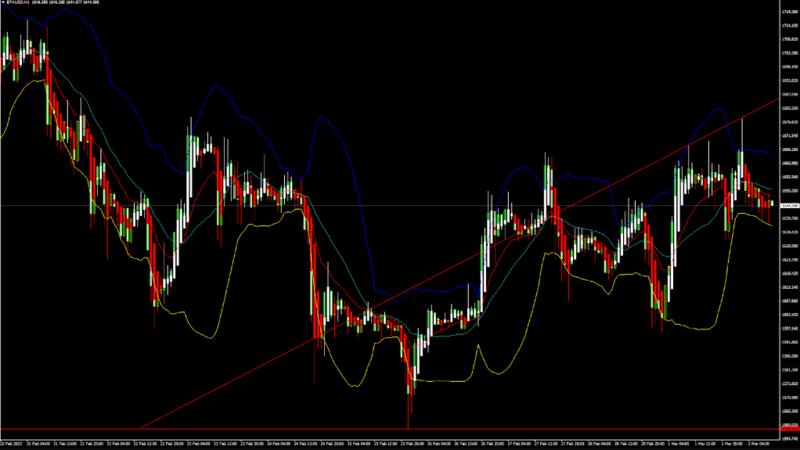

Ethereum tidak dapat mempertahankan momentum bearishnya dan setelah menyentuh titik terendah 1596 pada 22 Februari, harga mulai terkoreksi ke atas terhadap dolar AS melintasi pegangan $1650 hari ini di sesi perdagangan Eropa.

Kami telah melihat pembukaan pasar yang bullish minggu ini.

Kita dapat dengan jelas melihat pola hammer di atas pegangan $1596 yang merupakan pola bullish dan menandakan akhir dari fase bearish dan dimulainya fase bullish di pasar.

ETH sekarang diperdagangkan tepat di bawah level pivotnya di 1666 dan bergerak ke saluran yang agak bullish. Harga ETHUSD sekarang menguji level resistensi klasiknya di 1669 dan level resistensi Fibonacci di 1671 setelah itu jalur menuju 1700 akan dibersihkan.

Indeks kekuatan relatif berada di 61,93 menunjukkan permintaan yang kuat untuk Ether dan berlanjutnya fase bullish di pasar.

Kita bisa melihat pembentukan garis bullish engulfing pada time frame daily.

Baik STOCH maupun STOCHRSI mengindikasikan pasar overbought, yang berarti harga diperkirakan akan turun dalam kisaran jangka pendek.

Sebagian besar indikator teknis memberikan sinyal pasar beli yang kuat.

Sebagian besar rata-rata bergerak memberikan sinyal beli yang kuat, dan kita sekarang melihat level $1700 hingga $1750 dalam kisaran jangka pendek.

ETH sekarang diperdagangkan di atas rata-rata pergerakan sederhana dan eksponensial 100 & 200 jam.

- Ether: pembalikan bullish terlihat di atas $1596.

- Kisaran jangka pendek tampaknya sangat bullish.

- ETH terus berada di atas level $1650.

- Kisaran sebenarnya rata-rata menunjukkan lebih sedikit volatilitas pasar.

ETHUSD sekarang bergerak dalam saluran yang sangat bullish dengan harga diperdagangkan di atas $1650 di sesi perdagangan Eropa hari ini.

ETH menyentuh intraday low 1637 dan intraday high 1678 di sesi perdagangan Asia hari ini.

Resistensi horizontal ditembus dalam kerangka waktu harian, menunjukkan tren bullish.

MACD memotong rata-rata pergerakannya dalam kerangka waktu 4 jam yang menunjukkan sifat pasar yang bullish.

Ichimoku – crossover bullish: Pola Tenkan dan Kjiun terlihat yang merupakan indikasi bullish pasar.

Harga Ichimoku berada di atas awan dalam kerangka waktu 1 jam menunjukkan skenario bullish.

Indikator Aroon memberikan tren bullish dalam kerangka waktu 15 menit.

Level support utama yang harus diperhatikan adalah $1603 yang merupakan retracement 50% dari tertinggi/terendah 4 minggu, dan $1631 di mana harga melintasi rata-rata pergerakan 9 hari.

ETH telah meningkat sebesar 1,84% dengan perubahan harga sebesar $30,19 dalam 24 jam terakhir dan memiliki volume perdagangan sebesar 8,818 miliar USD.

Kami dapat melihat peningkatan sebesar 1,15% dalam total volume perdagangan dalam 24 jam terakhir yang tampaknya normal.

Minggu Depan

Harga ETH terus berada di zona bullish terhadap dolar AS dan bitcoin. ETHUSD diperkirakan akan bergerak lebih tinggi menuju level $1700 dan $1800 minggu ini.

Di sisi atas, kita sekarang melihat target terdekat di 1724 yang merupakan titik pivot level resistance ke-3, dan 1741 yang merupakan level tertinggi 13 minggu.

Prospek jangka pendek langsung untuk Ether telah berubah menjadi sangat bullish, prospek jangka menengah telah berubah menjadi bullish, dan prospek jangka panjang untuk Ether netral dalam kondisi pasar saat ini.

Harga ETHUSD harus tetap di atas level dukungan penting $1628 yang merupakan titik pivot.

Prospek mingguan diproyeksikan pada $1800 dengan zona konsolidasi $1750.

Penafian: CFD adalah instrumen yang kompleks dan memiliki risiko tinggi kehilangan uang Anda.