EUR/USD remained in a bearish zone below 1.0000. EUR/JPY is rising and there was a clear move above the 142.00 resistance zone.

Important Takeaways for EUR/USD and EUR/JPY

- The Euro started a major decline below the 1.0000 and 0.9980 support levels.

- There is a key bearish trend line forming with resistance near 0.9940 on the hourly chart.

- EUR/JPY started a fresh increase and jumped above the 142.00 resistance.

- There is a major bullish trend line forming with support near 141.60 on the hourly chart.

The Euro failed to start a steady recovery wave above the 1.0000 resistance against the US Dollar. The EUR/USD pair remained in a bearish zone and traded below the 0.9950 support.

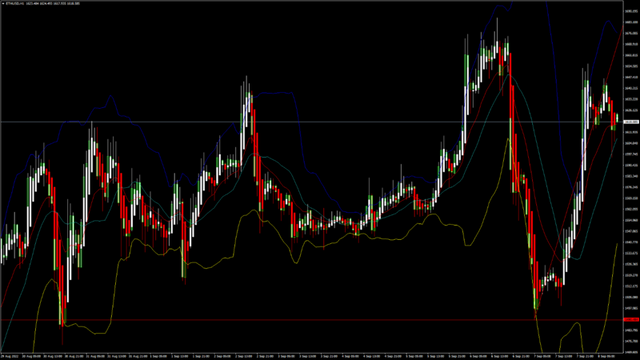

There was a clear move below the 0.9940 level and the 50 hourly simple moving average. The pair even settled below the 0.9940 level. A low was formed near 0.9864 on FXOpen and the pair is now consolidating losses.

EUR/USD Hourly Chart

The pair recovered above 0.9900 and the 38.2% Fib retracement level of the downward move from the 0.9986 swing high to 0.9864 low.

However, the bears were active near the 0.9925 level and the 50 hourly simple moving average. They protected gains above the 50% Fib retracement level of the downward move from the 0.9986 swing high to 0.9864 low.

There is also a key bearish trend line forming with resistance near 0.9940 on the hourly chart. On the upside, the pair is facing resistance near the 0.9925 level and the 50 hourly simple moving average.

The next major resistance is near the 0.9940 level. A clear move above the 0.9940 resistance might send the price towards 0.9980. If the bulls remain in action, the pair could revisit the 1.0050 resistance zone in the near term.

On the downside, the pair might find support near the 0.9865 level. The next major support sits near the 0.9820 level. If there is a downside break below the 0.9820 support, the pair might accelerate lower in the coming sessions.

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.