The day before yesterday I told you guys I hope I can get an anchor trade and yesterday I did. It was epic but not epic "epic", just a normal epic.

Spoiler... No SL for the anchor trade.

But even if you're no fan of my no SL trades you can still gain from the insight. Yes, instead of telling how much, in percentage, I made it's much better to tell people how to do it because this is the stuff that everyone loves.

Target pair: EU (you really only need 1 trading instrument to make money, big money).

TF to be monitored for bias: Daily, H1 (I mentioned this so many times in the past in this thread, but maybe not enough, that if H1 agrees with D1 you'll bank! Big time!)

Entry tf: 1 minute (5 minutes tf is still ok)

Market condition:

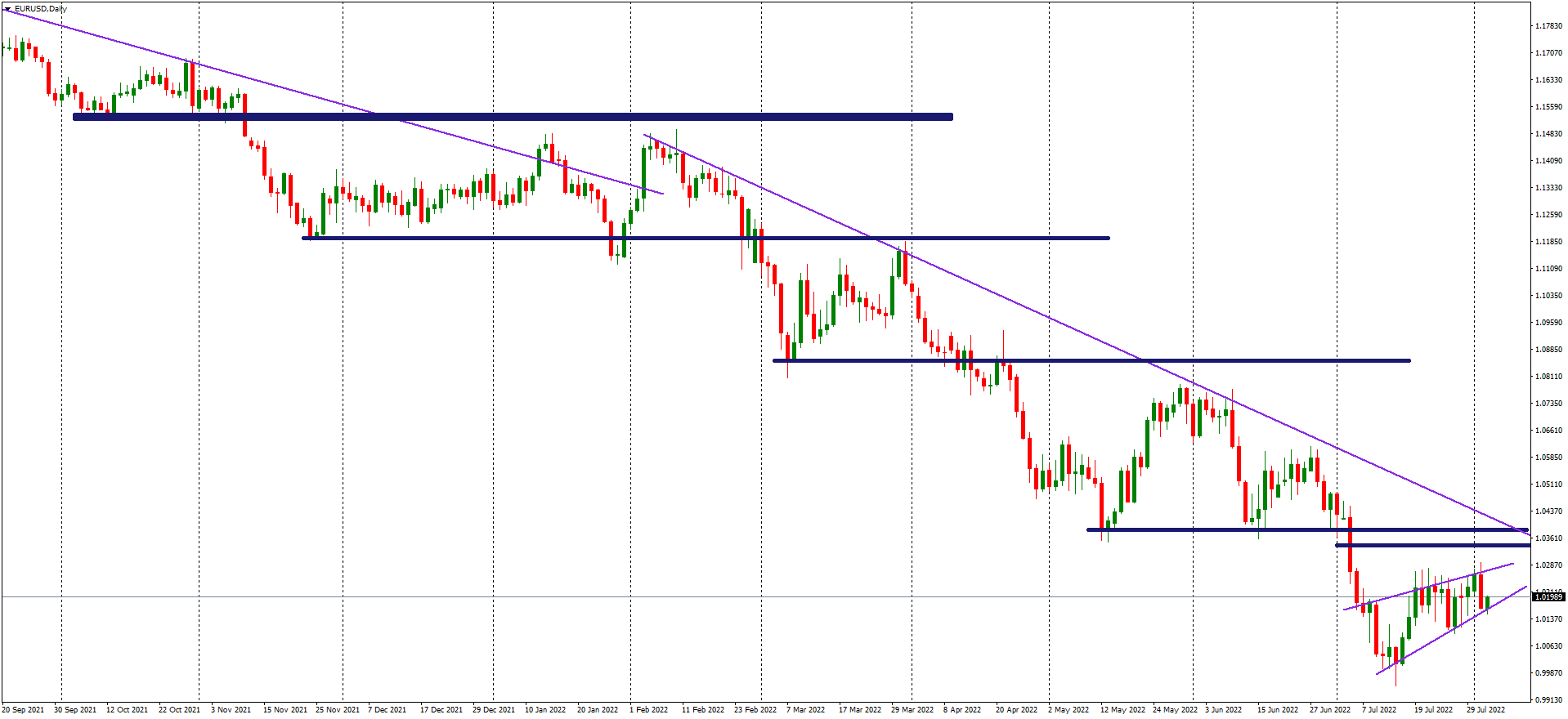

D1

The overall trend is down, it's too obvious you can't miss it. There are several trends in the market. Big, medium and small. Big trend belongs to a bigger tf but can also be seen from D1 (obviously). Medium and small belong to D1 but can also be seen in the smaller tfs (in this case H4 or H1 but I prefer H1). The market just broke out of June's low and it happened early July and then the market seemed to have ended the pattern and it's currently trying to decide where it will go next. it's true that the price jumped right after the end of the pattern where the parity level is but it does not grant any real bullish trend yet. And, seeing how the dojis during the middle of the month throughout the end of July you can see that there is hesitation not to go up or down. By doing this, it created a small wedge pattern. Because yesterday the price was hovering on the top trend line that could potentially materialize the wedge pattern it's the perfect time to take a bearish trade. But that's not all because when we dive into the "small" wedge pattern on D1 you can see a lot more on the smaller tf, H1.

- EURUSDDaily Yesterday.png (61.82 KiB) Viewed 1381 times

H1

During the time the price spent to form the upper trend line from days before, it's easy to tell that the price couldn't go up on high watermark since July 19 all the way to July 26. However, the price doesn't seem to hesitate when it formed the lower trend line since 26, 27 and 28 of July. From July 29, the angle got steeper upward and then on Aug 1 the price stalled creating multiple boxes along the way. Aug 2nd was the day that you see multiple dojis continuing the multiple dojis from hours before. I took a chance thinking that if the trade will break the prior low marked by the thick blue line then it might act as the conduit for further fall. All things considered I put no SL.

The entry candle was the one marked by the red line. I entered at the beginning of that candle. Plus, it happens to be the opening of London session.

Why the target is all the way down? Look left. The jumbled-up boxes are the kind that is easy to break especially considering the overall situation that I just mentioned. So where is the obvious TP? All the way down to the next available box. Box 4.

- EURUSDH1 Yesterday.png (142.81 KiB) Viewed 1381 times

- EURUSDH1 Yesterday.png close up.png (141 KiB) Viewed 1381 times

- EURUSDH1 Yesterday.png close up even more.png (99.2 KiB) Viewed 1381 times

Did you do scalp trade yesterday too? What do you think? Of course. But I already mentioned this stuff (scalping) too many times so it should be common knowledge in my thread now and also in Alias' thread.

I'm sorry coz there might be some things that I might missed in this post but this is all I could think of at the moment of writing.

IgazI mentioned pattern, breakout of pattern, pattern and things before pattern. Yes, that is true. The study of pattern is important especially because there is just a lot of pattern out there. Pick some that you can specialize and master. Afterward, expand your library by taking in more patterns and master them also. And then know how to combine them and use them all at once when the need arises. Rinse and repeat.

Trading with no SL is not for everyone but at least you could benefit from the stuff I put in here no matter what your trading style is.

Man I should get paid for posting this kinda stuff lolz just kiddin'. Enjoy.

Hope it helps! Viva Kreslik!