bb01100100 wrote:Hi Alias,

Every day has been a max down day, so I’m struggling to get my execution on track.

I blew the Bulenox account and am focusing on Apex now.

There are lessons I need to take to heart and so I’m keeping my head down and trying to return to consistency.

I run my charts in my local time zone so didn’t realize daylight savings change from Sunday meant I was starting my sessions an hour earlier in the US afternoon session.. that might explain the crazy chop I was experiencing, but how I dealt with losing has been the real cause of my losses.

I have rhythmic stop me out at a dollar loss level; but it feels like a weak move/giving up and I stew about it all day… how have you seen other traders approach and deal with multiple losing trades that lead to losing days?

I suppose I’m asking “what does a good trader do when the day goes wrong?” because I need to drastically improve how I handle losing.

Try and exist in a perpetual state of "where do I go from here"; it's not about today, but where you will be in the next several months or years.

The keys are:

- minimize risk (position sizing), maximize reward (position sizing)

- keep your analysis simple (can you explain it to a 12yo in a reasonable amount of time).

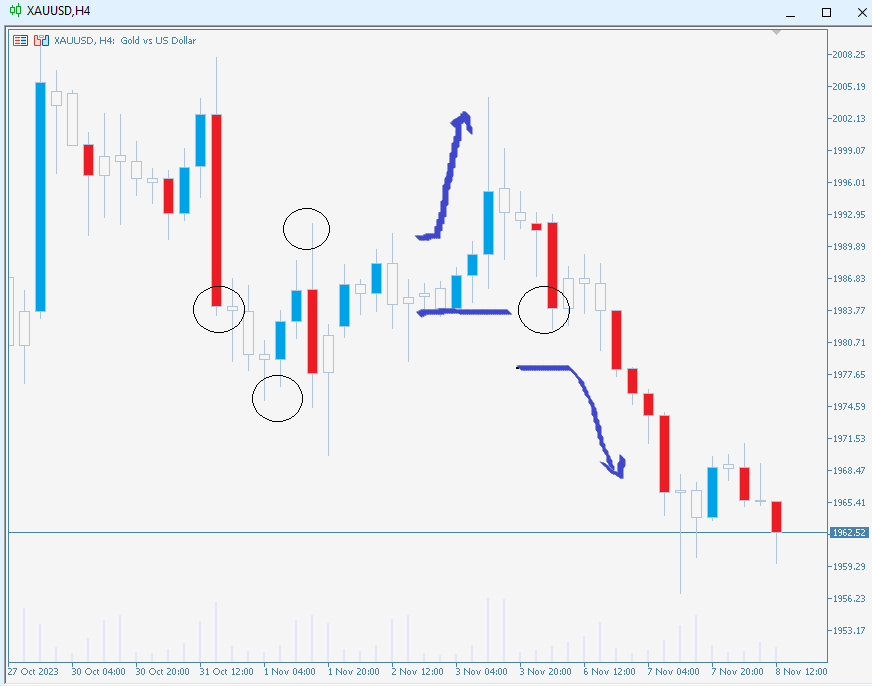

- adjust your strategy to how the chart is behaving

- even god fails in the short-term

- see_do.png (18.09 KiB) Viewed 19519 times