Ha! That's what you think... I love catching up with my homies!

Been too long! best get me on hangouts... Skype annoys me...

A fresh start! Doji's Trading Journal

Moderator: moderators

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- Mira

- rank: 1000+ posts

- Posts: 1729

- Joined: Thu Nov 10, 2016 8:37 pm

- Reputation: 1608

- Gender:

- Contact:

Re: Other things to consider

MightyOne wrote: If you risk the same 2 lines (2/8) on the next trade, going long, then +5 lines brings you up to (13/8)size or +164.0% OM on the next trade.

2/3 * 2.64 or 2/3 * 1.625 is still greater than 1

Mmm..

I'm not getting this part..

__________ THE  IS A LIE__________

IS A LIE__________

IS A LIE__________

IS A LIE__________Re: Other things to consider

Captain Pugwash wrote:

Thanks MO - I really wish i understood this - I know it's bloody important!

Stacking example: your trade size is $10/pip & your risk is 10 pips:

You make 10 pips, you now have 20, your next trade is now (20/10)$10 or $20/pip

That might be too aggressive for you so you might say that $400 (40 pips) is your 'risk box' and

$100 (10 pips) is a 'segment of risk'.

You make 10 pips, you now have 50, your next trade is (50/40)10 or $12.50/pip.

You make 35 pips, your now have 75 (you reduced to 40, 40 + 35 = 75), your next size is (75/40)12.50 or $23.40/pip;

your 'risk-box' contains four 10 pip trades at a size of $23.40/pip.

You lose one trade (-1), you double, lose that trade (-2), and are left with 10 pips of $23.40.

What is that at your original size? (23.40/10)10 pips is 23.4 pips of $10, you still have 2 trades of 11.7 pips ($234)!

If you lose all of your pips (4 trades) then your loss = the sum of your risk-box (-$400).

Either way you are losing $400 in 4 losing trades:

If you don't stack then you are hoping to have made money above -$400

& if you do stack then you are hoping to reach a profit goal before losing 4 trades.

@ Mira

2/3 of a move multiplied by a trade size that 62.5% greater than initial is 108.333% of the money.

- Captain Pugwash

- rank: 500+ posts

- Posts: 529

- Joined: Wed Sep 14, 2011 7:59 am

- Reputation: 166

- Location: Insanitary Industries

- Gender:

Re: Other things to consider

MightyOne wrote:Captain Pugwash wrote:

Thanks MO - I really wish i understood this - I know it's bloody important!

Stacking example: your trade size is $10/pip & your risk is 10 pips:

You make 10 pips, you now have 20, your next trade is now (20/10)$10 or $20/pip

That might be too aggressive for you so you might say that $400 (40 pips) is your 'risk box' and

$100 (10 pips) is a 'segment of risk'.

You make 10 pips, you now have 50, your next trade is (50/40)10 or $12.50/pip.

You make 35 pips, your now have 75 (you reduced to 40, 40 + 35 = 75), your next size is (75/40)12.50 or $23.40/pip;

your 'risk-box' contains four 10 pip trades at a size of $23.40/pip.

You lose one trade (-1), you double, lose that trade (-2), and are left with 10 pips of $23.40.

What is that at your original size? (23.40/10)10 pips is 23.4 pips of $10, you still have 2 trades of 11.7 pips ($234)!

If you lose all of your pips (4 trades) then your loss = the sum of your risk-box (-$400).

Either way you are losing $400 in 4 losing trades:

If you don't stack then you are hoping to have made money above -$400

& if you do stack then you are hoping to reach a profit goal before losing 4 trades.

@ Mira

2/3 of a move multiplied by a trade size that 62.5% greater than initial is 108.333% of the money.

OK- I intend to look very closely at this post after work tomorrow - with a calculator.

But I am thinking that what you are saying is this (from your last post and the above)

That is I should go back to using a risk box (you are correct in that assumption

That yesterdays trade should have been added to this one (you are right - it wasn't)

That it would have been preferable to get out at the first trouble area (I didn't)

That I should have re entered on the break lower - pulling my gained space tighter ( and massively pushing up my lot size)

Get out at my original tp for a nice gain

sorry the above is in basic layman's terms - but I am not the smartest of cats

I have not been following your eighths idea at all - sorry - it took all my limited powers to understand bredins fib idea!

"MOJO 1)Self-confidence, Self-assuredness. As in basis for belief in ones self in a situation. Esp/In context of contest or display of skill such as going into battle. 2)Ability to bounce back from a debilitating trauma and negative attitude YEH BABY

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

Re: A fresh start! Doji's Trading Journal

Im sensing some confusion.....

mo up is a momentum zline

mo down is a momentum zline..

the space between them is the bearish zone

price leaves there bearish go short...

price leaves there bullish go long...

When i use tick charts, its the same exact thing but scaled out... more like close above last swing high, close below last swing low...

retrace....goin all in....

examples is a tick chart, different color zones are just ways you could have taken them... they are all over the place...

Please dont overtrade!!! Find a filter you like for extremes...and have a session goal....it doesnt take alot!

Overtrading will result in emotional disbelief and discouragement!

doji

mo up is a momentum zline

mo down is a momentum zline..

the space between them is the bearish zone

price leaves there bearish go short...

price leaves there bullish go long...

When i use tick charts, its the same exact thing but scaled out... more like close above last swing high, close below last swing low...

retrace....goin all in....

examples is a tick chart, different color zones are just ways you could have taken them... they are all over the place...

Please dont overtrade!!! Find a filter you like for extremes...and have a session goal....it doesnt take alot!

Overtrading will result in emotional disbelief and discouragement!

doji

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

Re: A fresh start! Doji's Trading Journal

Posted this chart to show reversal process.

using swings,

down mo

up mo = bullish zone

retrace

went long...

note what happens....

THATS reversal.

This is just an example...

Would I have actually took this?

You tell me...

are my filters that I use in place?

If so, then yes I would have taken it.

If not, then no I would have passed OR the reversal would have been the initial trade...

doji

using swings,

down mo

up mo = bullish zone

retrace

went long...

note what happens....

THATS reversal.

This is just an example...

Would I have actually took this?

You tell me...

are my filters that I use in place?

If so, then yes I would have taken it.

If not, then no I would have passed OR the reversal would have been the initial trade...

doji

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

Re: A fresh start! Doji's Trading Journal

Still reading price action on current trade...

just asking myself...looking for more signs that im right....

added some zones within the zone for confluence.

Still looking good to me.

Stay cool and collected.

just asking myself...looking for more signs that im right....

added some zones within the zone for confluence.

Still looking good to me.

Stay cool and collected.

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

- Jalarupa

- rank: 1000+ posts

- Posts: 1300

- Joined: Tue Feb 23, 2010 5:50 pm

- Reputation: 324

- Location: South Africa

- Gender:

Re: Other things to consider

Captain Pugwash wrote:MightyOne wrote:Captain Pugwash wrote:

Thanks MO - I really wish i understood this - I know it's bloody important!

Stacking example: your trade size is $10/pip & your risk is 10 pips:

You make 10 pips, you now have 20, your next trade is now (20/10)$10 or $20/pip

That might be too aggressive for you so you might say that $400 (40 pips) is your 'risk box' and

$100 (10 pips) is a 'segment of risk'.

You make 10 pips, you now have 50, your next trade is (50/40)10 or $12.50/pip.

You make 35 pips, your now have 75 (you reduced to 40, 40 + 35 = 75), your next size is (75/40)12.50 or $23.40/pip;

your 'risk-box' contains four 10 pip trades at a size of $23.40/pip.

You lose one trade (-1), you double, lose that trade (-2), and are left with 10 pips of $23.40.

What is that at your original size? (23.40/10)10 pips is 23.4 pips of $10, you still have 2 trades of 11.7 pips ($234)!

If you lose all of your pips (4 trades) then your loss = the sum of your risk-box (-$400).

Either way you are losing $400 in 4 losing trades:

If you don't stack then you are hoping to have made money above -$400

& if you do stack then you are hoping to reach a profit goal before losing 4 trades.

@ Mira

2/3 of a move multiplied by a trade size that 62.5% greater than initial is 108.333% of the money.

OK- I intend to look very closely at this post after work tomorrow - with a calculator.

But I am thinking that what you are saying is this (from your last post and the above)

That is I should go back to using a risk box (you are correct in that assumption[I have shelved the idea]

That yesterdays trade should have been added to this one (you are right - it wasn't)

That it would have been preferable to get out at the first trouble area (I didn't)

That I should have re entered on the break lower - pulling my gained space tighter ( and massively pushing up my lot size)

Get out at my original tp for a nice gain

sorry the above is in basic layman's terms - but I am not the smartest of cats

I have not been following your eighths idea at all - sorry - it took all my limited powers to understand bredins fib idea!

The math is super easy Capt... Let FX Synergy do the calcs for you...

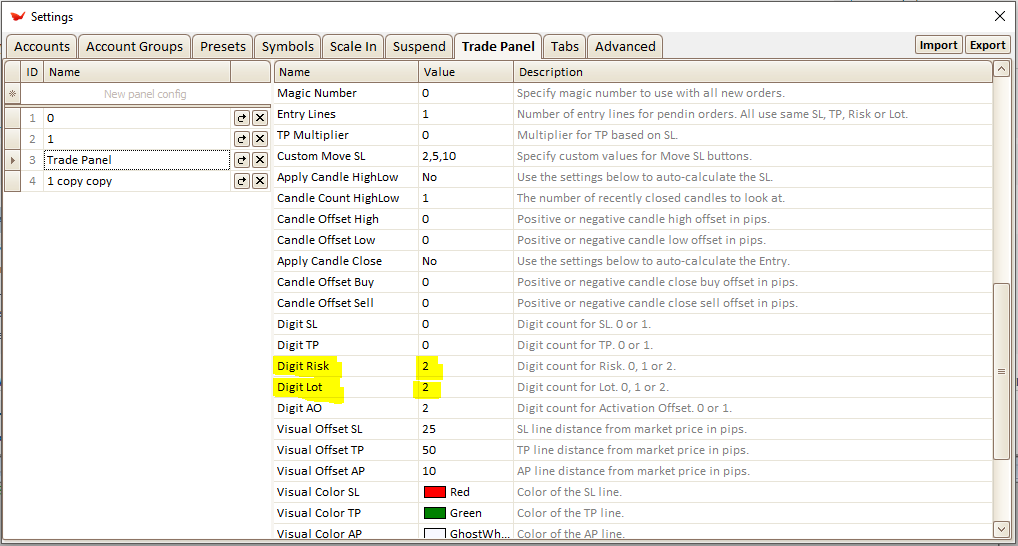

Just ensure you have your terminal (Trading Panel) setup so that you can input 2 digits on both lot and risk...

like this...

So the math is simple... Lets assume that you have $10 000 account and you are comfortable risking... 1% or $100

So no matter where you take the AP (Activation Price) via Market Order, Stop Order or Limit Order - depending on your Stop Placement you will get your lot size automatically entered for you into the trade...

So lets say that you choose to risk $100 (1%) over 30 pips - Synergy does the Math for you but its easy all the same... Its space/amount

So lets now say that you have 60 pip gain... you have made $200 on your trade...

Now this is where it gets fun because Synergy does all the heavy lifting for you...

All you have to do is now find out what your risk amount is $300 in this case (initial $100 + $200 Profit)

and divide this by your account size $10 200

So 300 / 10200 = 0,029 or said otherwise 2.94% (just multiply by 100 if you unsure when looking at decimals)

Now you place your 2.94% into Synergy and place your stop and it will all be calculated for you... knowing that you ONLY stand to lose your initial $100 risk (plus OPM)

If you don't get this hit me up on Hangouts...

//peace

- dojirock

- rank: 1000+ posts

- Posts: 1921

- Joined: Tue Nov 17, 2009 10:11 pm

- Reputation: 726

- Gender:

- Contact:

Re: A fresh start! Doji's Trading Journal

Late in day, all risk removed!

do you "see"?"

no worries....

doji

do you "see"?"

no worries....

doji

It always takes Momentum to break Momentum!

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

"A small loss is just as satisfying as a large gain" -MO

"Sometimes we need to stop learning and start thinking...."

"Once you stack, you'll never go back!"

- Mira

- rank: 1000+ posts

- Posts: 1729

- Joined: Thu Nov 10, 2016 8:37 pm

- Reputation: 1608

- Gender:

- Contact:

Re: Other things to consider

MightyOne wrote:Captain Pugwash wrote:

Thanks MO - I really wish i understood this - I know it's bloody important!

Stacking example: your trade size is $10/pip & your risk is 10 pips:

You make 10 pips, you now have 20, your next trade is now (20/10)$10 or $20/pip

That might be too aggressive for you so you might say that $400 (40 pips) is your 'risk box' and

$100 (10 pips) is a 'segment of risk'.

You make 10 pips, you now have 50, your next trade is (50/40)10 or $12.50/pip.

You make 35 pips, your now have 75 (you reduced to 40, 40 + 35 = 75), your next size is (75/40)12.50 or $23.40/pip;

your 'risk-box' contains four 10 pip trades at a size of $23.40/pip.

You lose one trade (-1), you double, lose that trade (-2), and are left with 10 pips of $23.40.

What is that at your original size? (23.40/10)10 pips is 23.4 pips of $10, you still have 2 trades of 11.7 pips ($234)!

If you lose all of your pips (4 trades) then your loss = the sum of your risk-box (-$400).

Either way you are losing $400 in 4 losing trades:

If you don't stack then you are hoping to have made money above -$400

& if you do stack then you are hoping to reach a profit goal before losing 4 trades.

@ Mira

2/3 of a move multiplied by a trade size that 62.5% greater than initial is 108.333% of the money.

Ahhhh I got it, thank you!

Space is like a sort of cube made by n lines (i.e. 10).

Any line gained goes inside the box and the total amount is "always" normalized at 10 lines (the value of each line is raising).

Now, having 4 lines COULD be like having 4 trades (1 line x trade) but having, i.e., 15 lines COULD be like having 2 trades x 3 lines + 1 trade x 5 lines + 2 trade x 2 lines.

Bigger the cube and slower the growth (and the risk, if I don't trade all the lines in one trade

BUT

If I play the metagame and I give strength at the single segments then I have an exponential growth (one time you told me that it's like 'Investing & Trading') with the same risk or even lower.

I could be more aggressive without any fear using "segments" because I am risking a portion of risk of a portion of risk and lot size still grows.

__________ THE  IS A LIE__________

IS A LIE__________

IS A LIE__________

IS A LIE__________Please add www.kreslik.com to your ad blocker white list.

Thank you for your support.

Thank you for your support.